Australia

Country Overview

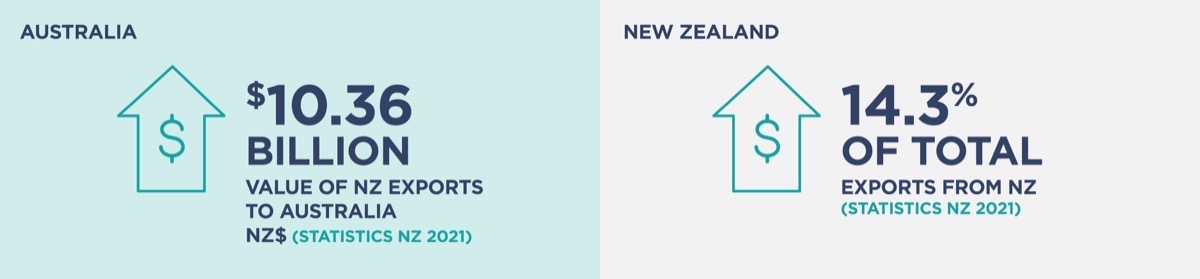

Australia is New Zealand's largest trading partner, and with good reason. Its proximity and the prospect of zero tariffs on eligible goods make Australia an obvious first choice for many New Zealand exporters.

Australia has some of the world’s most open trade and investment policies. It continues to be a large and wealthy market, enjoying nearly three decades of economic growth.

There are significant opportunities for New Zealand companies prepared to invest in Australia, and success there could springboard you to further global expansion.

Trade Agreements

Australia and New Zealand share the world's most comprehensive, effective and mutually compatible free trade agreement. Under the NZ-Australia Closer Economic Relations Trade Agreement, any goods that meet the Rules of Origin can be traded with zero tariffs.

Country intelligence

The Robinson Country Intelligence Index is a holistic measurement of country-level risk and serves as an alternative measure of country development. It incorporates four broad dimensions of Governance, Economics, Operations and Society. A higher ranking indicates a better Country Intelligence Index score.

Value of New Zealand exports

International logistics performance

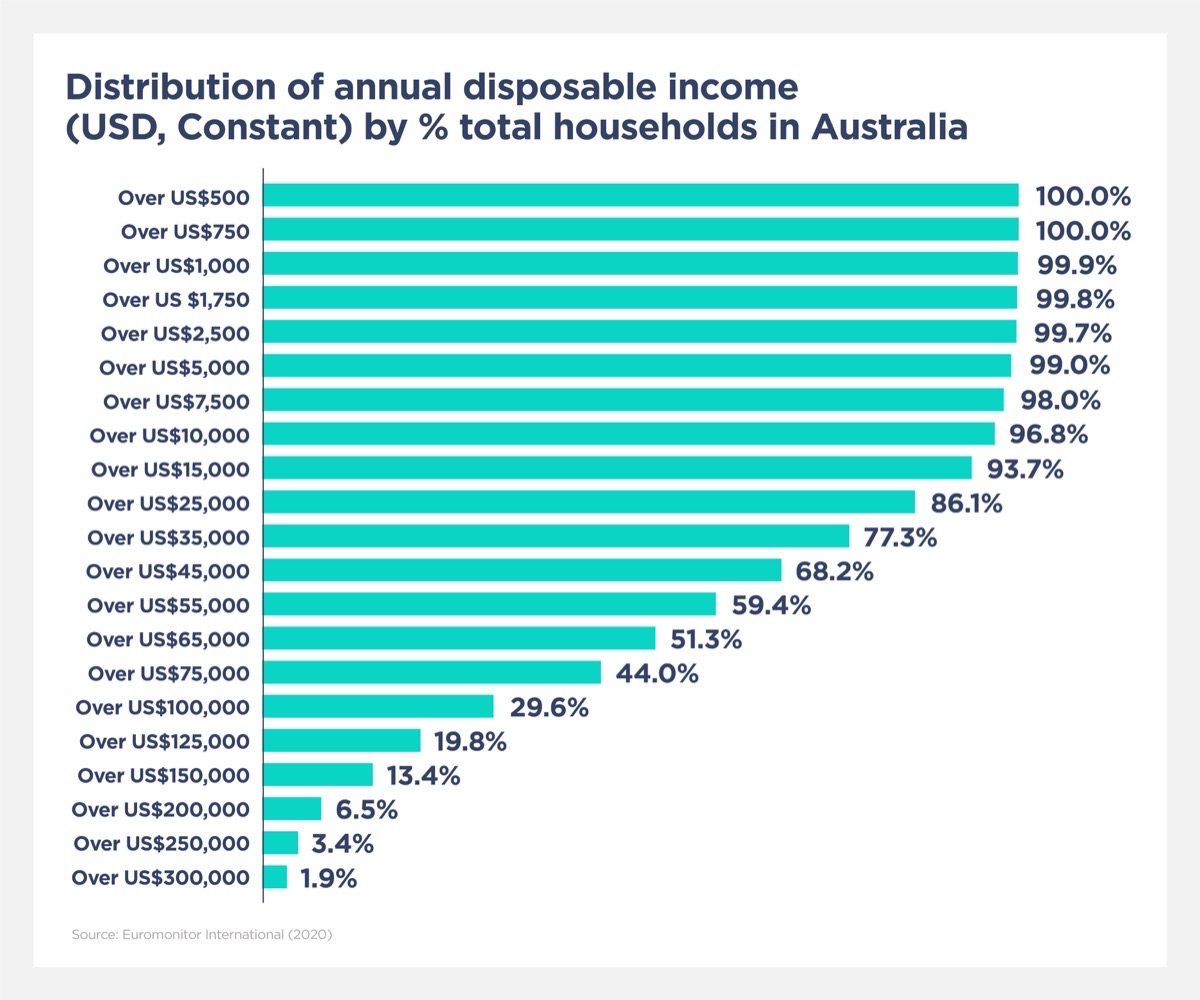

Income and distribution of wealth

Global National Income (GNI) per capita is the dollar value of a country's final income in a year, divided by its population.

Annual Disposable Income refers to gross income minus social security contributions and income taxes. Each income band presents data referring to the percentage of households with a disposable income over that amount.

Further information

For more information to validate Australia as an export market, see our Australia Market Guide.

- Vitamins & Dietary Supplements

- Skin Care

- Dog & Cat Food

- Alcoholic Drinks

- Health & Wellness Packaged Food & Beverages

Vitamins & Dietary Supplements

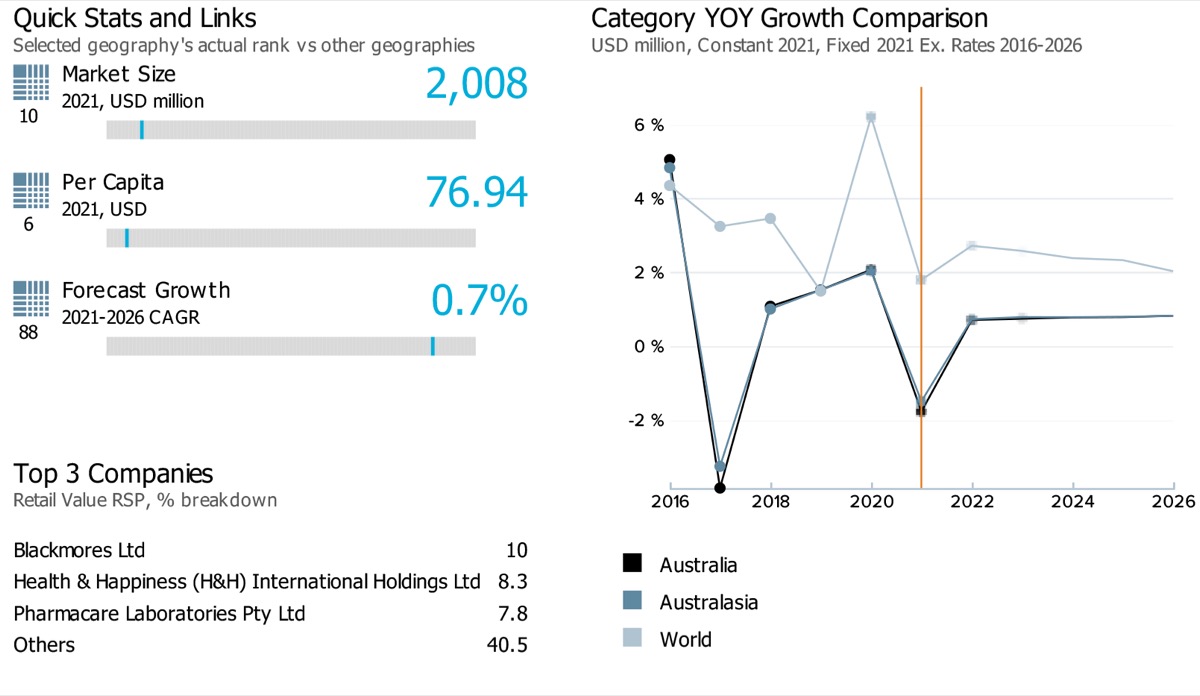

- Market size and growth

-

Note: Data on the top left corner of the image (9,6 and 90) showcases respective ranks for Australia for its market size, per capita and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents relative position of the country as per their rank

Retail value sales of vitamins and dietary supplements in Australia witnessed a historic compound annual growth rate of 4.4% during 2015-2020 and is further expected to grow at a CAGR of 0.5% over 2020-2025. The expected slowdown is largely in line with the global performance of the category where it witnessed a historic CAGR of 5.4% and forecast CAGR of 2.6% over the same period.

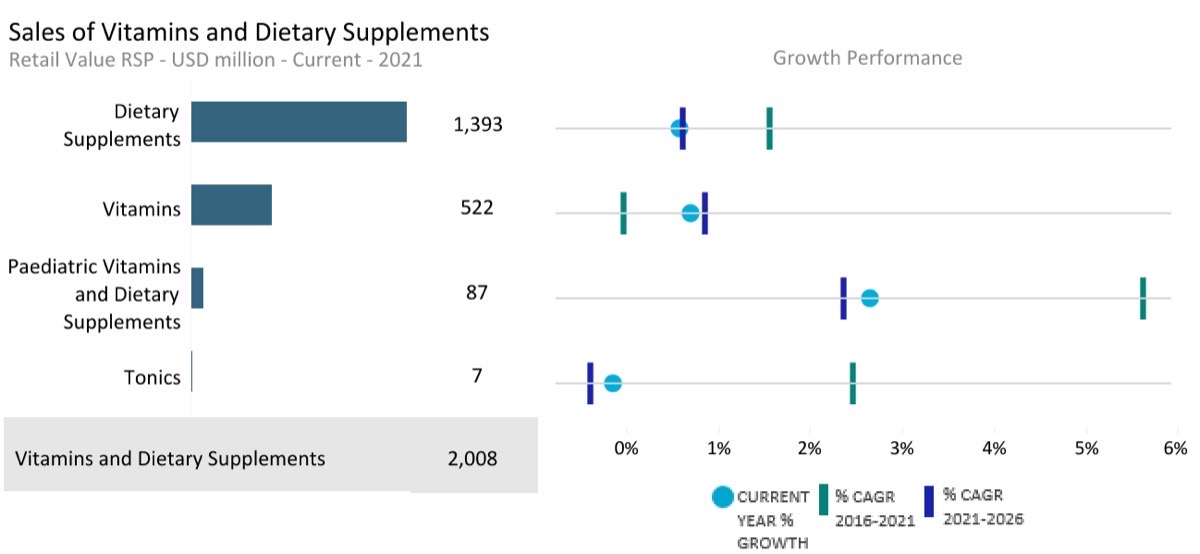

- Sub-category breakdown

-

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Vitamins and Dietary Supplements

USD million

2,073.23

0.48

Vitamins

USD million

522.78

0.64

Paediatric Vitamins and Dietary Supplements

USD million

83.95

2.52

Dietary Supplements

USD million

1,461.01

0.31

Tonics

USD million

5.47

-0.19

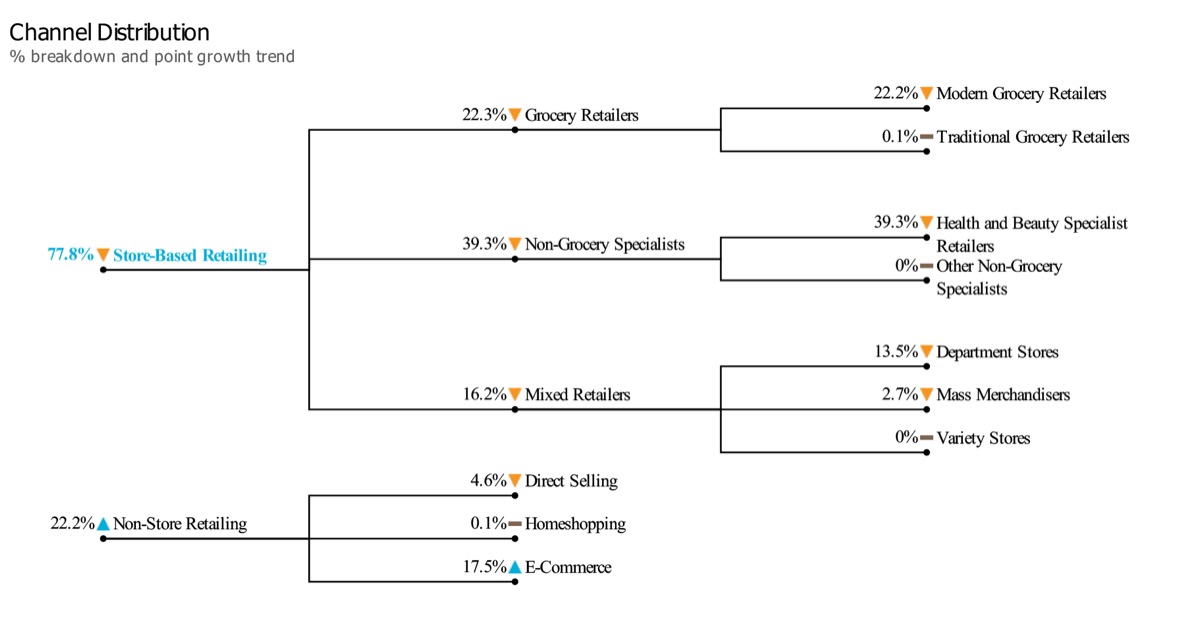

- Channel distribution

-

Kindly note: The chart here showcases retail value share of different channel sales for Vitamins and dietary supplement products in Australia in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained same against its share in the previous year

- Market insights

-

Market trends

- Consumer health products in general are expected to witness slightly higher demand in 2020 than was seen in the previous year due to the impact of Covid-19 and consumers stockpiling products for fear of shortages. Despite a high level of maturity, all, over the counter categories are expected to witness growth. This is largely in line with consumers increased health awareness. This trend is also expected to maintain the growth of vitamins and dietary supplements, although at a slowed rate, due to the loss of daigou sales as a result of regulation changes and border closures (Daigou: the practice of Chinese consumers purchasing goods in bulk in countries such as Australia and then privately importing them into China and selling them on through online channels).

- Australian consumers have also been increasingly seeking for products to boost their immunity during the Covid-19 outbreak, particularly Vitamin C. This also resulted in a significant rise in demand for dietary supplements marketed as immunity boosters and consumers have become increasingly interested in how natural medicine can be used to optimise immune system health.

- Probiotic supplements are expected to rise strongly with Australian consumers perceiving these to be essential daily supplements, as good health is increasingly tied to gut health.

- The number of vitamins in effervescent format continues to grow in Australia as companies launch new products in this format to maintain consumers’ interest.

Prospects and growth opportunity

- Health and beauty specialist retailers and supermarkets are expected to remain the leading channels for the distribution of consumer health products in 2020. Although many retail outlets were shut from March for several weeks, this did not apply to such essential retailers, helping to maintain the strong shares of these channels.

- However, e-commerce is expected to see the strongest increases in sales and share in 2020, as more consumers turn to online purchasing to avoid having to leave their homes due to COVID-19. Although Australians have been avid users of e-commerce for many products, online demand for consumer health products has been limited, and the adoption of technology has also been slower than in other industries.

- The pandemic led many players to start online sales or improve their platforms to include electronic ordering and payment. For instance, the Pay my Pharmacy feature by GuildCare NG helps pharmacies increase digital engagement with customers. A new feature allows customers to pay for prescriptions and OTC products using the app myPharmacyLink. In addition, retailers such as MyMedkit and Chemist2U are developing new online services and apps, with both offering users the delivery of prescriptions and OTC medication.

General health & wellness trends

- Over the coming years, product revamps and new launches are expected to drive growth particularly for dietary supplements in the country. Due to the fall in daigou sales, companies are moving away from targeting this segment to focus more on local consumers. Many have revamped their product ranges through new packaging focusing on benefits, rather than complex ingredients, whilst others have launched new products.

- For instance, Sanofi-Aventis Australia extended its Cenovis brand to the Hello range, aiming to offer a more simplified range of dietary supplements. The range offers six products targeting key benefits: Focus, Boost, Immunity, Calm, Detox and Energy. This local focus is expected to continue in the forecast period, as players will be more reliant on domestic consumers. Rising knowledge about benefits of specific dietary supplements, thanks to clearer packaging information, has shifted consumer behaviour away from combination products which cover more than one need, to specific dietary supplements which are expected to see the strongest growth.

- Sports nutrition is expected to continue to see the strongest value growth rate, as more consumers try to live holistic healthy lifestyles, and see sports nutrition as part of achieving this.

Skin Care

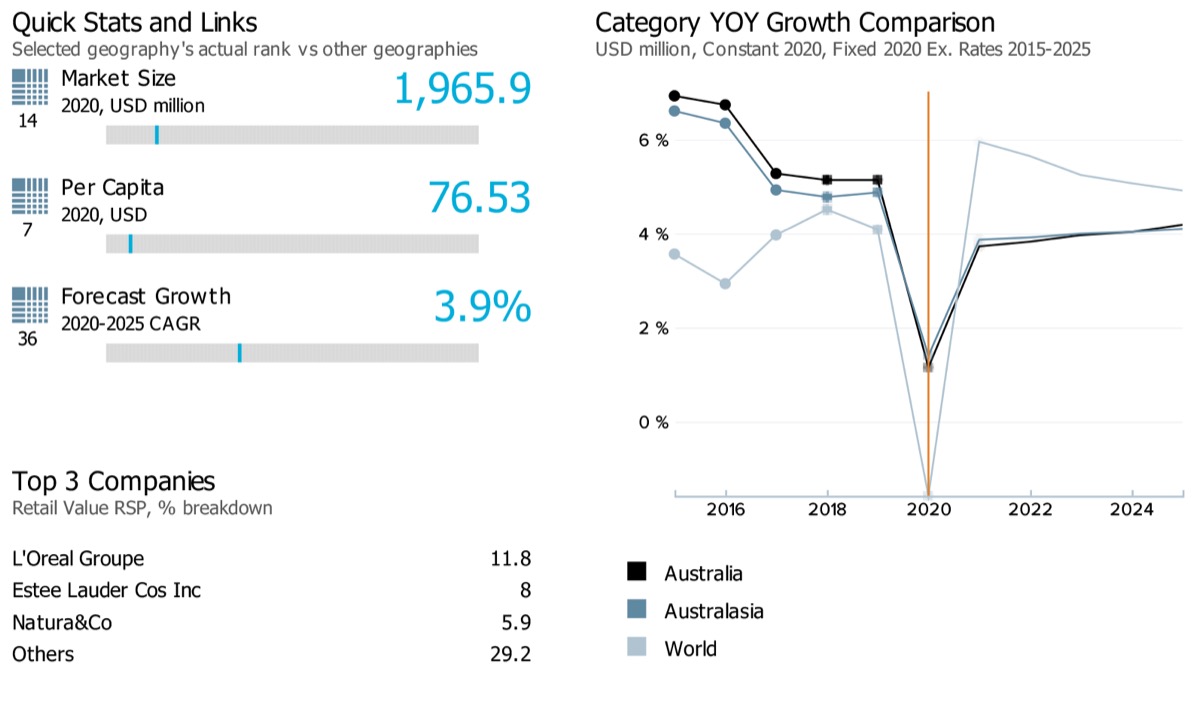

- Market size and growth

-

Note: Data on the top left corner of the image (14,7 and 36) showcases respective ranks for Australia for its market sizes, per capita and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents relative position of the country as per their rank

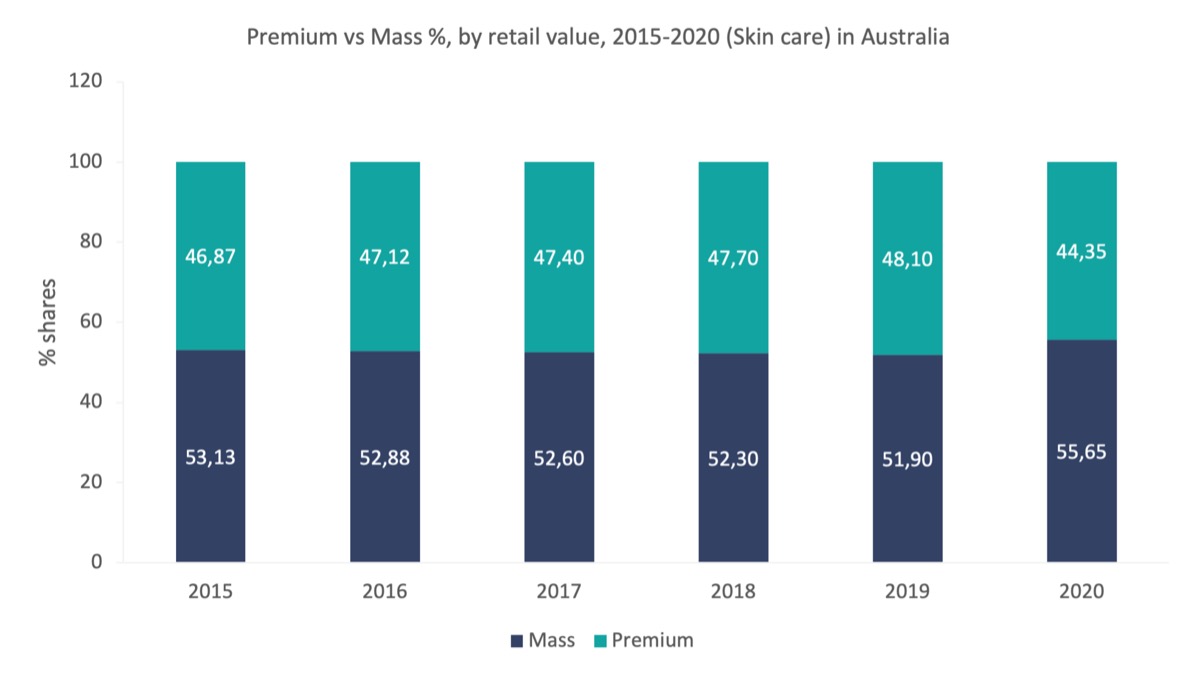

Retail value sales of skin care products in Australia witnessed a stronger Compound Annual Growth Rate during 2015-2020 (6.2%) against the category’s performance at global level (4.7%) during the same time period. However, over the forecast period (2020-2025), the category is estimated to witness an increased CAGR of 5.3% at the global level, while in Australia, the category’s CAGR for the same time period is estimated to come down to 3.9%.

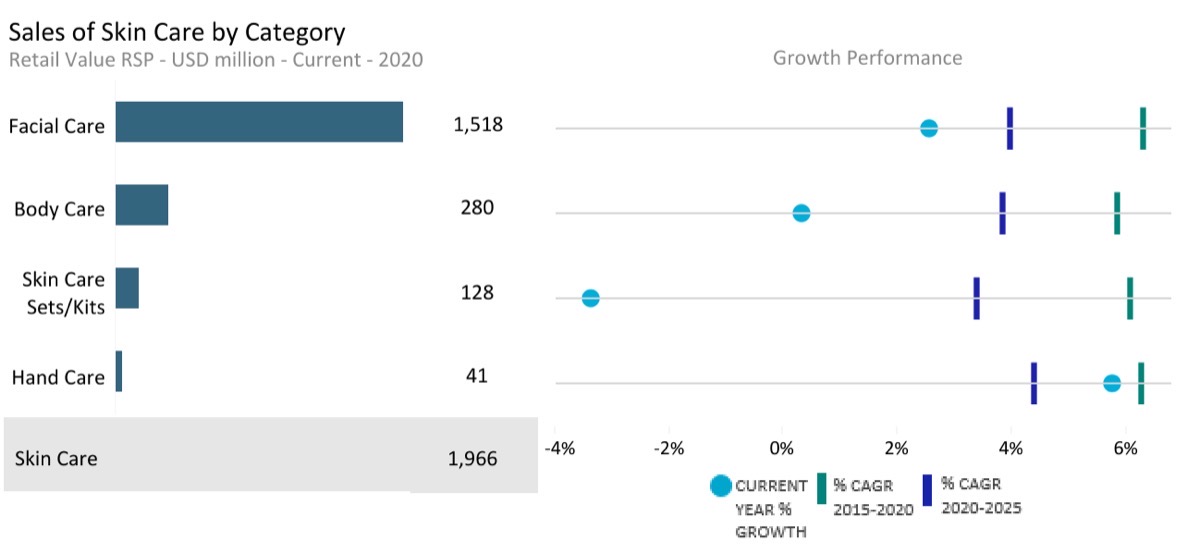

- Sub-category breakdown

-

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Skin Care

USD million

1,965.89

3.92

Body Care

USD million

279.86

3.85

Facial Care

USD million

1,517.50

3.97

Hand Care

USD million

40.73

4.41

Skin Care Sets/Kits

USD million

127.78

3.40

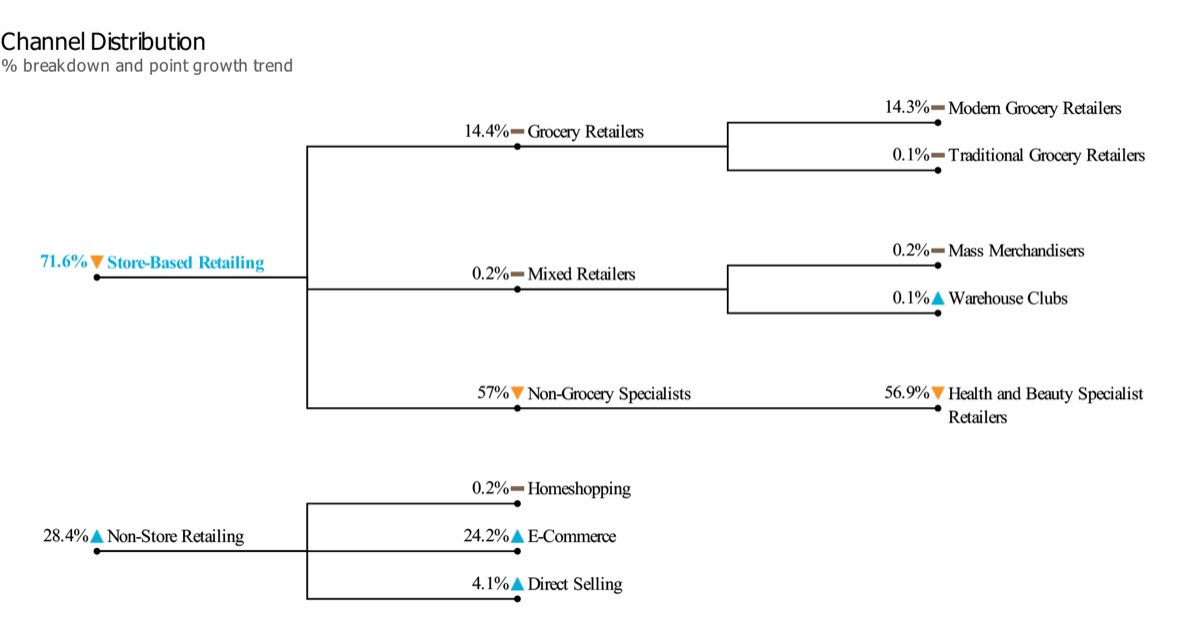

- Channel distribution

-

Kindly note: The chart here showcases retail value share of different channel sales for skin care products in Australia in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained same against its share in the previous year

- Market insights

-

Market trends

- COVID-19 accelerated the shift already seen in consumer preferences from colour cosmetics to skin care, with lockdown providing consumers more time to invest in self-care routines in 2020. The lack of social contact resulting from home seclusion bolstered the existing trend towards placing a greater emphasis on the health rather than the youthful appearance of skin. Therefore, growth was mostly driven by consumers’ focus on the health of their skin as well as growing interest towards self-care/self-indulgence products in 2020.

- Facial care was able to sustain a positive current value growth trajectory in 2020 largely due to the booming demand for mass face masks. Under lockdown, popularity of sheet masks exploded due to the convenience of multiple benefits offered in a single product.

Prospects and growth opportunity

- Skin care is expected to maintain strong growth over 2020-2025as consumers pay growing attention to the health of their skin. Indeed, it is likely that home seclusion will help to reinforce this trend in the longer-term, as consumers have become increasingly familiar with skin care products that they have used in place of colour cosmetics in 2020.

- As skin care receives more consumer attention, a growth in the number of brands and the availability of skin care is expected in Australia. The expansion of beauty specialist retailers offering a curated range of premium brands, as well as drugstores and supermarkets expanding their mass ranges will continue to support the strong performance of skin care over the forecast period.

- Sustainability and business with a purpose will continue to gain relevance in Australia, calling skin care brands to act in the coming years. Already, several industry players launched their own recycling programs for the packaging of their products or partnered with organisations such as Terra Cycle and REDCycle. For example, in 2020 BWX launched Sukin Biodegradable sheet masks while partnering with REDCycle to ensure that its packaging was recyclable. Such company activities are expected to proliferate in the forecast period as Australian consumers become more concerned about their environmental impact.

General health & wellness trends

- Coronavirus (COVID-19) had a marked impact on Australian beauty and personal care in 2020 through the restrictions imposed in order to limit the spread of the disease. Increased consumer hygiene-consciousness as a result of the pandemic led to a notable rise in demand for products to help prevent the spread of the disease, such as hand sanitisers. Meanwhile, home seclusion has led to a slight increase in the domestic use of essential products in categories such as bath and shower, and baby and child-specific products, with these categories also seeing sales boosted early in the pandemic by consumers panic buying for fear of running out of necessities.

- The lack of social contact resulting from home seclusion has increased the momentum of the consumer shift in emphasis from the appearance to the health of skin, which is likely to have an enduring effect on demand in skin care over the forecast period.

Dog & Cat Food

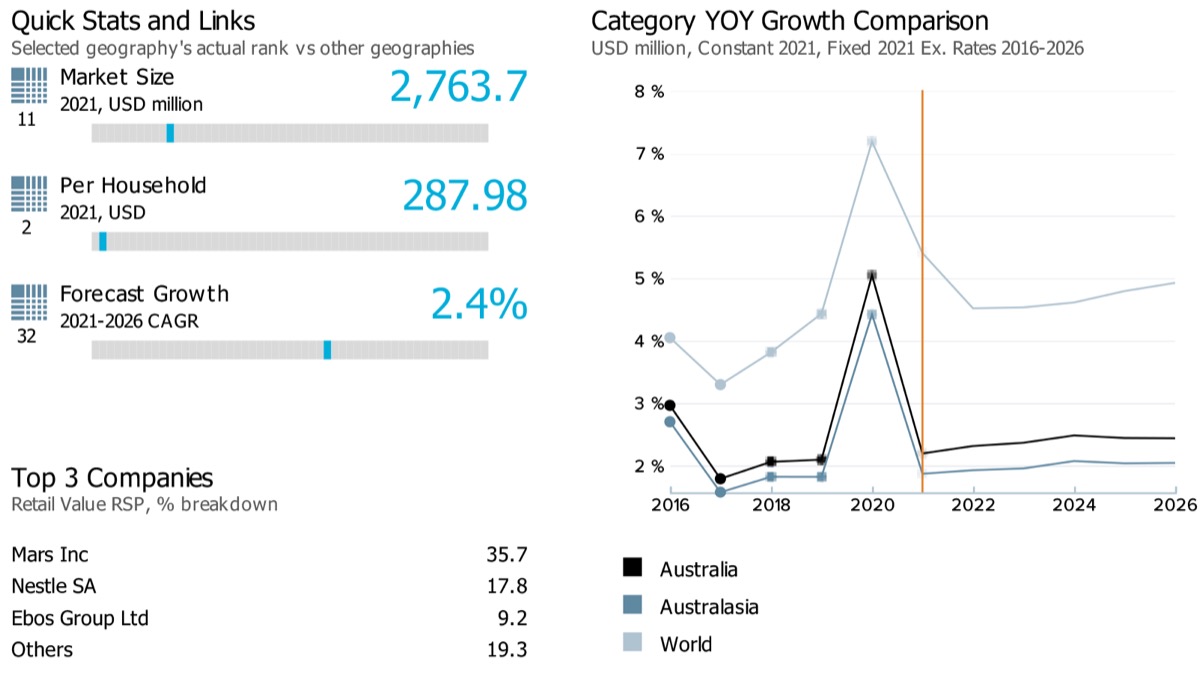

- Market size and growth

-

Note: Data on the top left corner of the image (11,2 and 32) showcases respective ranks for Australia for its market sizes, per capita and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents relative position of the country as per their rank

Note: *Latest market size data for the year 2021 has been shared for Dog and Cat food

Performance of retail value sales of dog and cat food in Australia is estimated to slowdown from historic Compound Annual Growth Rate of 4.3% during 2016-2021 to an estimated forecast CAGR of 2.4% over 2021-2026. The category’s performance in the country has been slower than its global growth. Globally, the category witnessed a historic CAGR of 6.9% and an estimated forecast CAGR of 4.7% during the same time period.

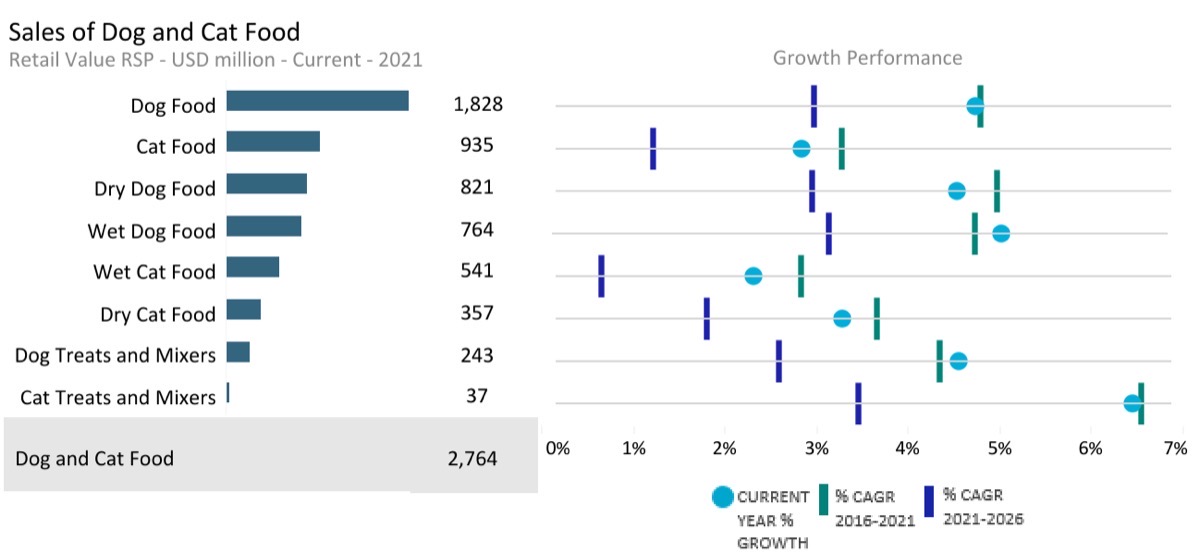

- Sub-category breakdown

-

Category

Unit

Market size (2021)

Retail value RSP

Forecast compound annual growth rate (2021/2026) %

Dog and Cat Food

USD million

2,763.67

2.39

Dog Food

USD million

1,828.32

2.98

Dog Treats and Mixers

USD million

242.85

2.60

Dry Dog Food

USD million

821.00

2.95

Wet Dog Food

USD million

764.47

3.13

Cat Food

USD million

935.34

1.22

Wet Cat Food

USD million

541.33

0.65

Dry Cat Food

USD million

356.98

1.81

Cat treats and mixers

USD million

37.03

3.46

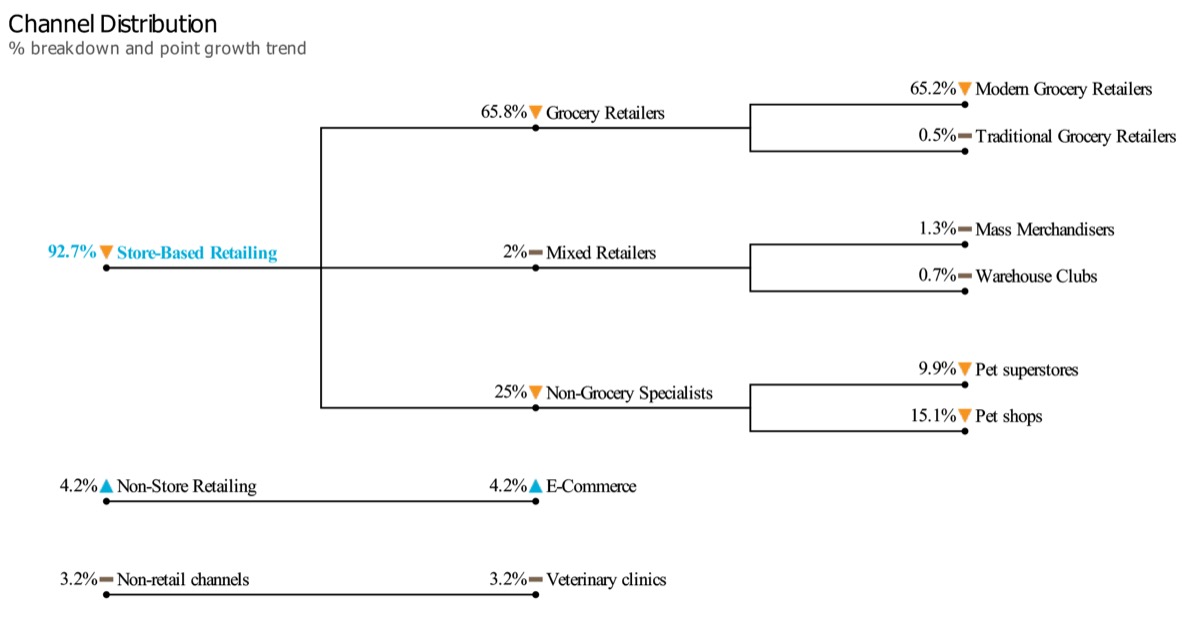

- Channel distribution

-

Kindly note: The chart here showcases retail value share of different channel sales for dog and cat food products in Australia in 2021. The triangle/dash represents whether the specific channel share has increased/decreased or remained same against its share in the previous year

- Market insights

-

Market trends

- Dog food has benefited from the event of COVID-19, as dog ownership in Australia increased over the time of the pandemic, leading to increased overall sales of dog food. At the start of the pandemic and lockdowns in 2020, dog owners opted to buy larger packs of dog food in stockpiling efforts which resulted in a short period of destocking in April 2020, and which balanced out across the remainder of the year. The trend of premiumisation and humanisation of dog food is evidenced by premium wet dog food having the strongest growth in 2021.

- As seen in dog food, the event of COVID-19 has increased pet ownership in Australia, thus stimulating sales of pet food and products overall. However, this increase in cat ownership has not impacted cat food to a significant degree over the past year, bar a small spike due to the stockpiling trend at the start of the pandemic in March 2020. The strongest performing sub-categories in 2021 are cat treats and mixers, premium wet cat food and premium dry cat food, with these being the main drivers for growth across the category. On the other hand, economy variants are seeing the sharpest declines, with mid-priced variants in small declines.

Prospects and growth opportunity

- E-commerce has boomed during the time of COVID-19, with an increasing amount of pet owners shopping for their pet food online. This led to players enhancing their online offerings alongside offering additional benefits for consumers shopping in-store. For example, retail giant Coles rolled out a “self-serve doggy treat bar” nationwide, across its supermarket chains, following a hugely popular trial in the retailer’s St Kilda stores in Melbourne and Victoria in 2020. The specialised pick-and-mix dog treats bar includes biscuits, bones, kangaroo tails, and chicken bites.

- Sales in cat treats and mixers are being boosted by higher incidences of treat occasions which mirror human snacking patterns, particularly with pet owners spending more time at home with their animals during the time of the pandemic. Such snack/treat occasions tap into pet owners’ increasing desire to bond with their pets, and players in cat food are targeting their advertising towards this trend. For example, Nestlé Purina PetCare Australia launched Felix Play Tubes, highlighting the rolling-shape of the snack which encourages playfulness and bonding with cats. The player also launched a new line of cat food toppers called Fancy Feast Appetizers in April 2020, which were sold exclusively in Coles and were marketed as being perfectly portioned to be used as a topper or complementary dietary snack.

General health & wellness trends

- Pet care has proven to be resilient over the pandemic and recession and figures are expected to return to pre-pandemic levels by 2022, as Australia gradually returns to normal. Despite the financial impacts from COVID-19, there is also a strong premiumisation trend in both cat and dog food, with clean labels and natural ingredients becoming of increasing importance, alongside fortified pet food. There has been no trading down and, in fact, economy food products have been in decline with premium food products booming

- Over the forecast period, convenience and pet humanisation are expected to continue driving industry growth, with a focus on functional products and premium pet food. Subscription services and pet food deliveries are expected to continue expanding, especially for cats.

Alcoholic Drinks

- Market size and growth

-

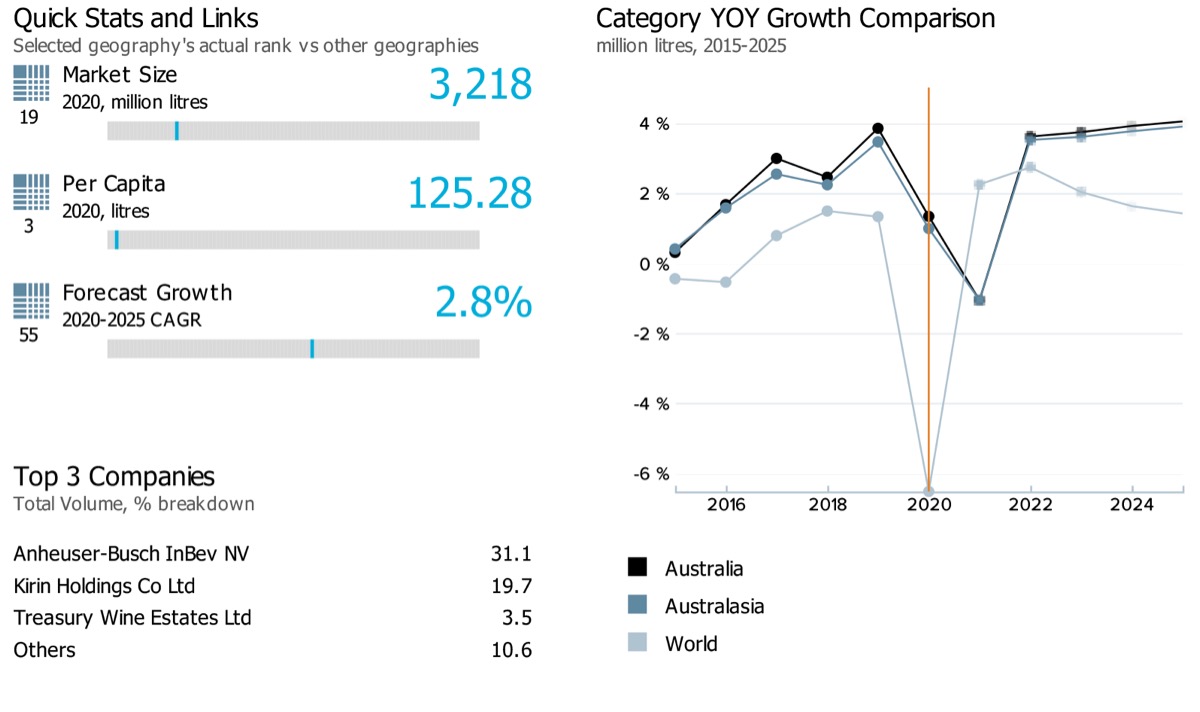

Note: Market size data for alcoholic drinks category in the country reflects the total volume in million litres. Data on the top left corner of the image (19,3 and 55) showcases respective ranks for Australia for its market sizes, per capita and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents relative position of the country as per their rank.

The compound annual growth rate for alcoholic drinks in Australia, both in terms of total value and volume, remained stronger against the category’s global performance over the historic period of 2015-2020. The trend is also expected to continue over the forecast period of 2020-2025.

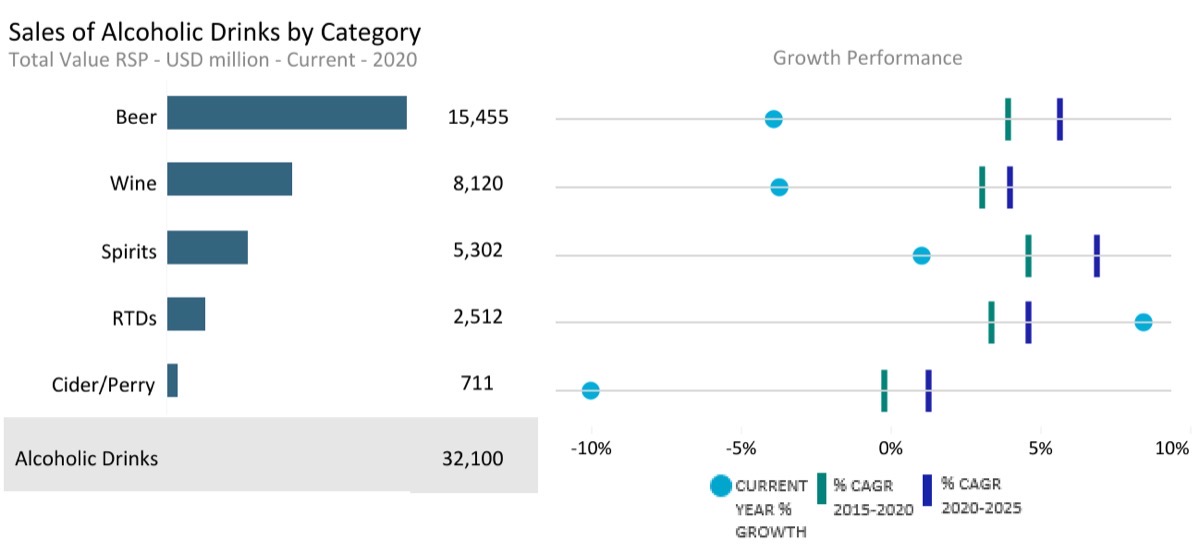

- Sub-category breakdown

-

Category

Data type

Market size (2020)

USD million

Forecast compound annual growth rate (2020/2025) %

Alcoholic Drinks

Total Value RSP

32,100.05

5.27

Alcoholic Drinks

Off-trade Value RSP

17,990.82

3.67

Alcoholic Drinks

On-trade Value RSP

14,109.22

7.18

Beer

Total Value RSP

15,455.46

5.63

Beer

Off-trade Value RSP

8,334.13

3.66

Beer

On-trade Value RSP

7,121.33

7.77

Cider/Perry

Total Value RSP

711.21

1.25

Cider/Perry

Off-trade Value RSP

364.62

-5.63

Cider/Perry

On-trade Value RSP

346.59

6.90

RTDs

Total Value RSP

2,512.00

4.64

RTDs

Off-trade Value RSP

2,049.22

4.06

RTDs

On-trade Value RSP

462.77

7.04

Spirits

Total Value RSP

5,301.54

6.86

Spirits

Off-trade Value RSP

3,137.46

5.88

Spirits

On-trade Value RSP

2,164.08

8.23

Wine

Total Value RSP

8,119.82

4.01

Wine

Off-trade Value RSP

4,105.38

2.41

Wine

On-trade Value RSP

4,014.44

5.55

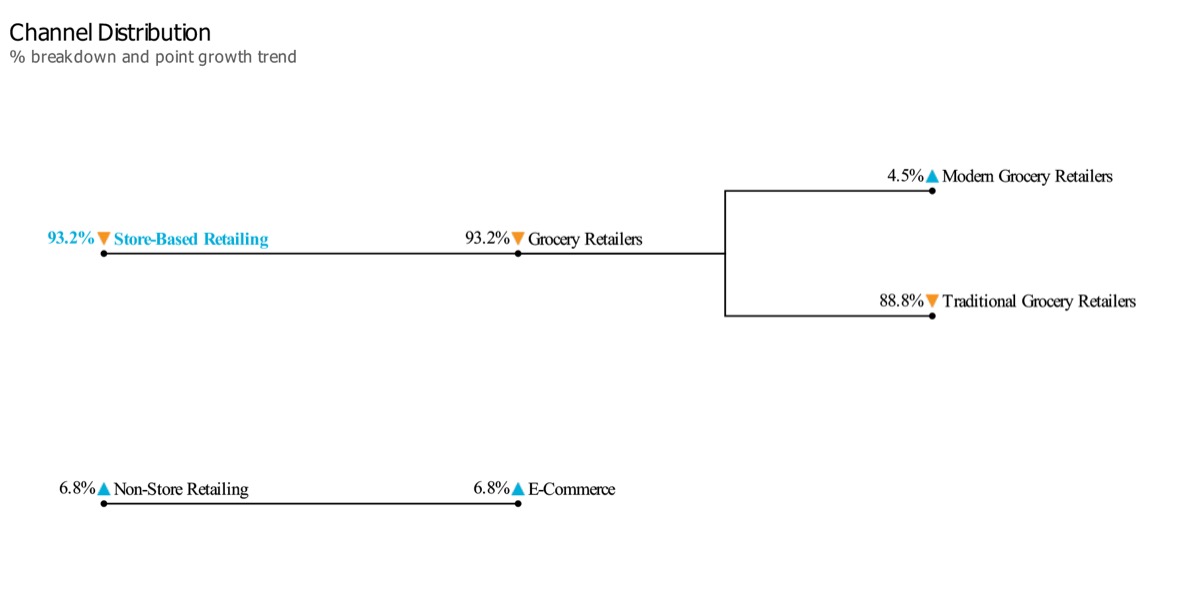

- Channel distribution

-

Kindly note: The chart here showcases off-trade volume share of different channel sales for alcoholic drink products in Australia in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained same against its share in the previous year

- Market insights

-

Market trends

- Total volume and value sales of alcoholic drinks saw decelerated growth in Australia as a result of the COVID-19 pandemic in 2020, with strong on-trade sales declines recorded across all categories. Although the country’s alcoholic drinks industry remained fully operational throughout the country’s lockdown period, which came into effect on the 25th of March, the entire Australian hospitality industry ground to a screeching halt overnight as social gatherings of more than two people were banned and all pubs, clubs, cafés and restaurants were required to remain closed, other than for takeaway orders. The inevitable result was a significant shift to the off trade as many Australians rediscovered the joys of home drinking.

- The National Drug Strategy survey conducted in 2019 showed that the proportion of Australians aged 18 who now abstain from alcohol has increased to 21% but the proportion of those aged between 18-25 years, although mindful, seems to be drinking the same amount of alcohol but less often and exclusively at special occasions when doing so, keeping in mind their calorie and sugar intake. This demographic does not prefer low ABV products or abstain from drinking completely but has constant exposure to social media which is now saturated with fitness related content and apps, as well as influencers increasingly promoting activewear and nutritional supplements. Non-alcoholic wine and non-alcoholic beer have seen demand increase at a rapid pace in recent years as part of the health and wellness trend.

- Gin was the fastest growing category within spirits and Australians are willing to pay more for their tonics and other mixers with premium mixers experiencing triple digit growth in 2020, driving the trend of minimalist cocktails, inspiring other classics like Aperol Spritz, vodka sodas and Negroni.

Prospects and growth opportunity

- Australians increasingly purchased alcoholic drinks through the e-commerce channel in 2020 thanks to the increasing availability of stores’ online websites, fast delivery times and the expansion of alcohol delivery applications across the country such as Jimmy Brings, which was launched in Perth in late 2019.

- To counter the decline in on-trade sales, several players have come up with new and innovative strategies. Many companies focused on investing on integrated marketing campaigns to provide consumers with much richer experiences, for example Heineken unveiled a first-of-its-kind “zero contact bar” for Heineken 0.0 in response to COVID-19 guidelines with its “Now You Can” campaign to ensure that drinkers can continue enjoying their beer.

- With regards to the growth opportunities for sales of wine in the country, champagne sales were robust in Australia during 2020. Demand for champagne has been decreasing in Western Europe, sales of champagne have been exceptional in Australia and that champagne sales through food/drink/tobacco specialists were up 20-40% when compared to the end of 2019. Rose wine remained the most dynamic category in wine in 2020.

- Craft beer is another area to emerge strongly in Australia, with more than 500 local breweries currently active. Although, craft beer drinkers are much less loyal to specific brands with aficionados changing their preferences often.

General industry trends

- Australia’s alcoholic drinks industry is expected to continue recording positive sales growth over the forecast period, although on-trade sales for most categories are not expected to return to pre-COVID-19 levels before the end of 2022.

- Value growth is expected to outperform volume growth overall, a reflection of the ongoing premiumisation trend being seen across all categories as alcohol consumption habits become more sophisticated, especially in wine and spirits. Higher quality and greater freshness are set to remain major priorities for most consumers, and it is expected that an increased number of premium launches will be seen in beer and RTDs, with the latter category poised to benefit substantially from the introduction of hard seltzers.

Health & Wellness Packaged Food & Beverages

- Market size and growth

-

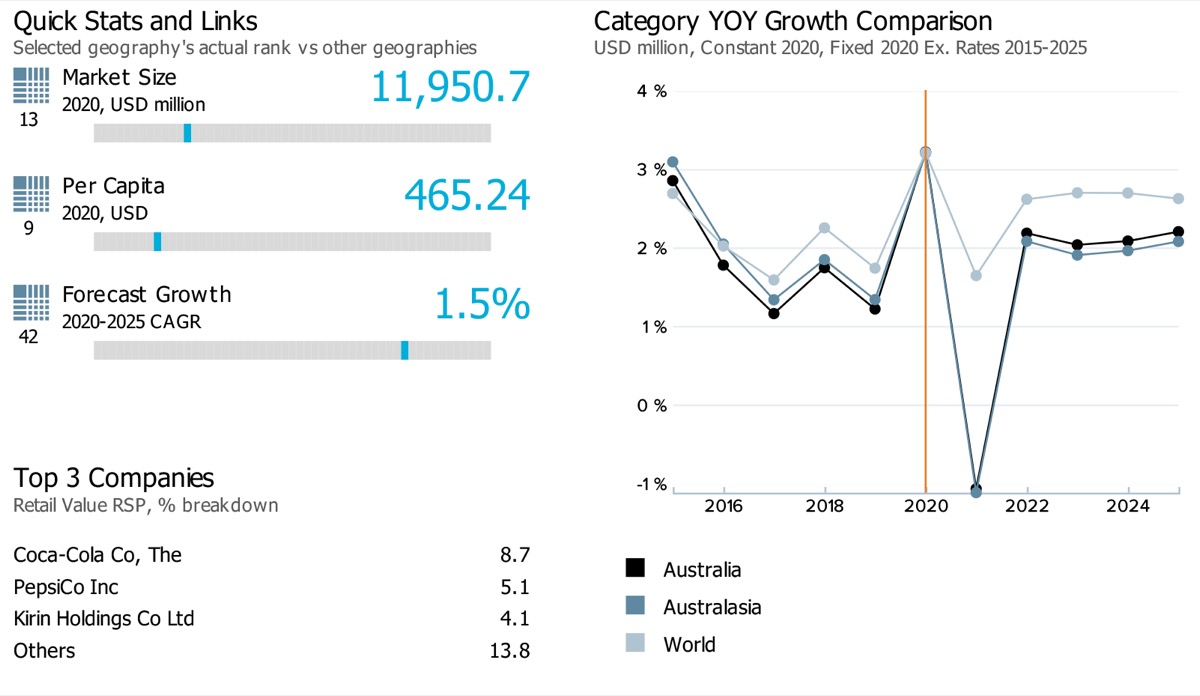

Note: Data on the top left corner of the image (13,9 and 42) showcases respective ranks for Australia for its market sizes, per capita and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents relative position of the country as per their rank

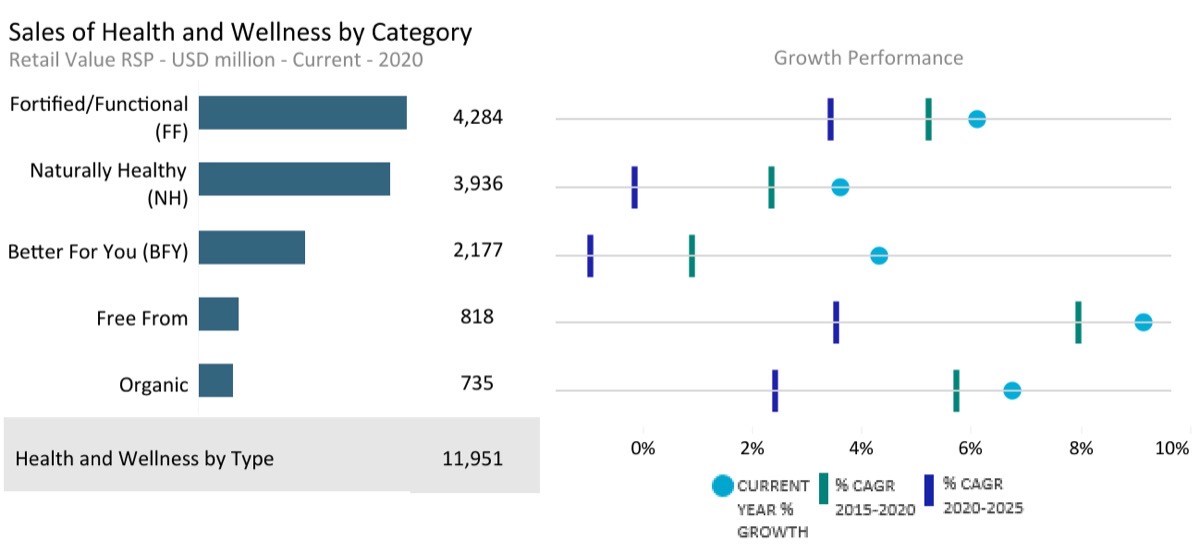

The retail value sales of health and wellness food and beverage products in Australia is expected to slow down when comparing the compound annual growth rates from historic to forecast periods i.e. (3.6% during 2015-2020 to 1.5% during 2020-2025). This is also the case with the category’s performance at the global level where its compound annual growth rate for retail value sales is estimated to slowdown from 4.6% during 2015-2020 to 2.4% during 2020-2025.

- Sub-category breakdown

-

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Health and Wellness by Type

USD million

11,950.70

1.47

Better For You (BFY)

USD million

2,176.80

-0.96

Fortified/Functional (FF)

USD million

4,284.48

3.43

Free From

USD million

817.81

3.54

Naturally Healthy (NH)

USD million

3,936.42

-0.14

Organic

USD million

735.18

2.42

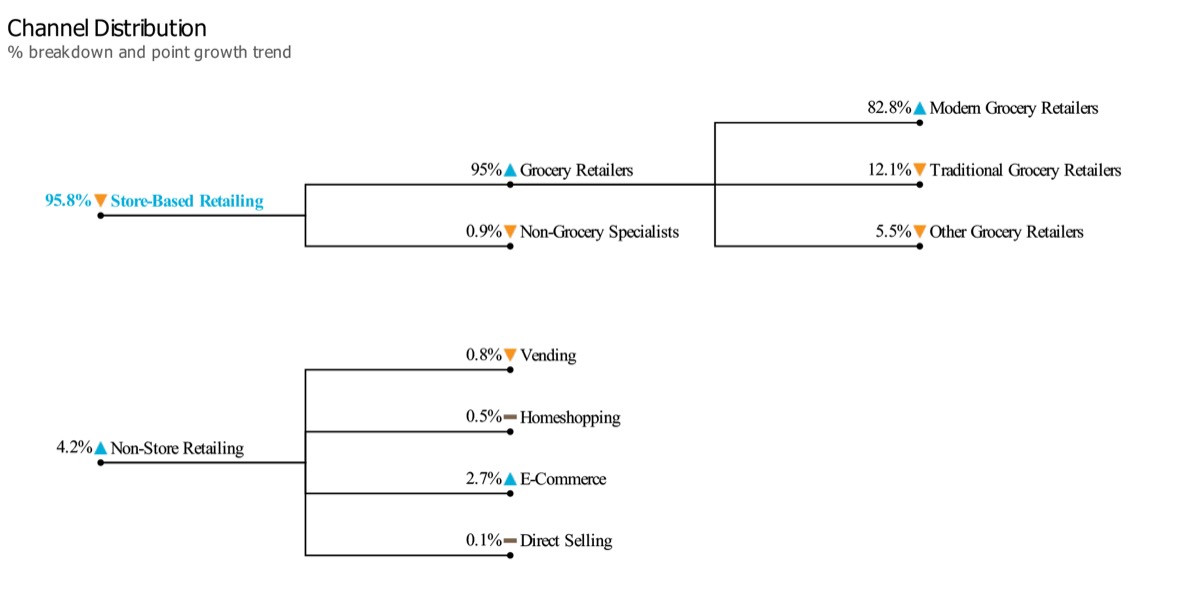

- Channel distribution

-

Kindly note: The chart here showcases retail value share of different channel sales for health and wellness by type products in Australia in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained same against its share in the previous year

- Market insights

-

Market trends

- Retail value sales of health and wellness packaged food and beverages in Australia recorded stronger growth in 2020 compared to 2019. In general, sales were boosted by the impact of the COVID-19 pandemic as consumers focused increasingly on their health and diet and adapted habits and lifestyles accordingly.

- Many consumers made renewed efforts to eat a healthier diet, including a growing shift towards plant-based and meat-free alternatives. A focus on preventative health also helped to drive sales in areas such as FF breakfast cereals. Products that provide functional benefits, such as kombucha, also continued to record significant growth in 2020 as consumers turned to products based on their wellbeing benefits.

- The COVID-19 pandemic and an increasing focus on sustainability reinforced consumers’ perception of organic food as healthy and clean. New product development responded to this trend, with many targeting new organic products at parents seeking healthier packaged food for their children. Organic baby food is set to offer the best prospects.

Prospects and growth opportunity

- Stockpiling and the temporary closure of foodservice outlets including cafés, pubs and restaurants due to the COVID-19 pandemic led to a rise in sales through retail channels, notably for supermarkets and discounters, with both seeing particularly strong growth for fortified/functional beverages.

- The e-commerce channel also continued to grow as Australians refrained from visiting stores and shopped from home more often. E-commerce also benefited from consumers seeking greater variety and premium products. Free from and organic beverages were among the categories to see a significant boost in e-commerce sales in 2020.

- In terms of innovation in 2020, new product development centred around consumers’ ongoing desire to reduce the amount of sugar in their diet. In fortified/functional packaged food, companies increasingly focused on foods with benefits for gut health as an area which is ultimately linked to the body’s immune system. This trend was particularly notable within FF dairy. Functional snacks also provided fertile ground for innovation as the line between snacking and meals continued to blur.

- A growing trend towards flexitarianism is likely to encourage further innovation and new product development in meat-free products, which are set to be one of the best performing ‘free from’ categories. Increasing demand for dairy-free substitutes and rising prevalence of lactose intolerance is also expected to drive growth in Free from dairy products.

General health & wellness trends

- Overall, the COVID-19 pandemic increased awareness of the need to adopt a healthier lifestyle and the importance of a healthy body and immune system.

- Consumers’ drive to reduce the amount of sugar in their diets is expected to remain a key issue over the forecast period, with further reduced sugar products set to be launched, especially in RTD tea, cordial and juice.

- In other areas, trends that emerged in response to the pandemic are expected to persist, such as increased demand for functional beverages. This will reflect consumers’ continuing interest in functional nutrition as many seek to better understand the role of products such as functional beverages in managing health conditions.

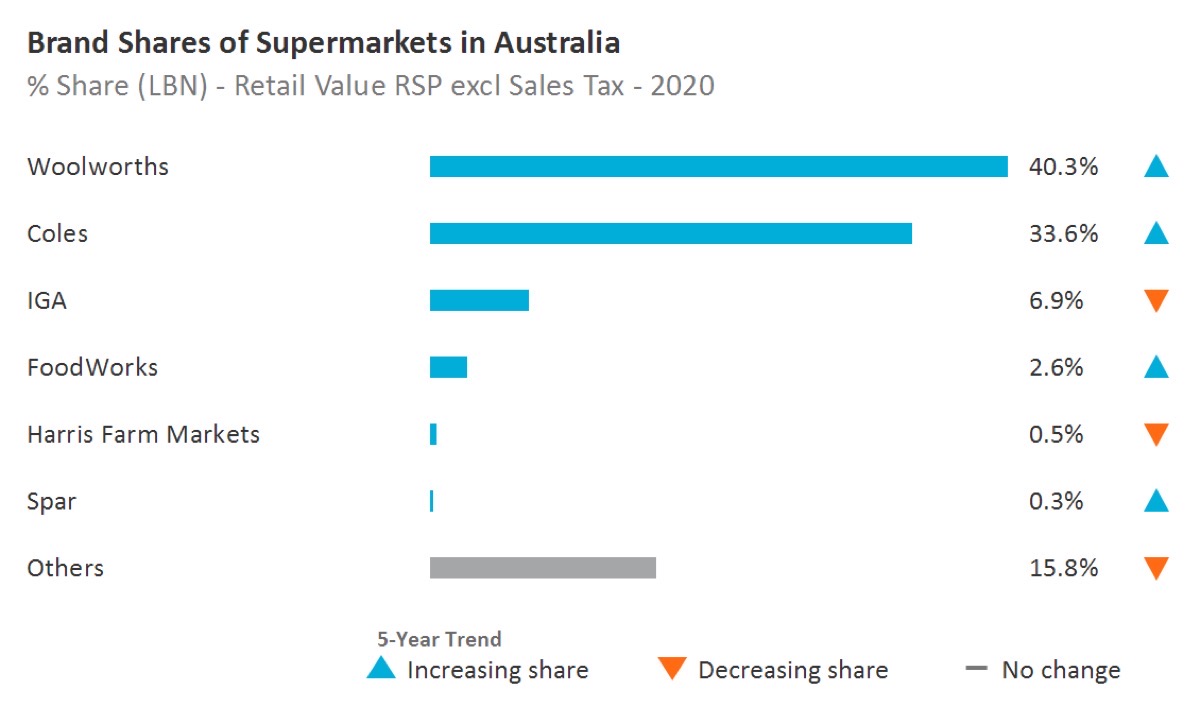

Retail Landscape

- Brand shares of supermarkets

-

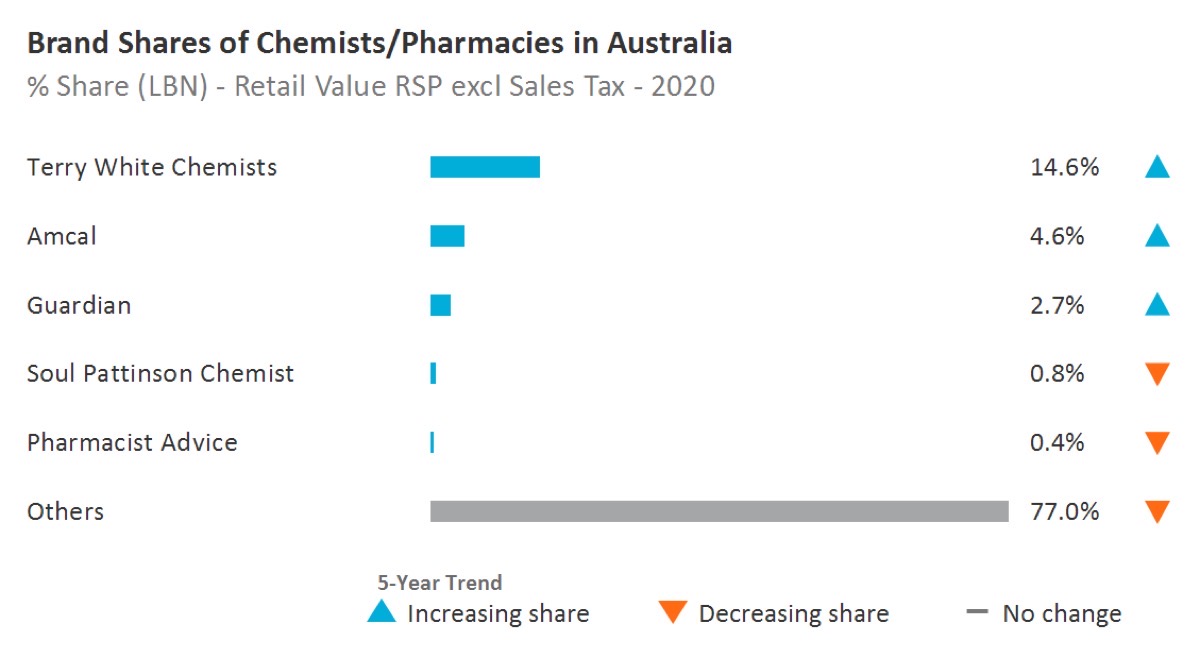

- Brand shares of chemists/pharmacies

-

- Retail insights

-

- The outbreak of COVID-19 had a wide-reaching impact on retailing in Australia, with the lockdown and social distancing measures forcing consumers to reassess how they shop. Many people switched to shopping online – some for the first time – with this being partly down to a lack of access to some products in store, but also due to concerns over the potential to catch COVID-19. Pandemic also caused consumers to reflect on their purchasing decisions. By and large it was products that were deemed essential which received the strongest interest such as food and drink, retail tissue and consumer health products, with supermarkets, discounters and chemists/pharmacies being key beneficiaries of this spending.

- Retailers rushed to improve and expand their offer in order to cope with the surge in demand for e-commerce, with some players such as Woolworths signing partnerships with on-demand delivery services such as Uber Eats in order to better manage consumer expectations. Other stores introduced click and collect and drive-through collection services, with this not only providing convenience but also helping to maintain social distancing.

- In response to the outbreak of COVID-19 there was a clear trend of consumers wanting to shop locally and closer to their homes, which benefitted leading players Woolworths, Coles and IGA. With Australians going on fewer shopping trips and shopping locally, this meant some consumers switched from going to their usual Woolworths and instead some opted for smaller Woolworths Metro outlets.

- Chemists/pharmacies held a value (Retail value RSP excluding sales tax) market size of USD 8,618.8 million for the year 2020 in the country. For the year 2020-2021, the channel witnessed a year on year growth rate of 1.4% which was almost close to its value compound annual growth rate over the historic period (2015-2020) of 1.3%. However, over the forecast period (2020-2025), the retail value compound annual growth rate of the channel is expected to rise to 2.3%.

- Definitions

- Acronyms Used & Key Notes

Definitions

|

Industry |

Category |

Definition |

|---|---|---|

|

Alcoholic Drinks |

Alcoholic Drinks |

Alcoholic drinks are the aggregation of beer, wine, spirits, cider/perry and RTDs. |

|

Alcoholic Drinks |

Beer |

An alcoholic drink usually brewed from malt, sugar, hops and water and fermented with yeast. Some beers are made by fermenting a cereal, especially barley, and therefore not flavoured by hops. Alcohol content for beer is varied – anything up to and over 14% ABV (alcohol by volume), although 3.5% to 5% is most common. Beer is the aggregation of lager, dark beer, stout and non/low alcohol beer. |

|

Alcoholic Drinks |

Cider/Perry |

Cider is made from fermented apple juice while perry is made from fermented pear juice. Both artisanal and industrial cider/perry are included. |

|

Alcoholic Drinks |

RTDs |

RTD stands for ‘ready-to-drink’. Other terms which may be used for these products are FABs, alcopops and premixes. The RTDs sector is the aggregation of malt-, wine-, spirit- and other types of premixed drinks. These drinks usually have an alcohol content of around 5% but this can reach as high as 10% ABV. Premixes containing a high percentage of alcohol of around 15%+ combined with juice or any other soft drink are included here. RTDs are usually marketed as products to be drunk neat, with ice, or as a cocktail ingredient. Fruit-flavoured, vodka-based spirits with an alcohol content of between 16-21% are classified here. Examples: Alizé, Ursus Roter, Berentzen Fruchtige, Kleiner Feigling. |

|

Alcoholic Drinks |

Spirits |

This is the aggregation of whisk(e)y, brandy and Cognac, white spirits, rum, tequila, liqueurs and other spirits. |

|

Alcoholic Drinks |

Wine |

This is the aggregation of still and sparkling light grape wines, fortified wine and vermouth and non-grape wine. In terms of alcohol content, light wine usually falls into the 8-14% ABV bracket while fortified wine ranges from 14-23% ABV. Low and non-alcoholic wine is also included in the data (attributed to each sector as appropriate). |

|

Beauty and Personal Care |

Skin Care |

This is the aggregation of facial care, body care, hand care and skin care sets/kits. |

|

Beauty and Personal Care |

Body Care |

This is the aggregation of firming/anti-cellulite products and general-purpose body care. |

|

Beauty and Personal Care |

Facial Care |

This is the aggregation of acne treatments, moisturisers and treatments, facial cleansers, toners, face masks, and lip care. Please note that Moisturisers and Treatments is the aggregation of basic moisturisers and anti-agers. |

|

Beauty and Personal Care |

Hand Care |

Includes all hand moisturisers, both premium and mass market, as well as combination hand and nail products. Includes protective emollients and deep moisturisers formulated to sooth and hydrate very dry or irritated skin, as well as those that prevent, or that are suitable for, eczema-prone or redness-prone skin. Excludes medicated emollients and/or those positioned as treatment for eczema or psoriasis. |

|

Beauty and Personal Care |

Skin Care Sets/Kits |

Multiple skin care items of the same brand line packaged together in a set and priced at an advantageous price compared to purchasing the items separately. Includes traditional gift sets, multi-step skin care regimens, skin care starter kits (including acne treatment regimen sets/kits) and skin care travel kits (sold through retail outlets). Also includes sets, which comprise of products from multiple categories (e.g. makeup and skin care), as long as the primary product is skin care. Men’s, women’s and unisex versions are included. Excludes: GWP (Gift with Purchase) – consumer does not pay for this (e.g. free product when you purchase a set or a free sample kit). |

|

Consumer Health |

Dietary Supplements |

It is the aggregation of all dietary supplements: Minerals, fish oils/omega fatty acids, garlic, ginseng, ginkgo biloba, evening primrose oil, Echinacea, St John's Wort, protein supplements, probiotic supplements, eye health supplements, co-enzyme Q10, glucosamine, combination herbal/traditional supplements, non-herbal/traditional supplements, and all other dietary supplements specific to country coverage. |

|

Consumer Health |

Paediatric Vitamins and Dietary Supplements |

All vitamin and dietary supplement products formulated, designed, marketed and labelled specifically for children. |

|

Consumer Health |

Tonics |

Include versions of combination dietary supplements that are sold in the format of liquid concentrates, mini-drinks, shots or oral gels. Include concentrated energy shot boosters and tonics such as 5-Hour Energy and Lipovitan. Exclude remedies made with active pharmaceutical ingredients as well as super fruit juice concentrates and weight-loss beverages, tracked under the Health and Wellness (HW) system. |

|

Consumer Health |

Vitamins |

This is the aggregation of multivitamins and single vitamins. |

|

Health and Wellness |

Health and Wellness by Type |

Health and Wellness by Type is the aggregation of all health and wellness food and beverages broken down by organic, fortified/functional, naturally healthy, better for you and free from products. |

|

Health and Wellness |

Better For You (BFY) |

Products where the amount of a substance considered to be less healthy (eg fat, sugar, salt, carbohydrates) has been actively reduced during production. To qualify for inclusion in this category, the “less healthy” element of the foodstuff needs to have been actively removed or substituted during the processing. This should also form a key part of the positioning/marketing of the product. Products which are naturally fat/sugar/carbohydrate -free are not included as nothing out of the ordinary has been done during their production to make them “better for you”. “No added sugar” claims are excluded too. Products most likely to be included here will be those which are low-fat/low-sugar versions of standard products (i.e. reduced fat mayonnaise, reduced fat cheese, reduced fat milk, reduced sugar confectionery, etc). |

|

Health and Wellness |

Fortified/Functional (FF) |

This category includes fortified/functional food and beverages. When identifying fortified/functional products, we focus on products to which health ingredients or/and nutrients have been added as well as brands that are positioned to deliver a certain functionality. To be included here the enhancement must be highlighted in the label or hold a health claim/nutritional claim. Fortified/functional food and beverages provide health benefits beyond their nutritional value and/or the level of added ingredients wouldn’t normally be found in that product. To merit inclusion in this category, the defining criterion here is that the product must have been actively fortified/enhanced during production. As such, inherently healthy products such as 100% fruit/vegetable juices are only included under "fortified/functional" if additional health ingredients (e.g. calcium, omega 3) have been added. To be included, the health benefit needs to form part of positioning/marketing of the product. For product category definitions please refer to the definitions section (can be found under the "Help" section on Passport) for the respective system: Packaged Food, Hot Drinks, Soft Drinks. |

|

Health and Wellness |

Free From |

This category includes free from gluten, free from lactose, free from allergens, free from dairy and free from meat products. This excludes foods which are certified ‘free’ of a specific product when this is based on use of sterilised equipment. |

|

Health and Wellness |

Naturally Healthy (NH) |

This category includes food and beverages based on naturally containing a substance that improves health and wellbeing beyond the product’s pure calorific value. These products are usually a healthier alternative within a certain sector/subsector. High fibre food (wholegrain/wholemeal/brown), soy products, sour milk drinks, nuts, seeds and trail mixes, honey, fruit and nut bars and olive oil are considered NH foods and 100% fruit/vegetable juice, superfruit juice, natural mineral water, spring water, RTD green tea etc. are considered NH beverages. While many of these products are marketed on a health basis, this might not always be the case. Naturally healthy food and beverages that are additionally fortified fall into the 'fortified/functional' category. |

|

Health and Wellness |

Organic |

Certified organic products are those which have been produced, stored, processed, handled and marketed in accordance with precise technical specifications (standards) and certified as "organic" by a certification body such as the Soil Association in the UK, the European Union or the US Department of Agriculture. It is important to note that an organic label applies to the production process, ensuring that the product has been produced and processed in an ecologically sound manner. The organic label is therefore a production process claim as opposed to a product quality claim. Note: For organic products to be included, the organic aspect needs to form a significant part of the overall positioning/marketing of the product, including the organic certification label in the packaging. |

|

Pet Care |

Dog and Cat Food |

This is the aggregation of dog and cat food. |

|

Pet Care |

Cat Food |

This is the aggregation of wet and dry cat food. |

|

Pet Care |

Cat Treats and Mixers |

This is the aggregation of mixers and treats for cats. |

|

Pet Care |

Dry Cat Food |

These products have a moisture content of 10-14% and are generally packed into paper, plastic or cardboard. Dry cat food is typically made from a combination of grain-based ingredients (corn and rice) and a meat component. It is typically produced by extrusion cooking under high heat and pressure and then sprayed with fat to increase palatability. Other ingredients may also be added to complete its composition. This is the aggregation of premium, mid-priced and economy dry cat food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal), have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Cat Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet cat food. |

|

Pet Care |

Dog Food |

This is the aggregation of wet and dry dog food. |

|

Pet Care |

Dog Treats and Mixers |

This is the aggregation of mixers and treats for dogs. |

|

Pet Care |

Dry Dog Food |

These products generally have a moisture content of 6-14% and are generally packed into paper, plastic or cardboard. Complete dry dog foods fall into two broad categories: Flaked (or 'Muesli' type blended products) and Extruded products (meat and cereals cooked by direct steaming). This is the aggregation of premium, mid-priced and economy dry dog food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal) have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Dog Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet dog food. |

|

Retail in Alcoholic Drinks |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Alcoholic Drinks |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Alcoholic Drinks |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Alcoholic Drinks |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Alcoholic Drinks |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (readymade sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Alcoholic Drinks |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Alcoholic Drinks |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Alcoholic Drinks |

Food/drink/tobacco specialists |

Retail outlets specialising in the sale of mainly one category of food, drinks store and tobacconists. Includes bakers (bread and flour confectionery), butchers (meat and meat products), fishmongers (fish and seafood), greengrocers (fruit and vegetables), drinks stores (alcoholic and non-alcoholic drinks), tobacconists (tobacco products and smokers’ accessories), cheesemongers, chocolatiers and other single food categories. Alcoholic drinks stores are retail outlets with a primary focus on selling beer/wine/spirits/other alcoholic beverages. Example brands include: Threshers, Gall & Gall, Liquorland, Watson’s Wine Cellar |

|

Retail in Alcoholic Drinks |

Independent Small Grocers |

Retail outlets selling a wide range of predominantly grocery products. These outlets are usually not chained and if chained will have fewer than 10 retail outlets. Mainly family owned, often referred to as Mom and Pop stores. |

|

Retail in Alcoholic Drinks |

Other Grocery Retailers |

Other retailers selling predominantly food, beverages and tobacco or a combination of these. Includes kiosks, markets selling predominantly groceries. Includes CTNs and health food stores, Food & drink souvenir stores and regional speciality stores. Direct home delivery, eg of milk, meat from farm/dairy is excluded. Sari-Sari stores in Philippines and Warung (Waroon) in Indonesia, that can either be markets or kiosks, are included in Other grocery retailers unless they occupy a separate permanent outlet building, in which case they are included in Independent small grocers. Outlets located within wet markets, particularly in South East Asia (often located in government-owned multi-story buildings) should be counted as separate outlets. Wine sales from Vineyards are included here. |

|

Retail in Alcoholic Drinks |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Alcoholic Drinks |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Alcoholic Drinks |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Alcoholic Drinks |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Alcoholic Drinks |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Alcoholic Drinks |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Alcoholic Drinks |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Alcoholic Drinks |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Alcoholic Drinks |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Alcoholic Drinks |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Alcoholic Drinks |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Alcoholic Drinks |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Beauty and Personal Care |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Beauty and Personal Care |

Modern Grocery Retailers |

Modern grocery retailing is the aggregation of those grocery channels that have emerged alongside the growth of chained retail: Hypermarkets, Supermarkets, Discounters, Forecourt Retailers and Convenience Stores. |

|

Retail in Beauty and Personal Care |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Beauty and Personal Care |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Beauty and Personal Care |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (ready-made sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Beauty and Personal Care |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Beauty and Personal Care |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Beauty and Personal Care |

Traditional Grocery Retailers |

Traditional grocery retailing is the aggregation of those channels that are invariably non-chained and are, therefore, owned by families and/or run on an individual basis. Traditional grocery retailing is the aggregation of three channels: Independent Small Grocers, Food/Drink/Tobacco Specialists and Other Grocery Retailers. |

|

Retail in Beauty and Personal Care |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Beauty and Personal Care |

Apparel and Footwear Specialist Retailers |

Outlets specialising in the sale of all types of apparel, footwear and fashion accessories including costume jewellery, belts, handbags, hats, scarves or a combination of these (for example stores selling handbags only are included). This includes those stores that carry a combination of all products for either men or women or children and those that may specialise by either gender, age or product. Example brands include Gap, H&M, Zara, C&A, Miss Selfridge, Foot Locker, Uniglo, Next, Matalan. Brands that offer sports apparel and sports goods are excluded from Apparel and footwear specialist retailers and are included in Sports goods stores. |

|

Retail in Beauty and Personal Care |

Electronics and Appliance Specialist Retailers |

Retail outlets specialising in the sale of large or small domestic electrical appliances, consumer electronic equipment (including mobile phones), computers or a combination of these. For mobile phone retailers, this excludes revenues derived from telecoms service plans and top-up cards, etc. Example brands include Apple, Best Buy, Euronics, PC World, Darty, But, Media Markt, Yamada Denki, Gome (China). |

|

Retail in Beauty and Personal Care |

Health and Beauty Specialist Retailers |

This is the aggregation of chemists/pharmacies, drugstores/parapharmacies, beauty specialist retailers, optical goods stores and other healthcare specialist retailers. |

|

Retail in Beauty and Personal Care |

Beauty Specialist Retailers |

Beauty specialist retailers are chained or independent retail outlets with a primary focus on selling fragrances, other cosmetics and toiletries, beauty accessories or a combination of these. Examples of Beauty specialist retailer brands include: Body Shop, Marionnaud, Sephora and Bath and Body Works. |

|

Retail in Beauty and Personal Care |

Chemists/Pharmacies |

Retail outlets selling prescription-bound medicines under the supervision of a pharmacist and as its core activity (other activities include sales of OTC healthcare and cosmetics and toiletries products). |

|

Retail in Beauty and Personal Care |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Beauty and Personal Care |

Home and Garden Specialist Retailers |

This is the aggregation of homewares and home furnishing stores and home improvement and gardening stores. Business-to-business sales are excluded. Home improvement and gardening stores are chained or independent retail outlets with a primary focus on selling one or more of the following categories: Home improvement materials and hardware, Paints, coatings and wall coverings, Kitchen and bathroom, fixtures and fittings, Gardening equipment, House/Garden plants. Home improvement and gardening stores includes Home improvement centres / DIY stores, Hardware stores (Ironmongers), Garden centres, Kitchen and bathroom showrooms, Tile specialists, Flooring specialists. Homewares and Home Furnishing stores are retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Homewares and Home Furnishing Stores |

Retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Other Non-Grocery Specialists |

Other non-grocery retailers are chained or independent retail outlets, kiosks, market stalls or street vendors and with a primary focus on selling non-food merchandise. Other non-grocery retailers include Charity shops, Second-hand shops and Market stalls. |

|

Retail in Beauty and Personal Care |

Outdoor Markets |

Includes bazaars, kiosks, street vendors and beach vendors. |

|

Retail in Beauty and Personal Care |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Beauty and Personal Care |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Beauty and Personal Care |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Beauty and Personal Care |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Beauty and Personal Care |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Beauty and Personal Care |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Beauty and Personal Care |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Beauty and Personal Care |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Beauty and Personal Care |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Beauty and Personal Care |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Hair Salons |

Hair salons |

|

Retail in Health and Wellness |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Health and Wellness |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Health and Wellness |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Health and Wellness |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (ready made sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Health and Wellness |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Health and Wellness |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Health and Wellness |

Independent Small Grocers |

Retail outlets selling a wide range of predominantly grocery products. These outlets are usually not chained and if chained will have fewer than 10 retail outlets. Mainly family owned, often referred to as Mom and Pop stores. |

|

Retail in Health and Wellness |

Other Grocery Retailers |

Other retailers selling predominantly food, beverages and tobacco or a combination of these. Includes kiosks, markets selling predominantly groceries. Includes CTNs and health food stores, Food & drink souvenir stores and regional speciality stores. Direct home delivery, e.g. of milk, meat from farm/dairy is excluded. Sari-Sari stores in Philippines and Warung (Waroon) in Indonesia, that can either be markets or kiosks, are included in Other grocery retailers unless they occupy a separate permanent outlet building, in which case they are included in Independent small grocers. Outlets located within wet markets, particularly in South East Asia (often located in government-owned multi-story buildings) should be counted as separate outlets. Wine sales from Vineyards are included here. |

|

Retail in Health and Wellness |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Health and Wellness |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Health and Wellness |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Health and Wellness |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Health and Wellness |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Pet Care |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Pet Care |

Grocery Retailers |