Singapore

Country Overview

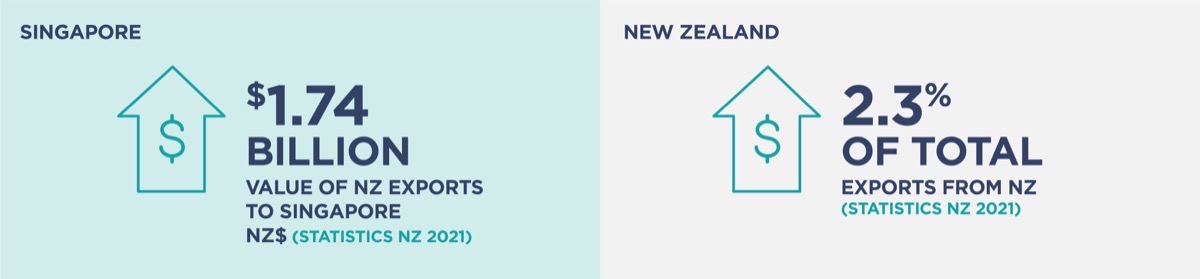

Singapore is 15th largest export economy globally, and New Zealand’s seventh largest trading partner. The World Economic Forum ranks Singapore as the best country in the world for trade openness and overall global competitiveness.

Singapore is a hub for the greater Asian region. More than 4000 multinational corporations are headquartered in an area smaller than Taupō and with a population of just 5.85 million.

Singaporean consumers are the wealthiest in Asia. Well-educated and well-travelled, they’re accustomed to trying international brands and products.

Its transparent government, thriving entrepreneurial ecosystem and affluent society make Singapore an ideal environment for business.

Trade agreements

Under the 2001 NZ-Singapore Closer Economic Partnership (CEP), Singapore is tariff-free for New Zealand goods. The 2019 New Zealand-Singapore Enhanced Partnership further improves access for New Zealand businesses.

Singapore is part of the ASEAN-Australian-New Zealand Free Trade Area (AANZFTA), the Trans-Pacific Strategic Economic Partnership Agreement (P4) and the Comprehensive and Progressive Agreement for Tans-Pacific Partnership (CPTPP). It is also a founding member of the Association of Southeast Asian Nations (ASEAN), which aims to strengthen economic ties and co-operation amongst its members.

Country intelligence

The Robinson Country Intelligence Index is a holistic measurement of country-level risk and serves as an alternative measure of country development. It incorporates four broad dimensions of Governance, Economics, Operations and Society. A higher ranking indicates a better Country Intelligence Index score.

Value of New Zealand exports

International logistics performance

The International Logistics Performance Index measures how efficiently countries move goods across and within borders. Countries are ranked on their index score with a higher ranking indicating higher performance of trade logistics based on six components: customs, infrastructure, ease of international shipments, logistics services quality and competence, tracking and tracing, and timeliness.

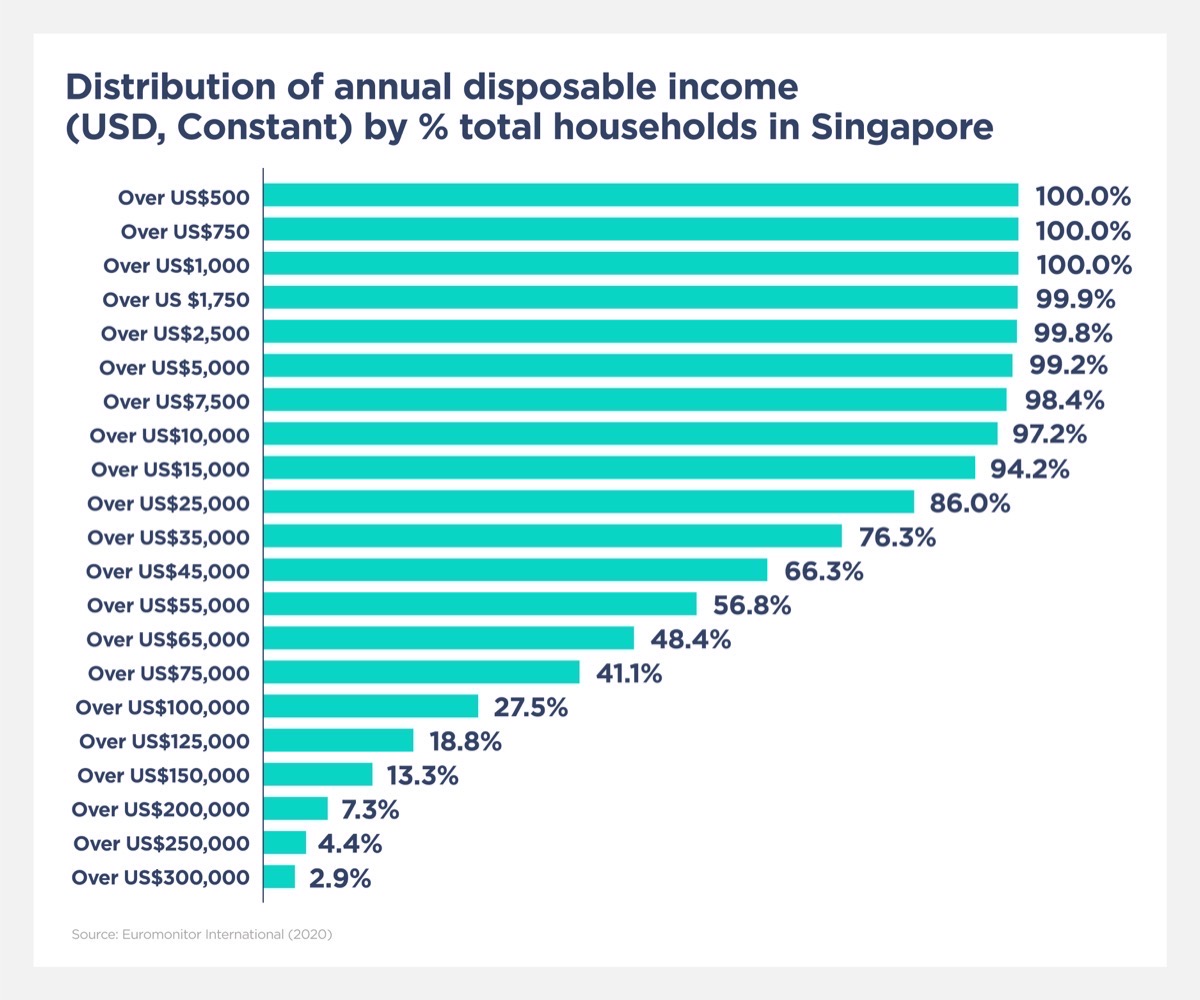

Income and distribution of wealth

Global National Income (GNI) per capita is the dollar value of a country's final income in a year, divided by its population.

Annual Disposable Income refers to gross income minus social security contributions and income taxes. Each income band presents data referring to the percentage of households with a disposable income over that amount.

Further information

For more information to validate Singapore as an export market, see our Singapore Market Guide.

- Vitamins & Dietary Supplements

- Skin Care

- Dog & Cat Food

- Alcoholic Drinks

- Health & Wellness Packaged Food & Beverages

Vitamins & Dietary Supplements

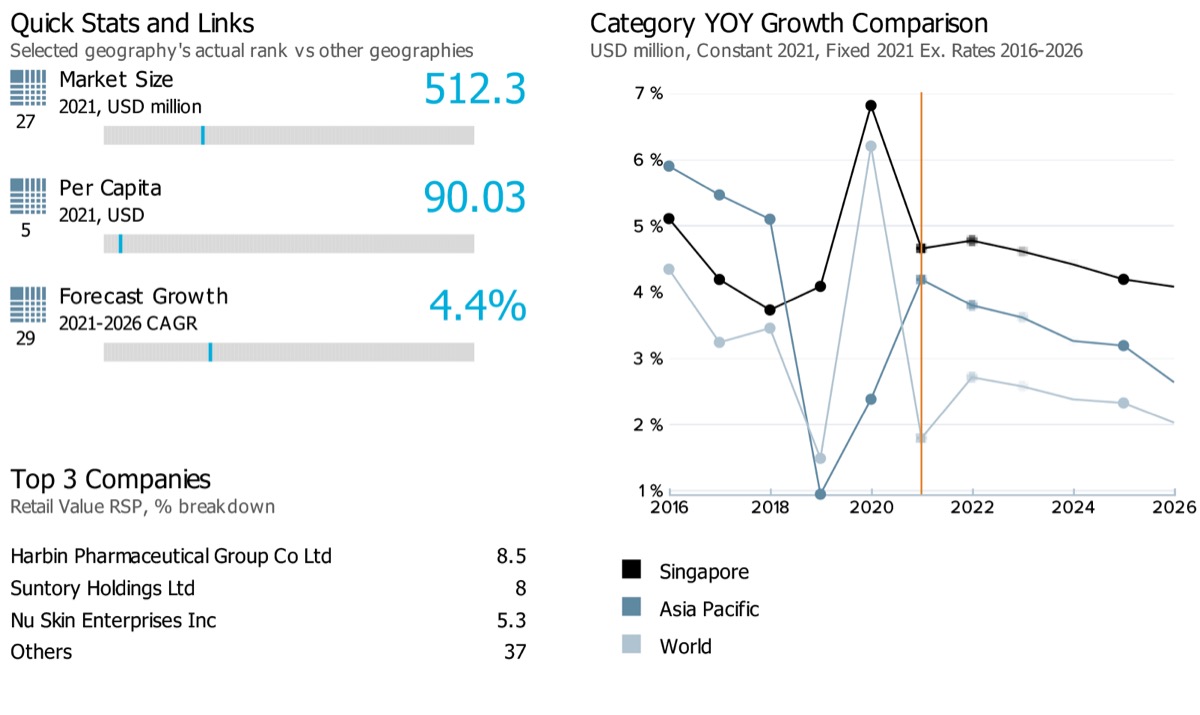

- Market size and growth

-

Note: Data on the top left corner of the image (27,5 and 29) showcases respective ranks for Singapore for its market size, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Note: Latest market size data for the year 2021 has been shared for Vitamins & Dietary Supplements

Retail value sales of vitamins and dietary supplements in Singapore witnessed a historic compound annual growth (CAGR) of 5.2% during 2016-2021. It is further expected to grow at a slowed-down retail value CAGR of 4.4% over 2021-2026. As for the global performance of the category, it is expected to slow down from a historic CAGR of 5.1% to a forecast CAGR of 2.4% over the same period for its retail value sales.

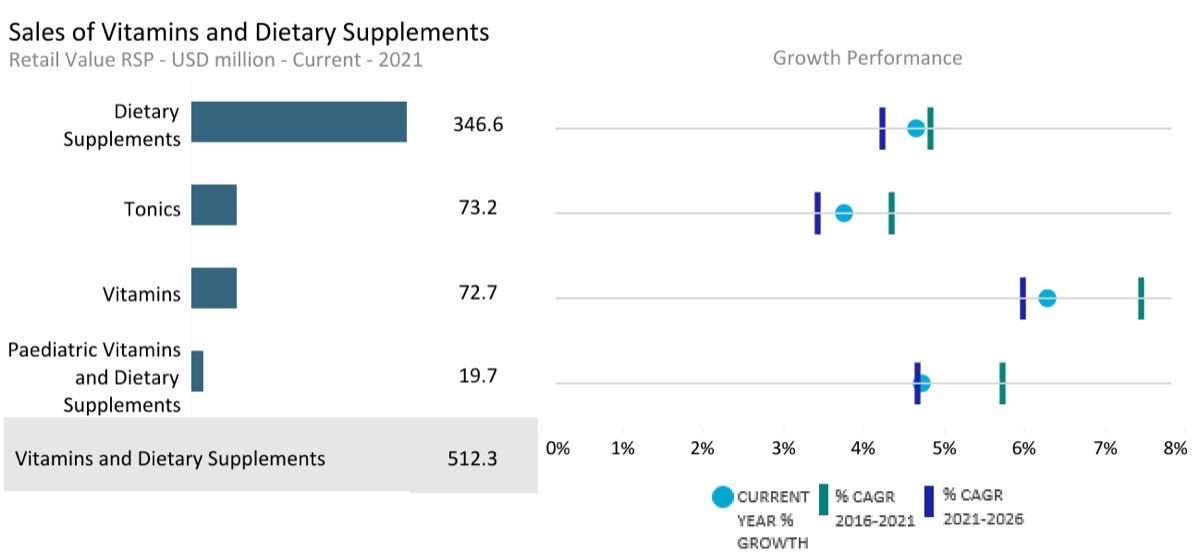

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to period 2021-22

Category

Unit

Market size (2021)

Retail value RSP

Forecast compound annual growth rate (2021/2026) %

Vitamins and Dietary Supplements

USD million

512.31

4.40

Vitamins

USD million

72.72

5.99

Paediatric Vitamins and Dietary Supplements

USD million

19.74

4.68

Dietary Supplements

USD million

346.62

4.24

Tonics

USD million

73.23

3.44

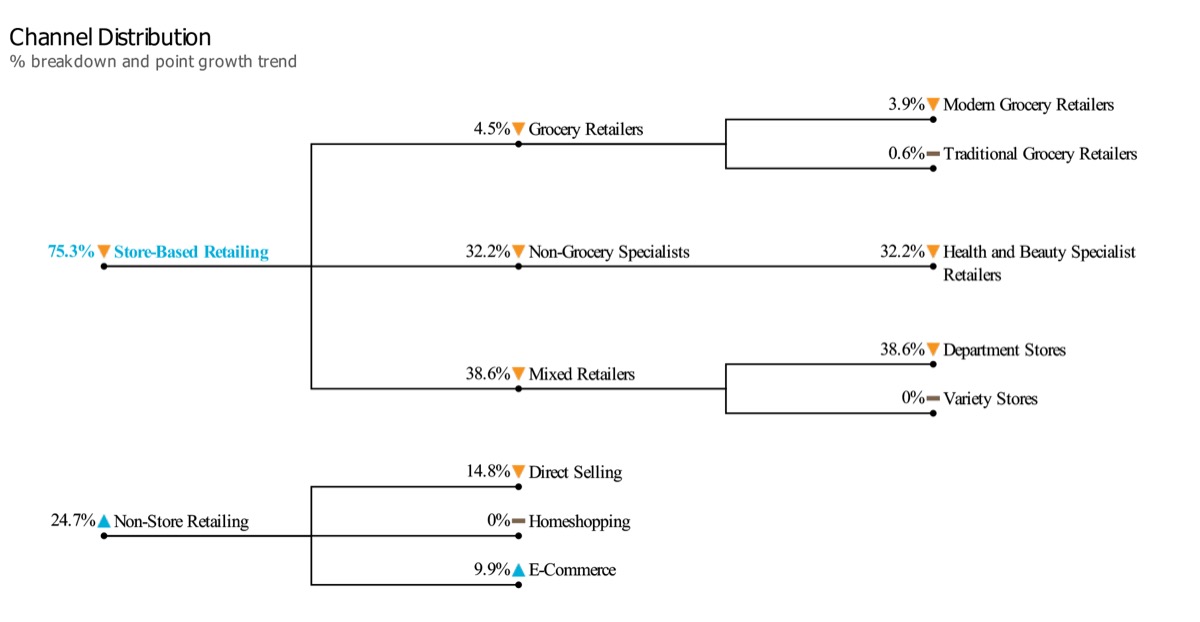

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for Vitamins and dietary supplement products in Singapore in 2021. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year

- Market Insights

-

Market trends

- The outbreak of COVID-19 resulted in a spike in demand for immunity boosting products, including vitamins. Given that Singaporeans have been used to consuming vitamins daily, the COVID-19 pandemic just accelerated the demand for these products. This was highlighted by a 3-5-fold increase in sales of multivitamins and vitamin C in leading supermarket retailers like NTUC. Besides this, local drugstores Watsons and Guardian also experienced a peak in online traffic purchases, leading to out-of-stock situations for vitamin products.

- With the number of Singaporeans with dementia expected to reach over 100,000 by 2030, memory issues are becoming a major concern. Dietary supplements targeted at memory improvement, including ginkgo biloba, omega, and fish oil, are therefore witnessing high demand. In addition to older consumers, younger consumers are more afraid of memory deterioration and thereby are increasingly seeking these products. ONI Global, an importer and distributor of health and Nutritional Supplements, leads the highly fragmented dietary supplements industry in Singapore. It benefits from the strong presence of its GNC brand in the country, supported by a wide distribution network as a retailer. It, therefore, capitalises on being able to promote its own products in both stores and online.

Prospects and growth opportunity

- The COVID-19 outbreak has accelerated the trend towards e-commerce for vitamins across overall consumer health. According to local drugstore retailer Watsons, online site traffic reached 1.1 million visits in February 2020 alone, compared to 780,000 during December 2019. This highlights consumers are increasing reliance on e-commerce channels for the purchase of vitamins and dietary supplement products. With the added convenience of various fulfilment methods, such as doorstep deliveries and availability to click-and-collect, e-commerce will therefore continue to gain ground from competing for offline channels.

- There has been an emergence of “wellCare” – the combination of wellness and healthcare overlapping across both beauty and health products. This will increasingly blur category lines, prompting the emergence of more dietary supplements with beauty positioning. Common examples include supplements formulated with antioxidants, collagen, and vitamins, with marine collagen being a popular ingredient. The increasing blurring of category lines will therefore force existing supplement players to relook at their product offerings and come up with beauty-related innovations over the forecast period.

General health & wellness trends

- Given the relatively fragmented vitamins market in Singapore, local biotech companies are beginning to enter by developing niche products. An example of this is Imagene Labs, a genetics-driven wellness company specialising in providing personalised vitamins according to one’s DNA. While the trend of tailored vitamin products remains largely a niche area within the wider vitamins landscape, it is an emerging trend with the potential to tap into during the forecast period.

- Eye health supplements such as omega, lutein and fish oil will continue to grow in popularity in tandem with the population of people suffering from myopic and presbyopia in Singapore. In fact, according to some reports up to 65% of Singaporean children are expected to suffer from myopia by the age of 12 years.

Skin Care

- Market size and growth

-

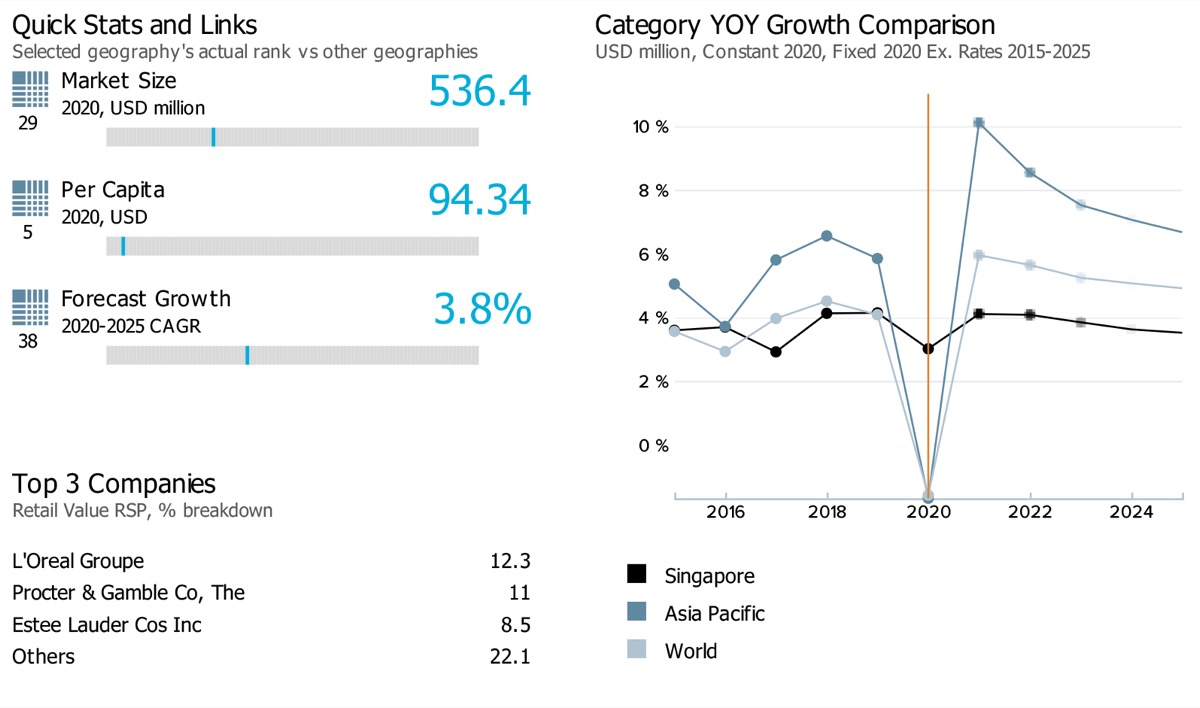

Note: Data on the top left corner of the image (29,5 and 38) showcases respective ranks for Singapore for its market size, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

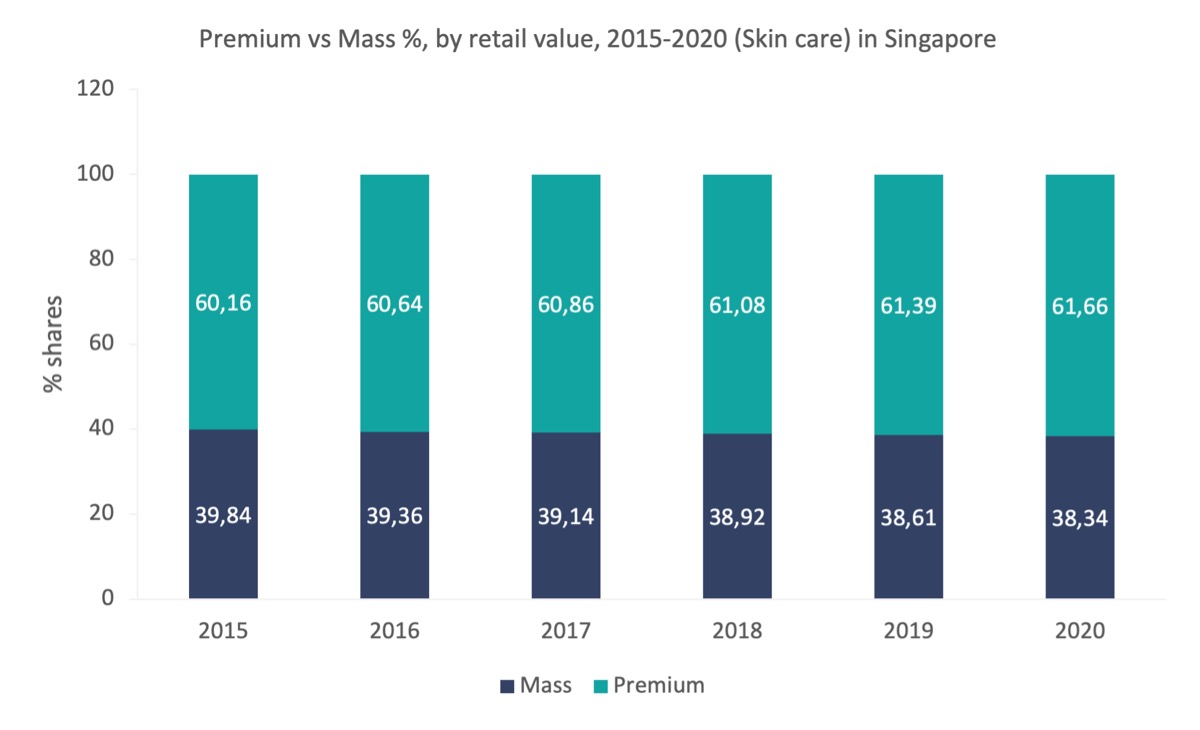

Retail value sales of skin care products in Singapore are expected to witness an almost steady compound annual growth rate (CAGR) over the historic (2015-2020: 3.7%) and forecast period (2020-2025: 3.8%). However, at the global level, the retail value sales of the category are estimated to witness a slightly increased CAGR over the forecast period (2020-2025: 5.3%) against its performance over the historic period (2015-2020: 4.7%).

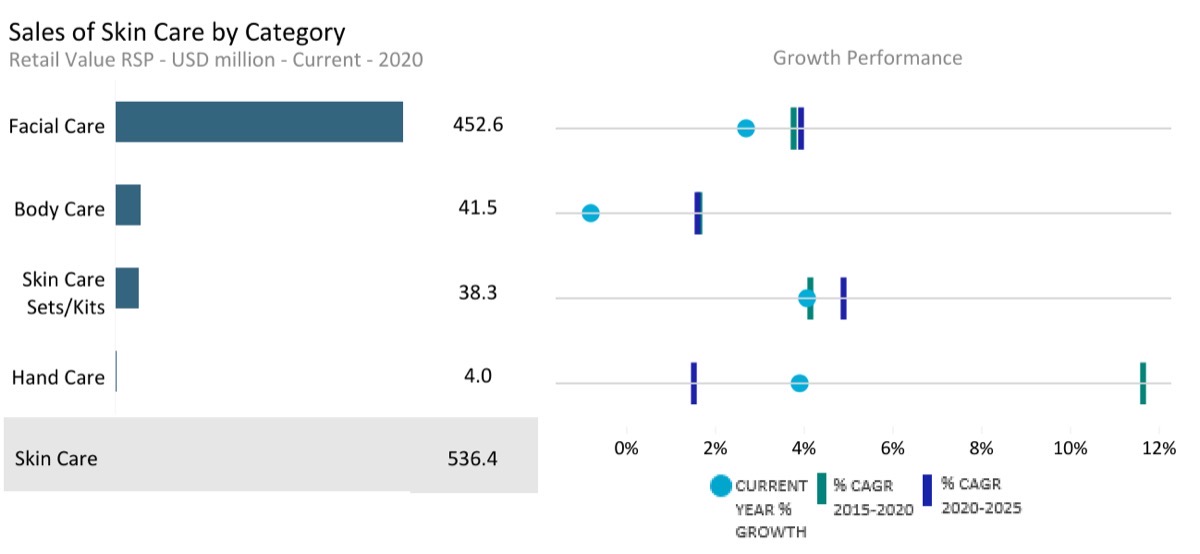

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to period 2019-20

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Skin Care

USD million

536.41

3.82

Body Care

USD million

41.55

1.59

Facial Care

USD million

452.64

3.94

Hand Care

USD million

3.96

1.49

Skin Care Sets/Kits

USD million

38.26

4.88

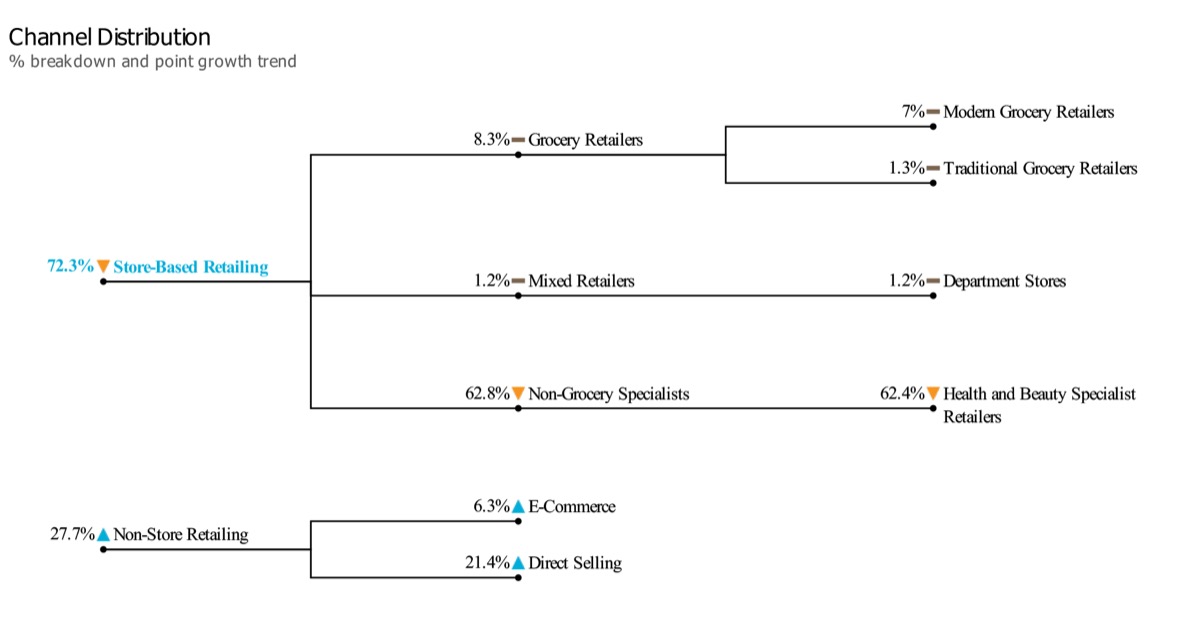

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for skin care products in Singapore in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- Amongst all the beauty and personal care categories, skin care was better positioned to manage through the COVID-19 crisis in 2020. The category remained largely resilient, with hand care and other products perceived as “clean” and “safe”, benefiting from the shift towards preventive health when it came to skin care. Consumers also opted for skin care as opposed to colour cosmetics and fragrances, with an ongoing desire to maintain good skin care routines. Local skin care brand Zyu Skincare launched its DIY (do it yourself) facial treatment kit in 2020, which was designed to replace salon facial treatments during the lockdown.

- The closure of brick-and-mortar retailers during the lockdown heavily accelerated the shift towards e-commerce. As such, brands and retailers were quick to refocus their efforts on either optimising their websites or pushing products through online marketplaces like Shopee and Lazada. With aggressive promotions and advertising, online sales for skin care saw a huge spike in sales during 2020. For example, local skin care brand Skin Inc reported a massive spike in online sales with loyal customers unable to shop in-store for its skin care serums and devices.

- Following the outbreak of COVID-19, it became mandatory to wear face masks in public in Singapore, which led to the emergence of so-called “maskne”. This is a skin irritation caused by mask-wearing, which results in acne around areas of the face covered by the mask. This, in turn, led to increased demand for skin care solutions in order to combat this problem. An example of such a solution is Skin Inc’s Mask Liner, which is an additional layer made of lightweight fabric that is meant to be worn under your mask to prevent it from irritating your face. With the wearing of face masks set to become the new normal, at least in the short-term future, it is expected that there will be further skin care solutions launched to help reduce instances of “maskne”.

Prospects and growth opportunity

- There has been an accelerated development of technology within the beauty industry that has helped create a more personalised experience for the consumer. For example, L’Oréal’s dermo-cosmetic skin care brand SkinCeuticals launched its tech-driven beauty counter at the BHG beauty hall in 2020. The counter is equipped with interactive VR and AR technology which educates consumers about the brand’s products, such as the Holographic Wall which allows consumers to enter a 3D space featuring different products. The introduction of innovative technologies is set to transform the beauty retail environment during the forecast period, creating an even more competitive environment for brands to compete within. Furthermore, introducing technology that can identify a consumer’s specific skin care needs would be a good way to add value and retain consumer loyalty.

- The outbreak of COVID-19 has set the stage for e-commerce to flourish over the forecast period. With this in mind, there has been an increasing collaboration between brands and online marketplaces to facilitate online shopping for skin care, especially for younger consumer segments such as Millennials and Generation Z. Proctor & Gamble’s Olay brand, for example, collaborated with online marketplace Shopee during 2020 to launch an online campaign targeted at digitally savvy Millennials. This included the launch of its Olay Retinol24 range during Shopee’s Super Brand Day.

General health & wellness trends

- Clean beauty products continued to receive a positive reception during 2020 in line with the movement towards holistic wellness. Local clean beauty brand MISEICO was launched in 2020 with it offering 100% natural, cruelty-free and vegan skin care products that are suitable for all genders, skin tones and types. With a growing number of discerning consumers paying more attention to the content of their skin care products, it can be expected that the trend towards clean and natural beauty will continue to influence skin care in terms of sales, marketing, and new product development.

Dog & Cat Food

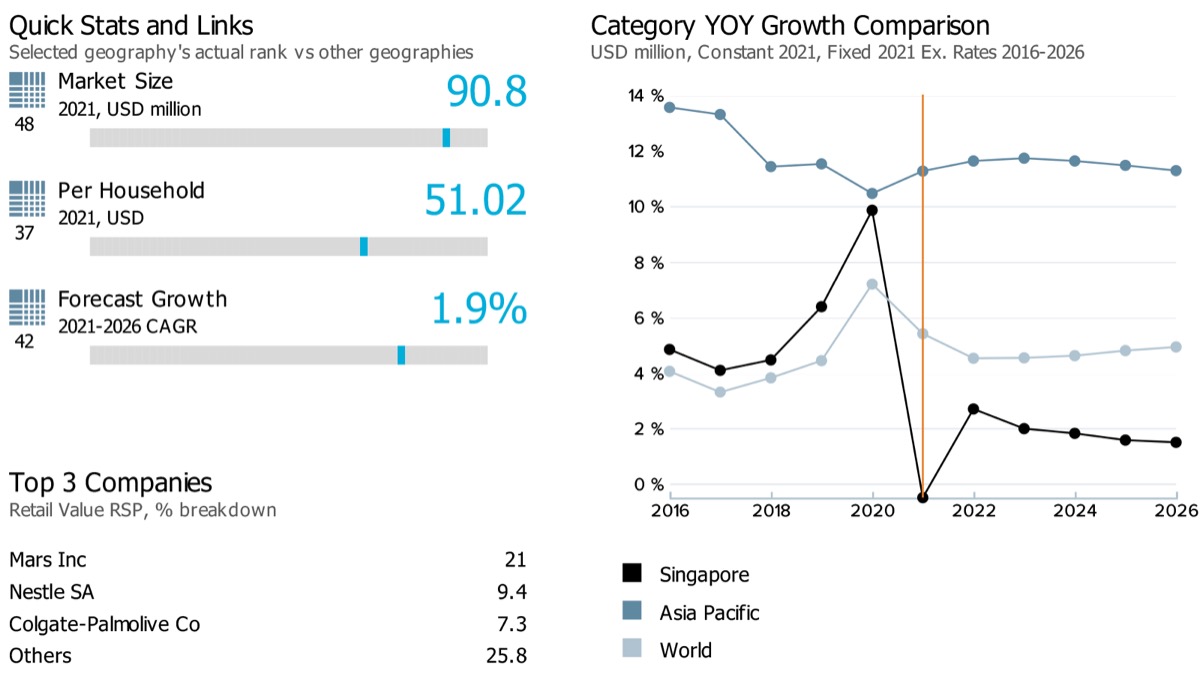

- Market size and growth

-

Note: Data on the top left corner of the image (48, 37, and 42) showcases respective ranks for Singapore for its market sizes, per capita, and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Note: Latest market size data for the year 2021 has been shared for Dog and Cat food

Performance of retail value sales of dog and cat food in Singapore is estimated to slow down from historic compound annual growth rate (CAGR) of 5.2% during 2016-2021 to an estimated forecast CAGR of 1.9% over 2021-2026. The category’s performance in the country has been slightly slower than its global performance. Globally, the category witnessed a historic CAGR of 6.9% and an estimated forecast CAGR of 4.7% during the same period.

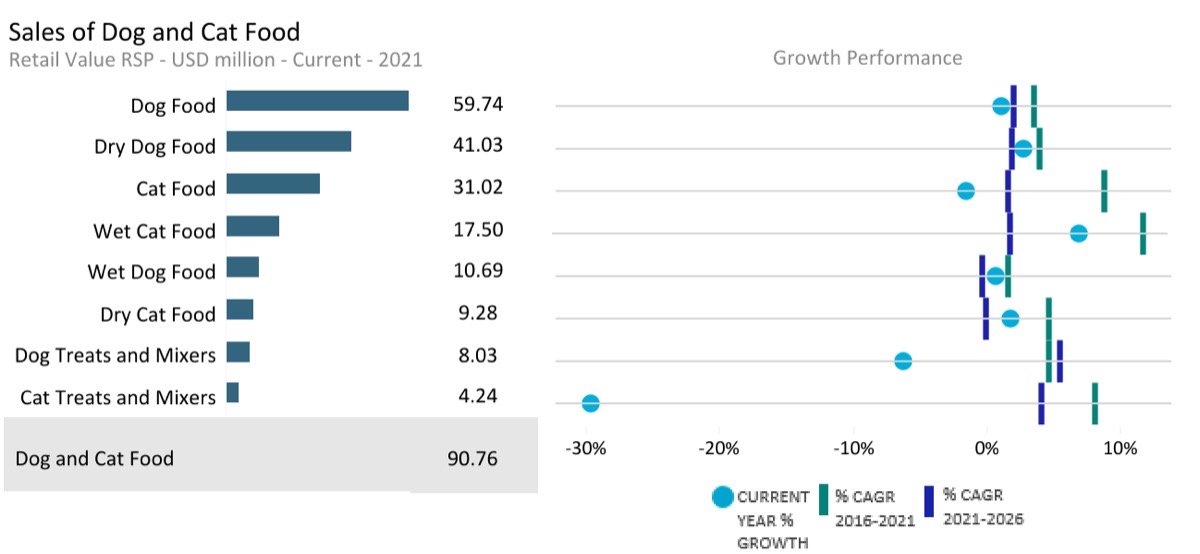

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to period 2020-21

Category

Unit

Market size (2021)

Retail value RSP

Forecast compound annual growth rate (2021/2026) %

Dog and Cat Food

USD million

90.76

1.89

Dog Food

USD million

59.74

2.07

Dog Treats and Mixers

USD million

8.03

5.53

Dry Dog Food

USD million

41.03

1.93

Wet Dog Food

USD million

10.69

-0.27

Cat Food

USD million

31.02

1.54

Wet Cat Food

USD million

17.49

1.74

Dry Cat Food

USD million

9.28

-0.11

Cat treats and mixers

USD million

4.24

4.12

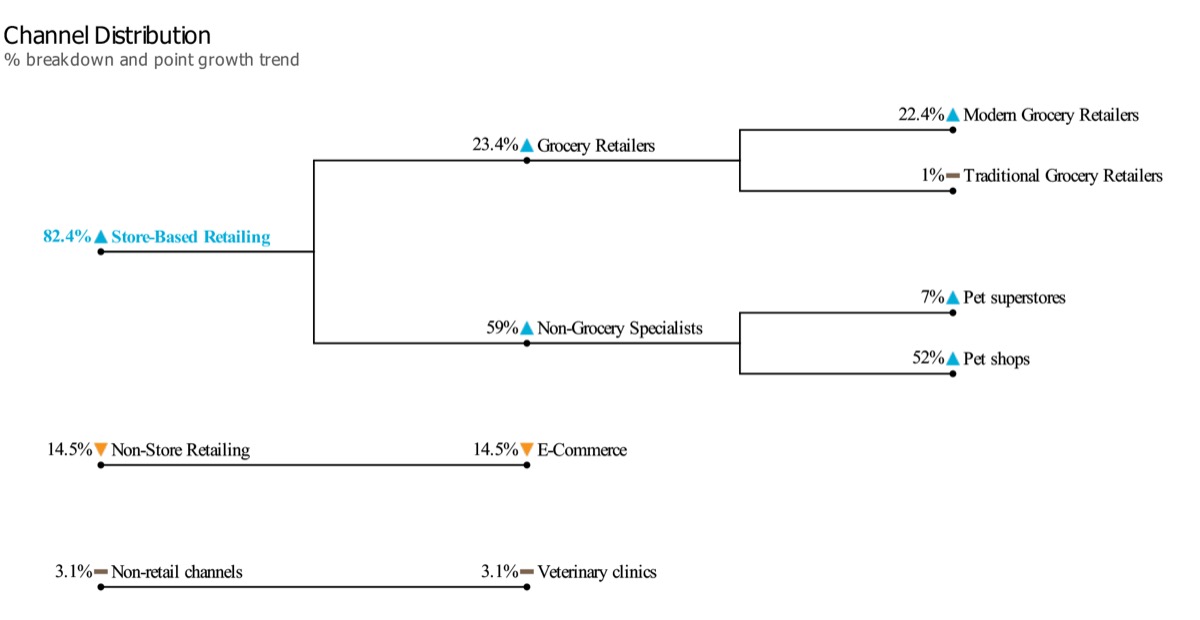

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for dog and cat food products in Singapore in 2021. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- There has been an increase in the adoption of pets in the country mainly because of the periods of lockdown urging people to look for some social companionship. Many families started adopting dogs, be it from rescue shelters, local breeders or imported sources. Besides the increase in dog adoptions, staying at home for work and studies also implies consumers spending more time playing with their pet dog. As such, this led to more treat occasions for pet dogs, which explained relatively higher growth for dog treats in 2020 compared to the historical period. Similarly, Local brand Kit-Cat witnessed high double-digit value sales growth, while imported brands from Japan such as Ciao and Miaw Miaw, despite facing supply chain disruptions, continued to grow strongly.

- Contrary to the belief that COVID-19 would force consumers to spend more on economy cat products, cat owners are generally working adults who can afford their cat’s food. Furthermore, cats tend to have specific diets and switching food frequently may affect a cat’s dietary health. Therefore in 2020, despite COVID-19, people largely maintained the food standard that they had been feeding their cats. The ongoing premiumisation trend over the review period explains the greater growth of premium dry cat food over mid-priced dry cat food. In 2021 with the ongoing trends of premiumisation and pet humanisation, premium cat food will perform better than mid-priced cat food.

Prospects and growth opportunity

- Over the forecast period to 2026, large dog food manufacturers are expected to offer raw packaged food or premium wet food that closely resembles freshly cooked food. Fresh dog food start-ups need to find ways to scale up in order to stay competitive and relevant. One example could be the case of Pet Cubes: in addition to growing e-commerce sales on its own website, the company also partners with other retailers and online merchants such as Pet Lover Centre, PolyPet, Kohepets and Nekojam. With such a potential increase in brand visibility and a wider customer base, ready to eat and fresh dog food start-ups can scale up more easily.

- During the lockdown period when foot traffic to pet stores was limited, pet owners turned to e-commerce for purchases of such food. With the convenience it offers, e-commerce has grown significantly in value sales terms, outperforming the growth of other channels such as pet stores and supermarkets. Many brands such as Hill’s Science, Purina, Whiskas, Sheba and IAMS are sold on official brand stores on third-party marketplace platforms such as LazMall and Shopee Mall for wider consumer outreach. This surge caused by COVID-19 is likely to be a permanent shock, as e-commerce sales of cat food are now seeing stronger growth than previously expected.

General health & wellness trends

- The pet humanisation trend can lead to slower growth of packaged dog food. Though remaining niche, some pet owners are starting to cook for their pets using ingredients that they themselves would eat to have full control of their pet’s nutrition intake and food safety. Though this trend is expected to remain niche due to the time required for thorough research for healthy and balanced dog food, it still deserves the attention of manufacturers. Such preference for home-cooked pet food also signals some safety concerns regarding packaged dog food, which saw major global recalls for brands such as Hill’s Science in 2020 as well as Sportmix pet food in 2021.

- Unlike dog food, where there is a rising trend for cooked dog food start-ups, it is unlikely that cooked cat food start-ups will enter cat food. This is attributed to the perception that cats are more picky eaters and require a higher level of customisation, which adds to production costs, hence lowers profit margins. Rather, it is expected that existing fresh food start-ups, together with potential fresh food start-ups, will enter the BARF (biologically appropriate raw food diet) space and offer natural, functional raw meat products for cats. Hence, over the forecast period to 2026, premium wet cat food is poised to benefit from heavy innovation efforts, be it around flavour, novel protein choice or cooking method.

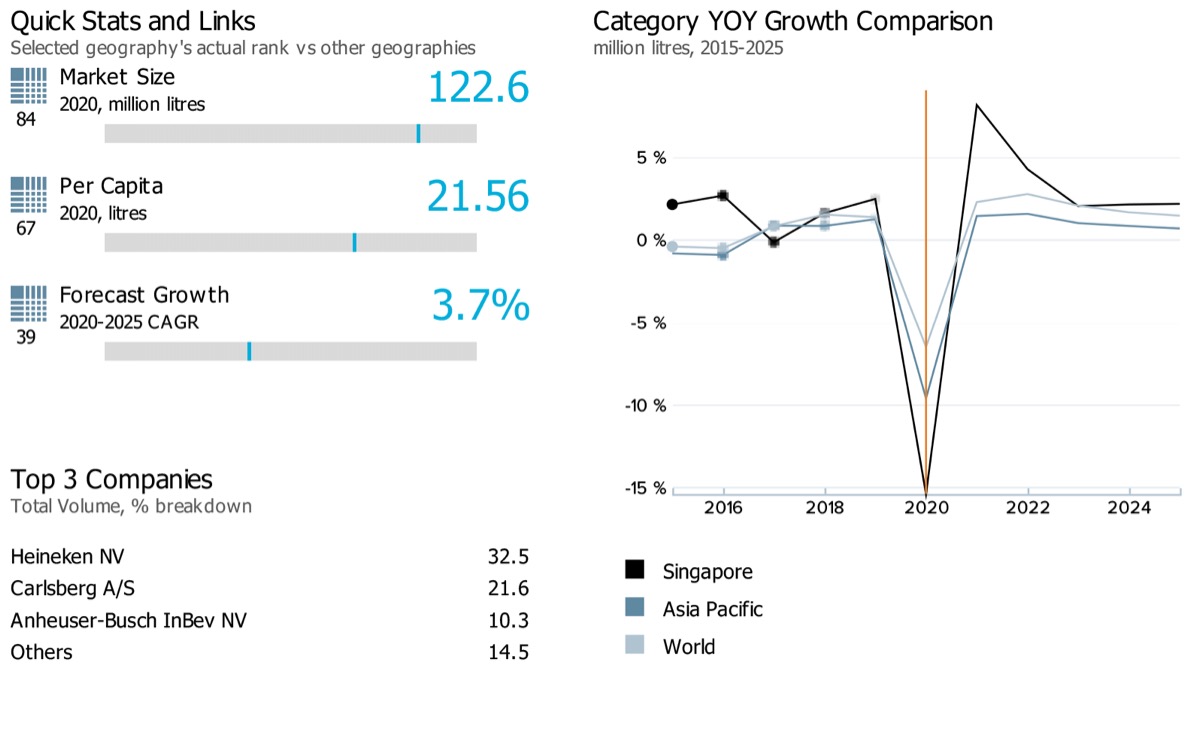

Alcoholic Drinks

- Market size and growth

-

Note: Market size data for the alcoholic drinks category in the country reflects the total volume in a million litres. Data on the top left corner of the image (84, 67 and 39) showcases respective ranks for Singapore for its market size, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

The compound annual growth rate (CAGR) for alcoholic drinks in Singapore, both in terms of total value and volume, is expected to gain momentum over the forecast period (2020-2025: FCAGR for total value: 4.9% and for total volume: 3.7% ) against its performance in the historic period (2015-2020: HCAGR for total value: -1.5% and for total volume: -2.1% ). This is largely in line with the category’s performance at the global level, where both in terms of total value and volume, alcoholic drinks are expected to gain momentum over the forecast period (2020-2025: FCAGR for total value: 4.6% and for total volume: 2.0% ) against its performance in the historic period (2015-2020: HCAGR for total value: 0.9% and for total volume: -0.7% )

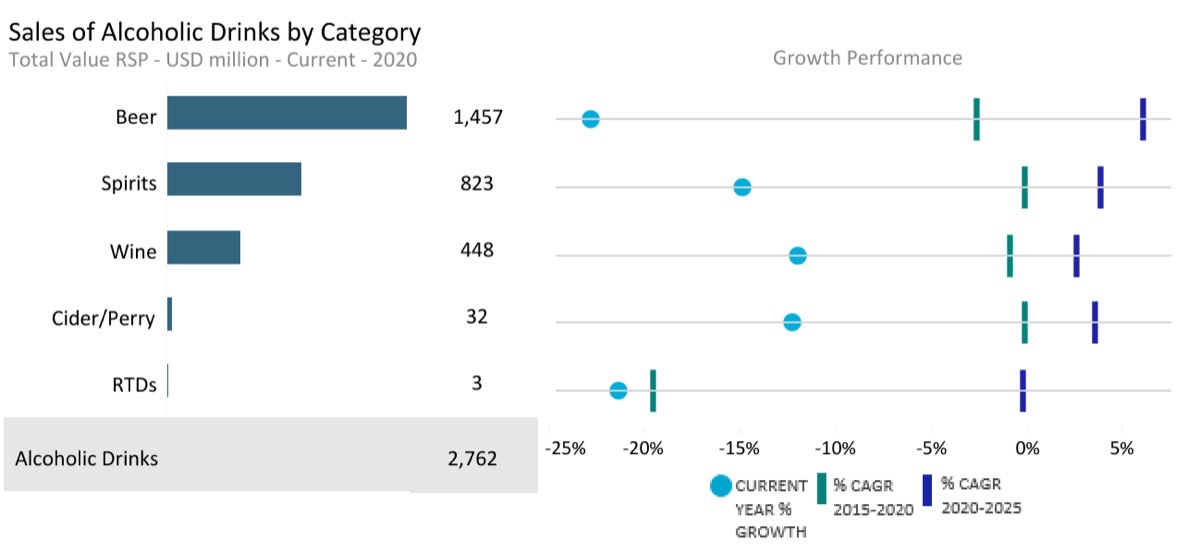

- Sub-category breakdown

-

Current year growth in the above chart refers to the period 2019-20

Category

Data type

Market size (2020)

USD million

Forecast compound annual growth rate (2020/2025) %

Alcoholic Drinks

Total Value RSP

2,761.51

4.84

Alcoholic Drinks

Off-trade Value RSP

665.49

1.16

Alcoholic Drinks

On-trade Value RSP

2,096.02

5.91

Beer

Total Value RSP

1,456.91

6.05

Beer

Off-trade Value RSP

346.75

2.66

Beer

On-trade Value RSP

1,110.16

7.03

Cider/Perry

Total Value RSP

31.80

3.57

Cider/Perry

Off-trade Value RSP

2.97

-2.88

Cider/Perry

On-trade Value RSP

28.83

4.15

RTDs

Total Value RSP

2.62

-0.19

RTDs

Off-trade Value RSP

0.78

0.28

RTDs

On-trade Value RSP

1.84

-0.39

Spirits

Total Value RSP

822.61

3.88

Spirits

Off-trade Value RSP

56.16

-3.38

Spirits

On-trade Value RSP

766.45

4.34

Wine

Total Value RSP

447.56

2.57

Wine

Off-trade Value RSP

258.82

0.01

Wine

On-trade Value RSP

188.74

5.71

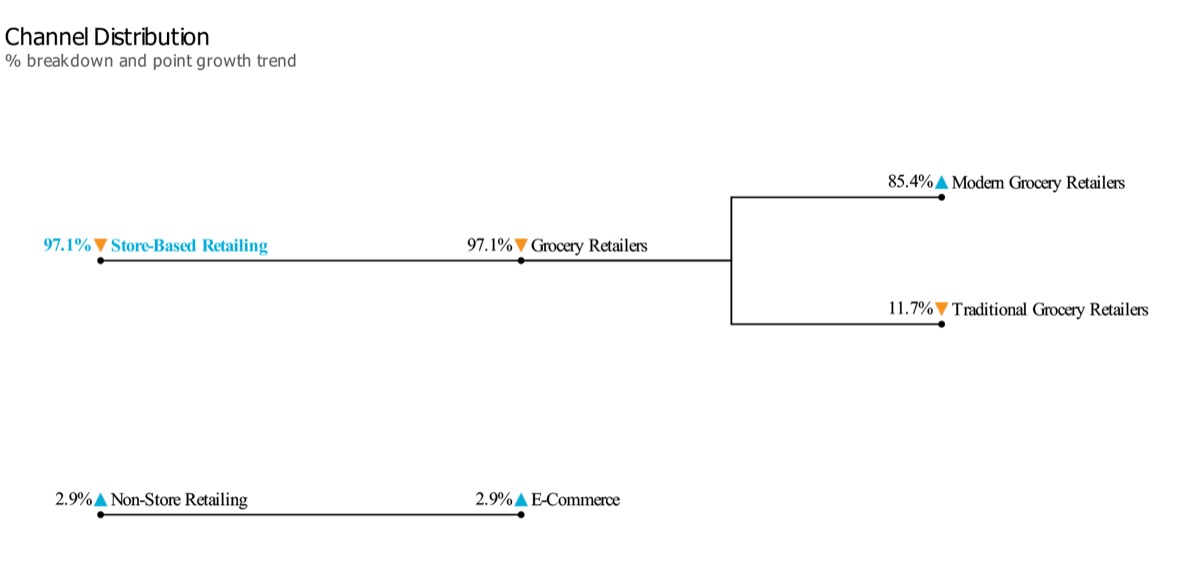

- Channel distribution

-

Note: The chart here showcases the off-trade volume share of different channel sales for alcoholic drink products in Singapore in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- The emergence of the pandemic in Singapore in 2020 resulted in the government implementing several measures to control the spread of the virus. This resulted in a shift of consumption from on-trade to off-trade channels. With volume sales of alcoholic drinks dominated by the on-trade channel in Singapore, demand was understandably significantly impacted during this time. While there was a slight shift towards off-trade sales during the year, as consumers purchased alcoholic drinks for “hometainment”, it was not enough to compensate for the huge losses though on-trade. Therefore, total volume sales recorded double-digit declines in 2020.

- All alcoholic drinks in Singapore experienced declines in total volume and value sales. Beer being the largest category experienced the most significant drop in demand due to the dominance of on-trade sales. Nevertheless, it saw polarising trends during the year, with rising price sensitivity amongst some consumers ensuring solid off-trade demand for an economy lager. While more affluent consumers, unable to travel and therefore to have additional disposable incomes, treated themselves to imported premium lager.

- Spirits also faced the same consequences as beer in Singapore. On-trade volume sales of spirits were negatively affected to a great extent, with both volume sales and value sales dominating, although a larger share for the former is due to higher mark-ups through this channel. Although some bars attempted to compensate for the loss of on-trade sales of spirits during this period by delivering pre-mixed bottled cocktails, such efforts were not enough. On the other hand, there was a greater shift towards off-trade sales of spirits, such a shift was also not adequate to compensate for the significant loss experienced by the on-trade channel, and therefore total volume sales of spirits experienced a double-digit decline in 2020.

Prospects and growth opportunity

- Polarising trends were evident during the pandemic, which contradicted the belief that most consumers would trade down during the pandemic due to uncertainties over the economy. However, demand for craft beer continued to grow through off-trade channels. Consumers who are well-travelled tend to be the target audience of craft beer as they are likely to be aware of the vast culture of craft beer overseas and often seek similar options when they return to Singapore due to the perception of higher quality and a superior flavour. This trend is encouraging an increasing number of craft beer brands to push for distribution through mass-market channels such as supermarkets.

- For alcoholic drinks, COVID-19 placed a greater emphasis amongst consumers on the importance of mindful drinking and the “sober-curious” trend. Mindful drinkers, as well as other specific consumer groups such as pregnant women, are looking for alternatives such as low and non-alcoholic spirits. These drinks not only imitate the flavour of alcohol but are also positioned as healthier, such as using botanicals, lower sugar levels and fewer or no calories. Several examples of non-alcoholic spirits to have emerged in Singapore include English brand Seedlip which made its debut in 2019, as well as Jinro, a low-alcoholic soju.

General industry trends

- The entry of established brands such as Heineken and Carlsberg have made non-alcoholic beer more visible to local consumers. As such, it is expected that non-alcoholic beer has potential for further growth in Singapore but is likely to remain a niche compared to the popularity of other beer types, unless other notable brands enter to offer competition and expand its visibility further.

- Although non-alcoholic variants are unlikely to pose a real threat to spirits over the forecast period, such a movement in terms of product offering and different positioning in terms of production method is expected to gain consumers’ interest, especially from younger generations of consumers who want to try new offerings whilst being health-conscious at the same time.

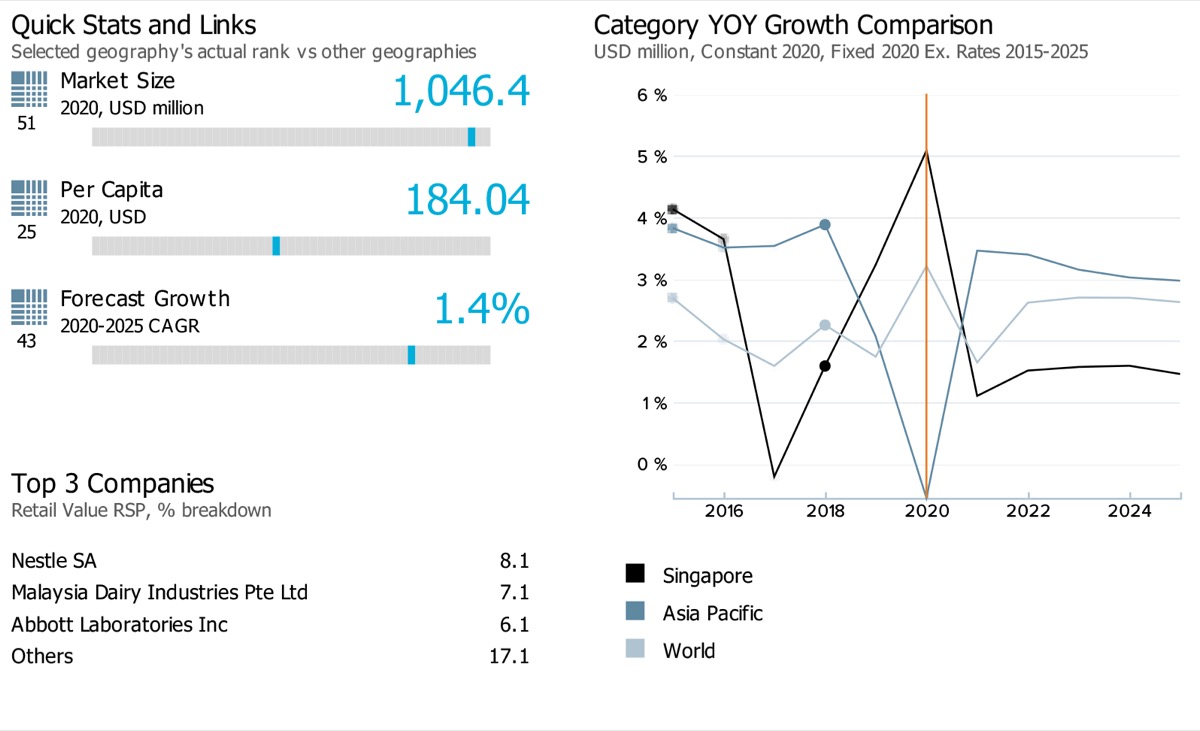

Health & Wellness Packaged Food & Beverages

- Market size and growth

-

Note: Data on the top left corner of the image (51, 25, and 43) showcases respective ranks for Singapore for its market size, per capita, and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

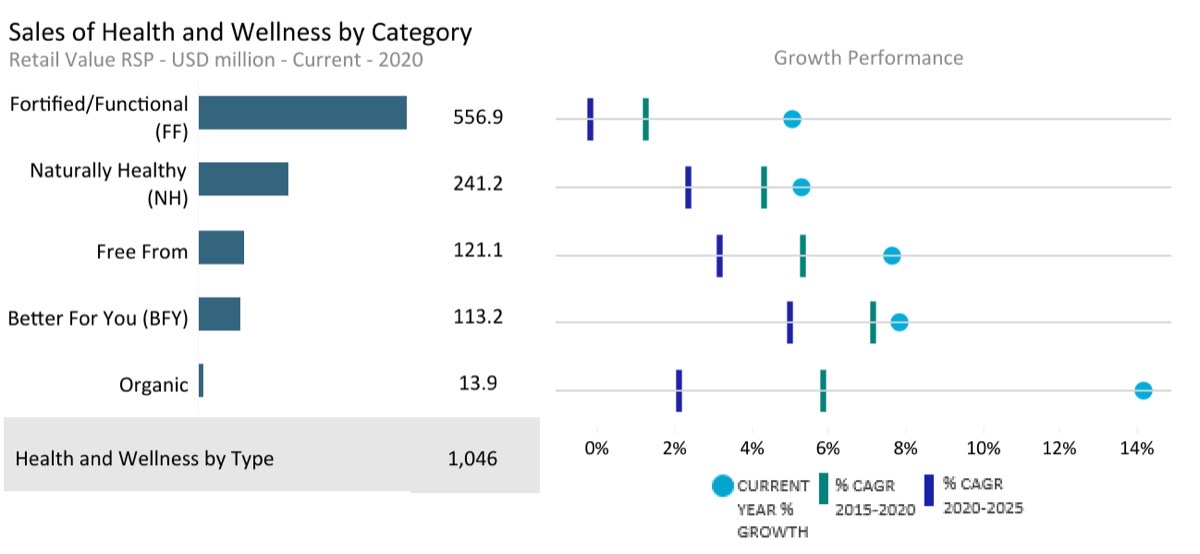

The retail value sales of health and wellness food and beverage products in Singapore is expected to slow down when comparing the compound annual growth rates from historic to forecast periods, i.e. (3.0% during 2015-2020 to 1.4% during 2020-2025). This was also the case with the category’s performance at the global level, where its compound annual growth rate for retail value sales is estimated to slow down from 4.6% during 2015-2020 to 2.4% during 2020-2025.

- Sub-category breakdown

-

Current year growth in the above chart refers to the period 2019-20

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Health and Wellness by Type

USD million

1,046.42

1.44

Better For You (BFY)

USD million

113.23

4.99

Fortified/Functional (FF)

USD million

556.89

-0.19

Free From

USD million

121.14

3.15

Naturally Healthy (NH)

USD million

241.21

2.35

Organic

USD million

13.94

2.10

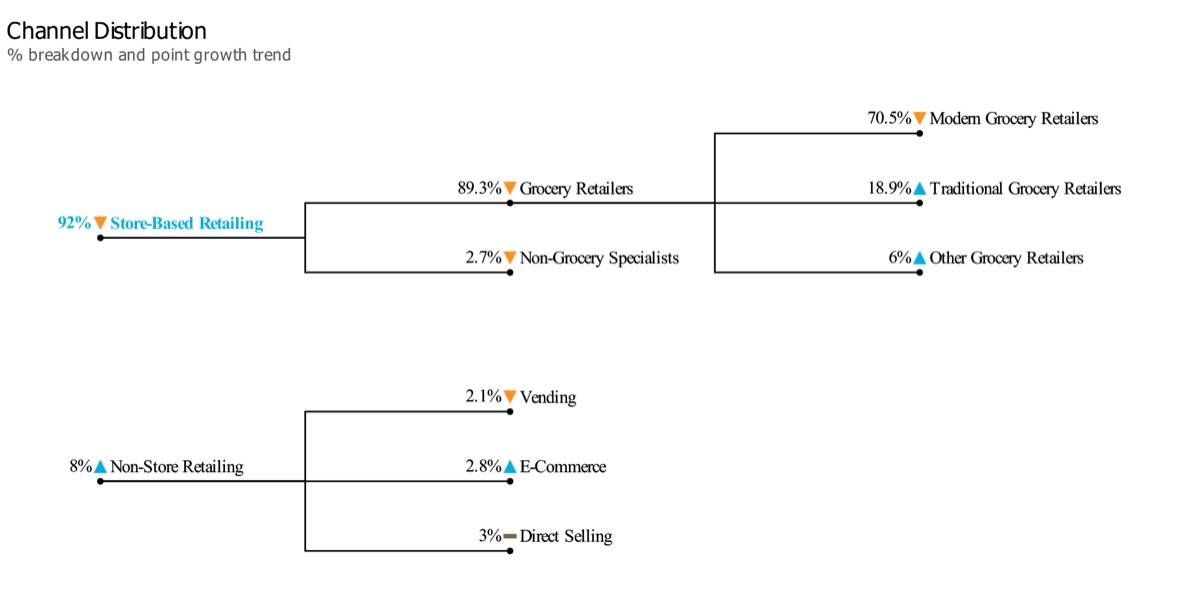

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for health and wellness by type products in Singapore in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- Health and wellness registered overall positive retail current value growth in 2020. There was strong growth in many categories in both health and wellness packaged food and beverages. The positive performance of health and wellness can be attributed to rising health concerns, which placed a premium on healthier and safer food and beverages. There was also a spike in demand for packaged foods like BFY (better for you) reduced-fat products, organic rice and FF (fortified/functional) cheese, yoghurt, bread, and sweet biscuits. While consumers also sought healthier drinks options, beverages were considered less essential than packaged food during COVID-19.

- Some categories did see slowdowns or declines in retail volume and current value sales because of COVID-19, such as fortified/functional sports drinks and FF (fortified/functional) gum. Fortified/functional sports drinks are mainly used for post-workout hydration, with gyms closed because of Covid induced lockdowns. For fortified/functional gum, due to the Imports and Exports Acts, only fortified/functional therapeutic gum products were available in pharmacies. However, fortified/functional beverages sustained positive retail volume growth and saw only a marginal dip in retail current value sales. This result was supported by the performance of fortified/functional hot drinks, with fortified/functional fruit/herbal tea, chocolate-based flavoured powder drinks and plant-based and malt-based hot drinks all-seeing spikes in retail volume and current value sales.

- As consumers stayed at home and avoided social contact, there were fewer on-the-go consumption occasions for single-serve soft drinks, leading to a strong retail current value sales decline in naturally healthy soft drinks and a steep drop in naturally healthy bottled water. As in fortified/functional beverages, the faster growth performances of the smaller hot drinks’ categories naturally healthy tea and naturally healthy other hot drinks improved the overall situation in naturally healthy beverages in 2020. Additionally, heightened health concerns and stress levels in the wake of COVID-19 boosted the demand for naturally healthy fruit/herbal, green and “other” tea and other hot drinks.

Prospects and growth opportunity

- Over the forecast period, with the stricter regulation of products via the multi-grade labelling system and rising consumer health awareness, naturally healthy Ready-to-drink (RTD) tea is set to benefit from the shift away from sugar-laden drinks like carbonates and fruit/vegetable juice. However, as most still RTD tea products have been classified as a healthier choice, this is likely to reduce the effect of reduced sugar or sugar-free as a selling point in RTD tea in general and naturally healthy RTD tea.

- To stay competitive, it may be necessary for manufacturers to consider other aspects of health and wellness in their functional/fortified formulations, such as reducing the sugar or fat content in products. With stricter regulation, the offer of reduced sugar or fat versions may help fortified/functional brands stand out from the crowd. By the end of 2021, the Singapore government is committed to the full implementation of its multi-grade labelling policy. As a result, products with high sugar and/or fat content would mandatorily carry the grade D label. Importantly, the marketing of grade D products is banned in the media and restricted to the point of sale.

General health & wellness trends

- Health and wellness) packaged food and beverages is likely to see a demand for new flavours and tastes, health-orientated ingredients, and higher-quality products. The economic fallout of COVID-19 will continue to discourage some companies from investing in new product development in the short term, although this important activity is set to grow apace as the economy recovers. Thus, as in the pre-COVID-19 period, manufacturers are set to launch products with new and innovative flavours and healthier variants to lure consumers and remain competitive.

- In addition, manufacturers will also need to respond to the roll-out of the strict multi-grade labelling regulation for sugary drinks by the end of 2021, as labelling will affect their ability to market their products and appeal to consumers. Meanwhile, sustainability is predicted to grow in importance as local consumers are increasingly environmentally conscious; therefore, packaging material/sizes and suitability for recycling will play an important role in consumer acceptance of brands and products in the forecast period.

Retail Landscape

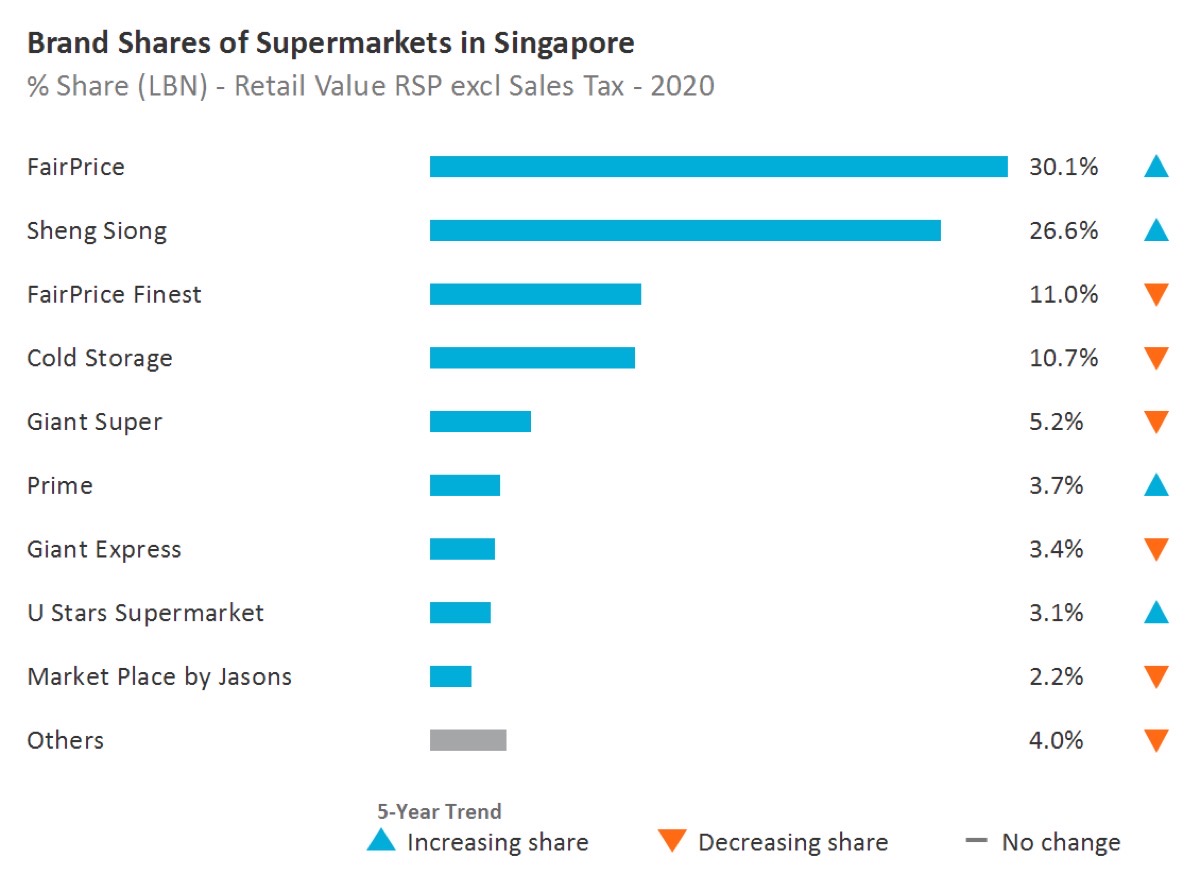

- Brand shares of supermarkets

-

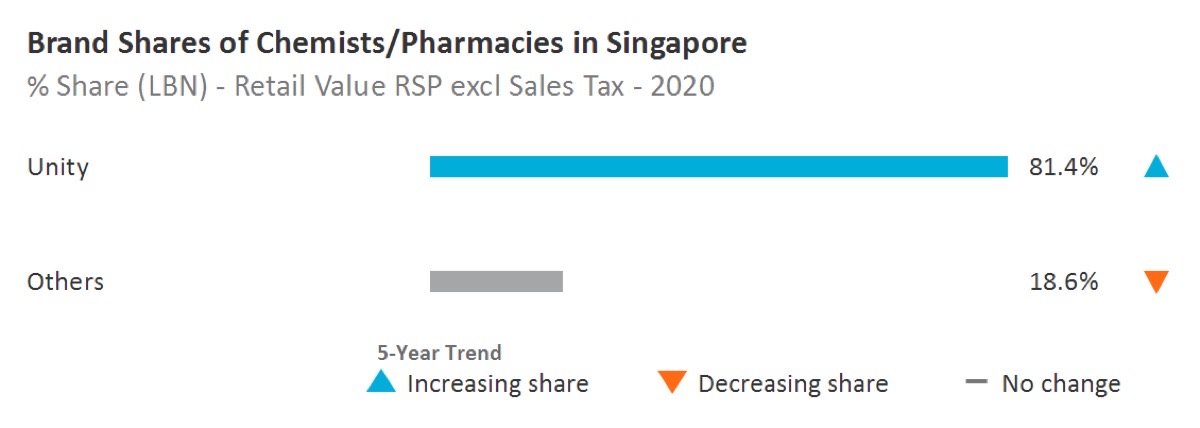

- Brand shares of chemists/pharmacies

-

- Retail insights

-

- COVID-19 has created great challenges for retailing in Singapore in 2020. The circuit breaker measures between April and May prompted the closure of non-essential retail businesses. Even in recovery, safe-distancing requirements limit the capacity in stores and shopping malls. However, panic buying, and stay-at-home lifestyles resulted in strong demand and growth for grocery retailers such as supermarkets and hypermarkets as consumers rushed to stockpile additional groceries. Demand in the latter half of 2020 remained elevated as more consumers stayed at home and worked from home. E-commerce also benefited from COVID-19 as consumers stayed home and spent more time on their digital devices. The closure of non-essential retail stores during the circuit breaker also shifted demand online.

- In the context of the economic consequences due to Covid-19, we witnessed an interesting trend; on the one hand, there was a general shift towards prudence in purchases at grocery retailers, and consumers are increasingly looking for value in the products they buy. This may manifest in smaller basket sizes, consumers moving from brand name products towards more value-based house brands and choosing to forego product bundle promotions if that means spending more. At the other end of the spectrum, wealthier consumers are trading up their purchases and indulging in treats during their grocery purchases. Premium supermarkets have consequently performed well during COVID-19.

- With infection rates brought under control in the community, the easing of COVID-19 restrictions has led to more consumers returning to public places, and workplaces and schools are resuming operations. The demand for groceries is likely to normalise in the near to mid-term as consumers switch their eating occasions outside the home and return to hawker centres and restaurants. COVID-19 has prompted a tightening of wallets and consumers are looking for lower prices and value while shopping for groceries. Major supermarket brands have recognised this change in consumer behaviour and are responding by adapting their pricing and promotional strategies. FairPrice, the largest grocery retailer in Singapore, extended a price freeze previously due to end in June 2020 on essentials and house brands until December 2020. The price freeze covers household essentials and groceries and part of its SGD50 million package to help support Singaporeans in managing the cost of living in 2020.

- The country's chemist/pharmacies market was valued at USD 119.7 million in 2020 (Retail value RSP without sales tax). In 2020-2021, the channel's year-over-year growth rate was -3.8%. The value compound annual growth rate has been 6.0% over the last five years (2015-2020). However, the channel's retail value compound annual growth rate is expected to grow at 4.1% over the forecast period (2020-2025).

- Definitions

- Acronyms Used & Key Notes

Definitions

|

Industry |

Category |

Definition |

|---|---|---|

|

Alcoholic Drinks |

Alcoholic Drinks |

Alcoholic drinks are the aggregation of beer, wine, spirits, cider/perry and RTDs. |

|

Alcoholic Drinks |

Beer |

An alcoholic drink usually brewed from malt, sugar, hops and water and fermented with yeast. Some beers are made by fermenting a cereal, especially barley, and therefore not flavoured by hops. Alcohol content for beer is varied – anything up to and over 14% ABV (alcohol by volume), although 3.5% to 5% is most common. Beer is the aggregation of lager, dark beer, stout and non/low alcohol beer. |

|

Alcoholic Drinks |

Cider/Perry |

Cider is made from fermented apple juice while perry is made from fermented pear juice. Both artisanal and industrial cider/perry are included. |

|

Alcoholic Drinks |

RTDs |

RTD stands for ‘ready-to-drink’. Other terms which may be used for these products are FABs, alcopops and premixes. The RTDs sector is the aggregation of malt-, wine-, spirit- and other types of premixed drinks. These drinks usually have an alcohol content of around 5% but this can reach as high as 10% ABV. Premixes containing a high percentage of alcohol of around 15%+ combined with juice or any other soft drink are included here. RTDs are usually marketed as products to be drunk neat, with ice, or as a cocktail ingredient. Fruit-flavoured, vodka-based spirits with an alcohol content of between 16-21% are classified here. Examples: Alizé, Ursus Roter, Berentzen Fruchtige, Kleiner Feigling. |

|

Alcoholic Drinks |

Spirits |

This is the aggregation of whisk(e)y, brandy and Cognac, white spirits, rum, tequila, liqueurs and other spirits. |

|

Alcoholic Drinks |

Wine |

This is the aggregation of still and sparkling light grape wines, fortified wine and vermouth and non-grape wine. In terms of alcohol content, light wine usually falls into the 8-14% ABV bracket while fortified wine ranges from 14-23% ABV. Low and non-alcoholic wine is also included in the data (attributed to each sector as appropriate). |

|

Beauty and Personal Care |

Skin Care |

This is the aggregation of facial care, body care, hand care and skin care sets/kits. |

|

Beauty and Personal Care |

Body Care |

This is the aggregation of firming/anti-cellulite products and general-purpose body care. |

|

Beauty and Personal Care |

Facial Care |

This is the aggregation of acne treatments, moisturisers and treatments, facial cleansers, toners, face masks, and lip care. Please note that Moisturisers and Treatments is the aggregation of basic moisturisers and anti-agers. |

|

Beauty and Personal Care |

Hand Care |

Includes all hand moisturisers, both premium and mass market, as well as combination hand and nail products. Includes protective emollients and deep moisturisers formulated to sooth and hydrate very dry or irritated skin, as well as those that prevent, or that are suitable for, eczema-prone or redness-prone skin. Excludes medicated emollients and/or those positioned as treatment for eczema or psoriasis. |

|

Beauty and Personal Care |

Skin Care Sets/Kits |

Multiple skin care items of the same brand line packaged together in a set and priced at an advantageous price compared to purchasing the items separately. Includes traditional gift sets, multi-step skin care regimens, skin care starter kits (including acne treatment regimen sets/kits) and skin care travel kits (sold through retail outlets). Also includes sets, which comprise of products from multiple categories (e.g. makeup and skin care), as long as the primary product is skin care. Men’s, women’s and unisex versions are included. Excludes: GWP (Gift with Purchase) – consumer does not pay for this (e.g. free product when you purchase a set or a free sample kit). |

|

Consumer Health |

Dietary Supplements |

It is the aggregation of all dietary supplements: Minerals, fish oils/omega fatty acids, garlic, ginseng, ginkgo biloba, evening primrose oil, Echinacea, St John's Wort, protein supplements, probiotic supplements, eye health supplements, co-enzyme Q10, glucosamine, combination herbal/traditional supplements, non-herbal/traditional supplements, and all other dietary supplements specific to country coverage. |

|

Consumer Health |

Paediatric Vitamins and Dietary Supplements |

All vitamin and dietary supplement products formulated, designed, marketed and labelled specifically for children. |

|

Consumer Health |

Tonics |

Include versions of combination dietary supplements that are sold in the format of liquid concentrates, mini-drinks, shots or oral gels. Include concentrated energy shot boosters and tonics such as 5-Hour Energy and Lipovitan. Exclude remedies made with active pharmaceutical ingredients as well as super fruit juice concentrates and weight-loss beverages, tracked under the Health and Wellness (HW) system. |

|

Consumer Health |

Vitamins |

This is the aggregation of multivitamins and single vitamins. |

|

Health and Wellness |

Health and Wellness by Type |

Health and Wellness by Type is the aggregation of all health and wellness food and beverages broken down by organic, fortified/functional, naturally healthy, better for you and free from products. |

|

Health and Wellness |

Better For You (BFY) |

Products where the amount of a substance considered to be less healthy (eg fat, sugar, salt, carbohydrates) has been actively reduced during production. To qualify for inclusion in this category, the “less healthy” element of the foodstuff needs to have been actively removed or substituted during the processing. This should also form a key part of the positioning/marketing of the product. Products which are naturally fat/sugar/carbohydrate -free are not included as nothing out of the ordinary has been done during their production to make them “better for you”. “No added sugar” claims are excluded too. Products most likely to be included here will be those which are low-fat/low-sugar versions of standard products (i.e. reduced fat mayonnaise, reduced fat cheese, reduced fat milk, reduced sugar confectionery, etc). |

|

Health and Wellness |

Fortified/Functional (FF) |

This category includes fortified/functional food and beverages. When identifying fortified/functional products, we focus on products to which health ingredients or/and nutrients have been added as well as brands that are positioned to deliver a certain functionality. To be included here the enhancement must be highlighted in the label or hold a health claim/nutritional claim. Fortified/functional food and beverages provide health benefits beyond their nutritional value and/or the level of added ingredients wouldn’t normally be found in that product. To merit inclusion in this category, the defining criterion here is that the product must have been actively fortified/enhanced during production. As such, inherently healthy products such as 100% fruit/vegetable juices are only included under "fortified/functional" if additional health ingredients (e.g. calcium, omega 3) have been added. To be included, the health benefit needs to form part of positioning/marketing of the product. For product category definitions please refer to the definitions section (can be found under the "Help" section on Passport) for the respective system: Packaged Food, Hot Drinks, Soft Drinks. |

|

Health and Wellness |

Free From |

This category includes free from gluten, free from lactose, free from allergens, free from dairy and free from meat products. This excludes foods which are certified ‘free’ of a specific product when this is based on use of sterilised equipment. |

|

Health and Wellness |

Naturally Healthy (NH) |

This category includes food and beverages based on naturally containing a substance that improves health and wellbeing beyond the product’s pure calorific value. These products are usually a healthier alternative within a certain sector/subsector. High fibre food (wholegrain/wholemeal/brown), soy products, sour milk drinks, nuts, seeds and trail mixes, honey, fruit and nut bars and olive oil are considered NH foods and 100% fruit/vegetable juice, superfruit juice, natural mineral water, spring water, RTD green tea etc. are considered NH beverages. While many of these products are marketed on a health basis, this might not always be the case. Naturally healthy food and beverages that are additionally fortified fall into the 'fortified/functional' category. |

|

Health and Wellness |

Organic |

Certified organic products are those which have been produced, stored, processed, handled and marketed in accordance with precise technical specifications (standards) and certified as "organic" by a certification body such as the Soil Association in the UK, the European Union or the US Department of Agriculture. It is important to note that an organic label applies to the production process, ensuring that the product has been produced and processed in an ecologically sound manner. The organic label is therefore a production process claim as opposed to a product quality claim. Note: For organic products to be included, the organic aspect needs to form a significant part of the overall positioning/marketing of the product, including the organic certification label in the packaging. |

|

Pet Care |

Dog and Cat Food |

This is the aggregation of dog and cat food. |

|

Pet Care |

Cat Food |

This is the aggregation of wet and dry cat food. |

|

Pet Care |

Cat Treats and Mixers |

This is the aggregation of mixers and treats for cats. |

|

Pet Care |

Dry Cat Food |

These products have a moisture content of 10-14% and are generally packed into paper, plastic or cardboard. Dry cat food is typically made from a combination of grain-based ingredients (corn and rice) and a meat component. It is typically produced by extrusion cooking under high heat and pressure and then sprayed with fat to increase palatability. Other ingredients may also be added to complete its composition. This is the aggregation of premium, mid-priced and economy dry cat food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal), have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Cat Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet cat food. |

|

Pet Care |

Dog Food |

This is the aggregation of wet and dry dog food. |

|

Pet Care |

Dog Treats and Mixers |

This is the aggregation of mixers and treats for dogs. |

|

Pet Care |

Dry Dog Food |

These products generally have a moisture content of 6-14% and are generally packed into paper, plastic or cardboard. Complete dry dog foods fall into two broad categories: Flaked (or 'Muesli' type blended products) and Extruded products (meat and cereals cooked by direct steaming). This is the aggregation of premium, mid-priced and economy dry dog food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal) have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Dog Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet dog food. |

|

Retail in Alcoholic Drinks |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Alcoholic Drinks |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Alcoholic Drinks |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Alcoholic Drinks |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Alcoholic Drinks |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (readymade sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Alcoholic Drinks |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Alcoholic Drinks |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Alcoholic Drinks |

Food/drink/tobacco specialists |

Retail outlets specialising in the sale of mainly one category of food, drinks store and tobacconists. Includes bakers (bread and flour confectionery), butchers (meat and meat products), fishmongers (fish and seafood), greengrocers (fruit and vegetables), drinks stores (alcoholic and non-alcoholic drinks), tobacconists (tobacco products and smokers’ accessories), cheesemongers, chocolatiers and other single food categories. Alcoholic drinks stores are retail outlets with a primary focus on selling beer/wine/spirits/other alcoholic beverages. Example brands include: Threshers, Gall & Gall, Liquorland, Watson’s Wine Cellar |

|

Retail in Alcoholic Drinks |

Independent Small Grocers |

Retail outlets selling a wide range of predominantly grocery products. These outlets are usually not chained and if chained will have fewer than 10 retail outlets. Mainly family owned, often referred to as Mom and Pop stores. |

|

Retail in Alcoholic Drinks |

Other Grocery Retailers |

Other retailers selling predominantly food, beverages and tobacco or a combination of these. Includes kiosks, markets selling predominantly groceries. Includes CTNs and health food stores, Food & drink souvenir stores and regional speciality stores. Direct home delivery, eg of milk, meat from farm/dairy is excluded. Sari-Sari stores in Philippines and Warung (Waroon) in Indonesia, that can either be markets or kiosks, are included in Other grocery retailers unless they occupy a separate permanent outlet building, in which case they are included in Independent small grocers. Outlets located within wet markets, particularly in South East Asia (often located in government-owned multi-story buildings) should be counted as separate outlets. Wine sales from Vineyards are included here. |

|

Retail in Alcoholic Drinks |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Alcoholic Drinks |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Alcoholic Drinks |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Alcoholic Drinks |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Alcoholic Drinks |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Alcoholic Drinks |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Alcoholic Drinks |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Alcoholic Drinks |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Alcoholic Drinks |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Alcoholic Drinks |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Alcoholic Drinks |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Alcoholic Drinks |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Beauty and Personal Care |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Beauty and Personal Care |

Modern Grocery Retailers |

Modern grocery retailing is the aggregation of those grocery channels that have emerged alongside the growth of chained retail: Hypermarkets, Supermarkets, Discounters, Forecourt Retailers and Convenience Stores. |

|

Retail in Beauty and Personal Care |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Beauty and Personal Care |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Beauty and Personal Care |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (ready-made sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Beauty and Personal Care |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Beauty and Personal Care |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Beauty and Personal Care |

Traditional Grocery Retailers |

Traditional grocery retailing is the aggregation of those channels that are invariably non-chained and are, therefore, owned by families and/or run on an individual basis. Traditional grocery retailing is the aggregation of three channels: Independent Small Grocers, Food/Drink/Tobacco Specialists and Other Grocery Retailers. |

|

Retail in Beauty and Personal Care |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Beauty and Personal Care |

Apparel and Footwear Specialist Retailers |

Outlets specialising in the sale of all types of apparel, footwear and fashion accessories including costume jewellery, belts, handbags, hats, scarves or a combination of these (for example stores selling handbags only are included). This includes those stores that carry a combination of all products for either men or women or children and those that may specialise by either gender, age or product. Example brands include Gap, H&M, Zara, C&A, Miss Selfridge, Foot Locker, Uniglo, Next, Matalan. Brands that offer sports apparel and sports goods are excluded from Apparel and footwear specialist retailers and are included in Sports goods stores. |

|

Retail in Beauty and Personal Care |

Electronics and Appliance Specialist Retailers |

Retail outlets specialising in the sale of large or small domestic electrical appliances, consumer electronic equipment (including mobile phones), computers or a combination of these. For mobile phone retailers, this excludes revenues derived from telecoms service plans and top-up cards, etc. Example brands include Apple, Best Buy, Euronics, PC World, Darty, But, Media Markt, Yamada Denki, Gome (China). |

|

Retail in Beauty and Personal Care |

Health and Beauty Specialist Retailers |

This is the aggregation of chemists/pharmacies, drugstores/parapharmacies, beauty specialist retailers, optical goods stores and other healthcare specialist retailers. |

|

Retail in Beauty and Personal Care |

Beauty Specialist Retailers |

Beauty specialist retailers are chained or independent retail outlets with a primary focus on selling fragrances, other cosmetics and toiletries, beauty accessories or a combination of these. Examples of Beauty specialist retailer brands include: Body Shop, Marionnaud, Sephora and Bath and Body Works. |

|

Retail in Beauty and Personal Care |

Chemists/Pharmacies |

Retail outlets selling prescription-bound medicines under the supervision of a pharmacist and as its core activity (other activities include sales of OTC healthcare and cosmetics and toiletries products). |

|

Retail in Beauty and Personal Care |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Beauty and Personal Care |

Home and Garden Specialist Retailers |

This is the aggregation of homewares and home furnishing stores and home improvement and gardening stores. Business-to-business sales are excluded. Home improvement and gardening stores are chained or independent retail outlets with a primary focus on selling one or more of the following categories: Home improvement materials and hardware, Paints, coatings and wall coverings, Kitchen and bathroom, fixtures and fittings, Gardening equipment, House/Garden plants. Home improvement and gardening stores includes Home improvement centres / DIY stores, Hardware stores (Ironmongers), Garden centres, Kitchen and bathroom showrooms, Tile specialists, Flooring specialists. Homewares and Home Furnishing stores are retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Homewares and Home Furnishing Stores |

Retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Other Non-Grocery Specialists |

Other non-grocery retailers are chained or independent retail outlets, kiosks, market stalls or street vendors and with a primary focus on selling non-food merchandise. Other non-grocery retailers include Charity shops, Second-hand shops and Market stalls. |

|

Retail in Beauty and Personal Care |

Outdoor Markets |

Includes bazaars, kiosks, street vendors and beach vendors. |

|

Retail in Beauty and Personal Care |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Beauty and Personal Care |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Beauty and Personal Care |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Beauty and Personal Care |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Beauty and Personal Care |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Beauty and Personal Care |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Beauty and Personal Care |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Beauty and Personal Care |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Beauty and Personal Care |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Beauty and Personal Care |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Hair Salons |

Hair salons |

|

Retail in Health and Wellness |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Health and Wellness |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Health and Wellness |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Health and Wellness |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (ready made sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Health and Wellness |

Hypermarkets |