Brazil

Country Overview

With the world’s fifth largest population and ninth largest GDP, Brazil is Latin America's most influential nation. Its vast and diverse communities are potential markets for a wide variety of businesses. New Zealand exporters have found success in Brazil’s health, dairy, communications, mining and technology sectors.

Brazil has a large consumer market of almost 210 million people. This is a diverse population with varied socio-economic statuses, ethnic backgrounds and tastes. The median age is 33 and 81% of Brazilians are under 55.

The changing nature of Brazilian households has given rise to shifting consumption habits. Health and wellbeing are on the rise and consumers are becoming more aware of sustainability and social responsibility related to the products they buy.

Trade agreements

There are currently no free trade agreements between New Zealand and Brazil. However, our countries have a friendly and developing relationship. The launch of the Latin American Strategy in 2000 and the opening of the New Zealand Embassy and Consulate offices in Brazil have strengthened bilateral ties. New Zealand engages in regular trade dialogue with the Mercosur bloc to encourage the launch of free trade agreement negotiations.

Country intelligence

The Robinson Country Intelligence Index is a holistic measurement of country-level risk and serves as an alternative measure of country development. It incorporates four broad dimensions of Governance, Economics, Operations and Society. A higher ranking indicates a better Country Intelligence Index score

Value of New Zealand exports

International logistics performance

The International Logistics Performance Index measures how efficiently countries move goods across and within borders. Countries are ranked on their index score with a higher ranking indicating higher performance of trade logistics based on six components: customs, infrastructure, ease of international shipments, logistics services quality and competence, tracking and tracing, and timeliness.

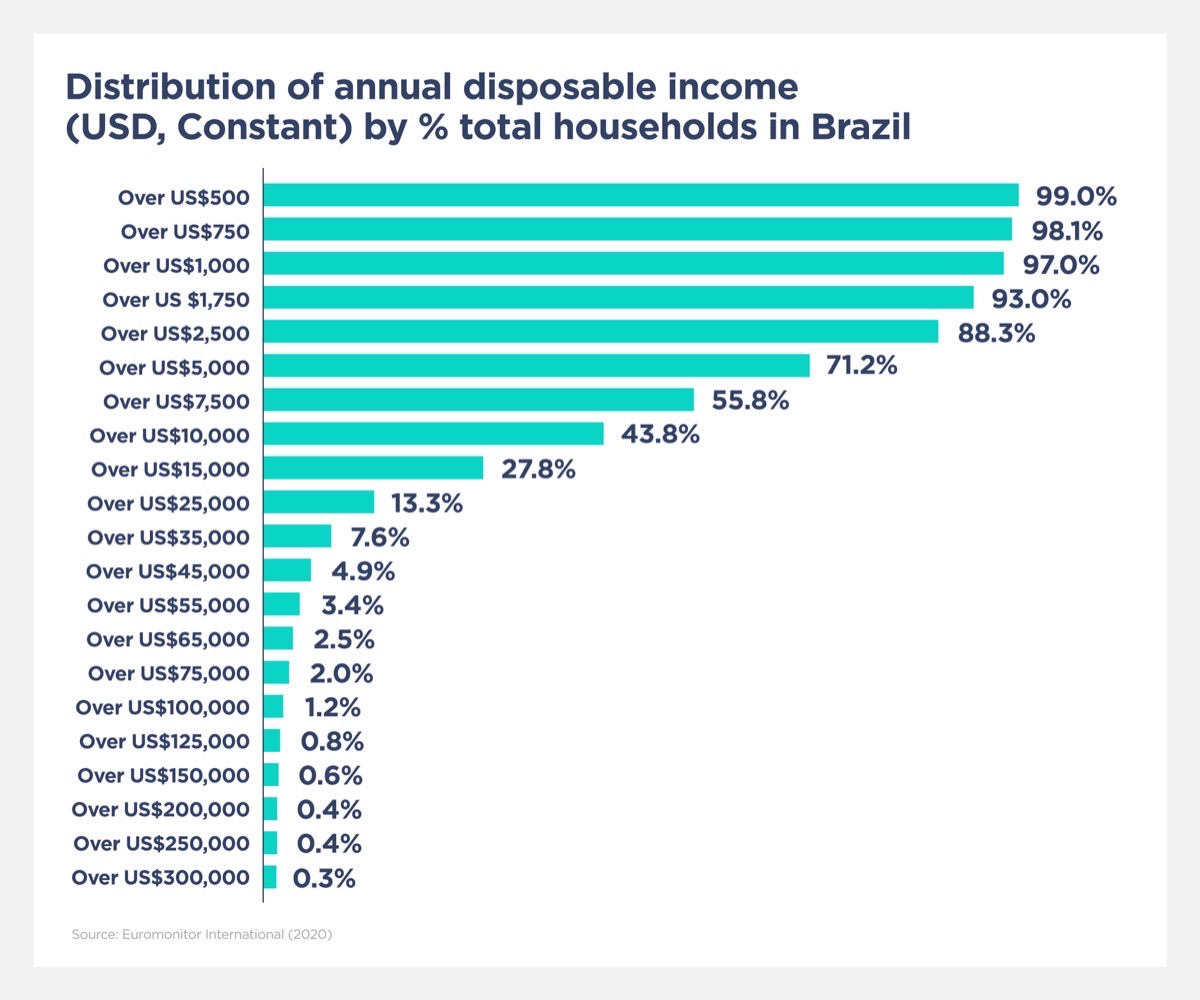

Income and distribution of wealth

Global National Income (GNI) per capita is the dollar value of a country's final income in a year, divided by its population.

Annual Disposable Income refers to gross income minus social security contributions and income taxes. Each income band presents data referring to the percentage of households with a disposable income over that amount.

Further information

For more information to validate Brazil as an export market, see our Brazil Market Guide.

- Vitamins & Dietary Supplements

- Skin Care

- Dog & Cat Food

- Alcoholic Drinks

- Health & Wellness Packaged Food & Beverages

Vitamins & Dietary Supplements

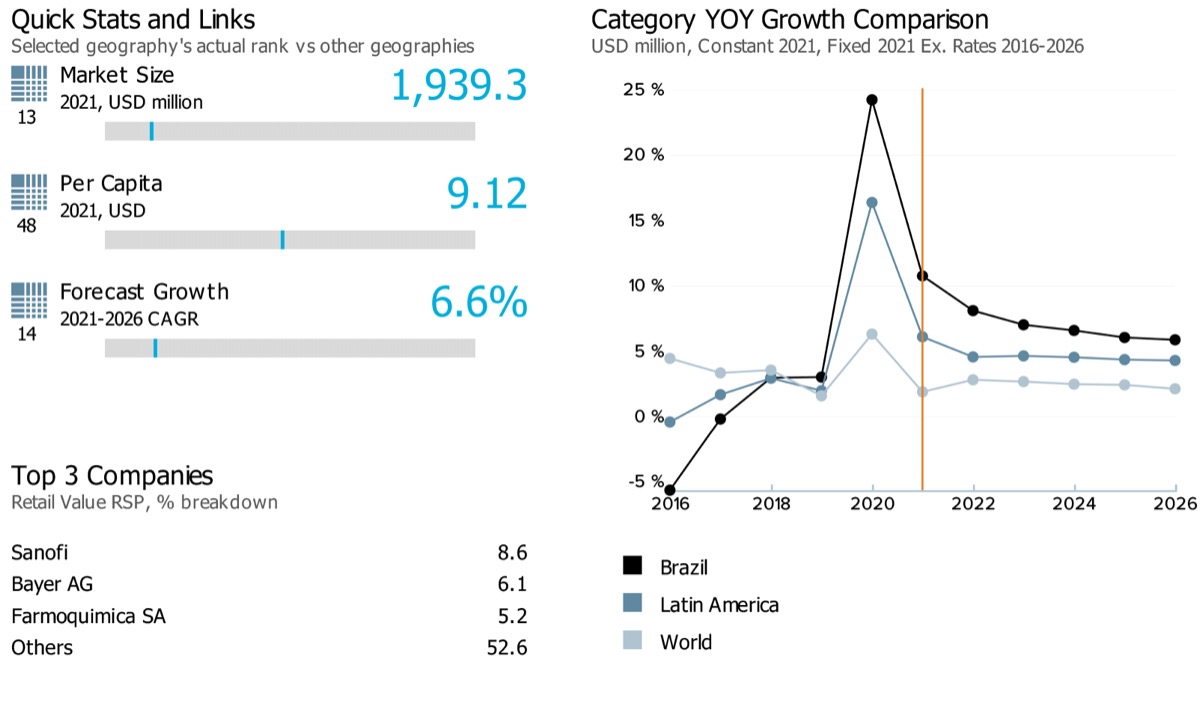

- Market size and growth

-

Note: Data on the top left corner of the image (13, 48, and 14) showcases respective ranks for Brazil for its market size, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Note: Latest market size data for the year 2021 has been shared for Vitamins & Dietary Supplements

Brazil's retail value sales of vitamins and dietary supplements witnessed a historic compound annual growth rate (CAGR) of 11.6% during 2016-2021. It is further expected to grow at a slowed-down retail value CAGR of 6.6% over 2021-2026. As for the global performance of the category, it is expected to slow down from a historic CAGR of 5.1% to a forecast CAGR of 2.4% over the same period for its retail value sales. - Sub-category breakdown

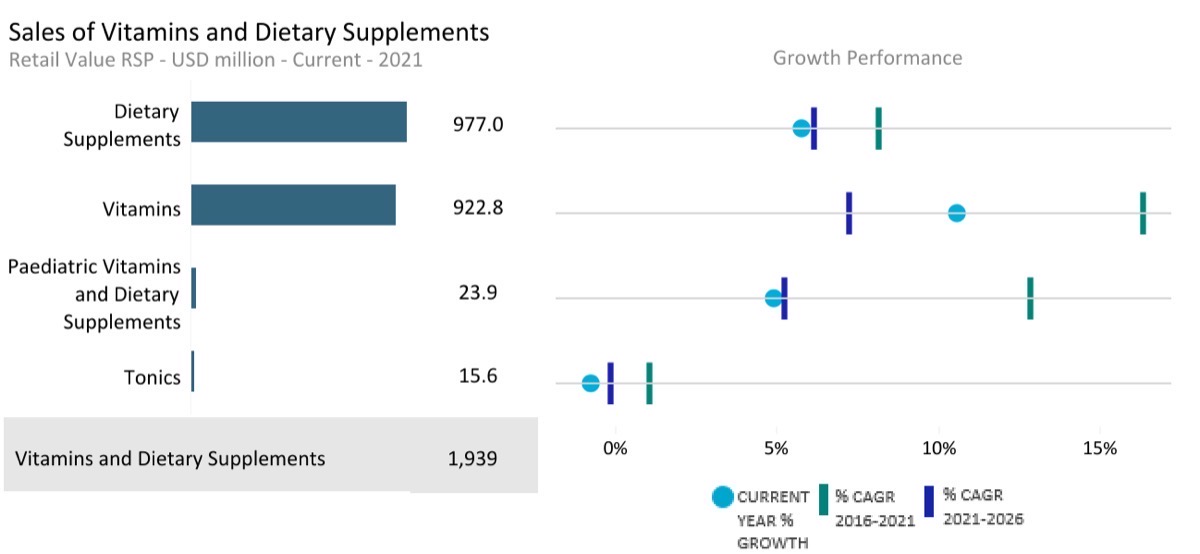

-

Note: Current year growth in the above chart refers to period 2021-22

Category

Unit

Market size (2021)

Retail value RSP

Forecast compound annual growth rate (2021/2026) %

Vitamins and Dietary Supplements

USD million

1,939.30

6.60

Vitamins

USD million

922.77

7.22

Paediatric Vitamins and Dietary Supplements

USD million

23.90

5.20

Dietary Supplements

USD million

977.02

6.14

Tonics

USD million

15.61

-0.16

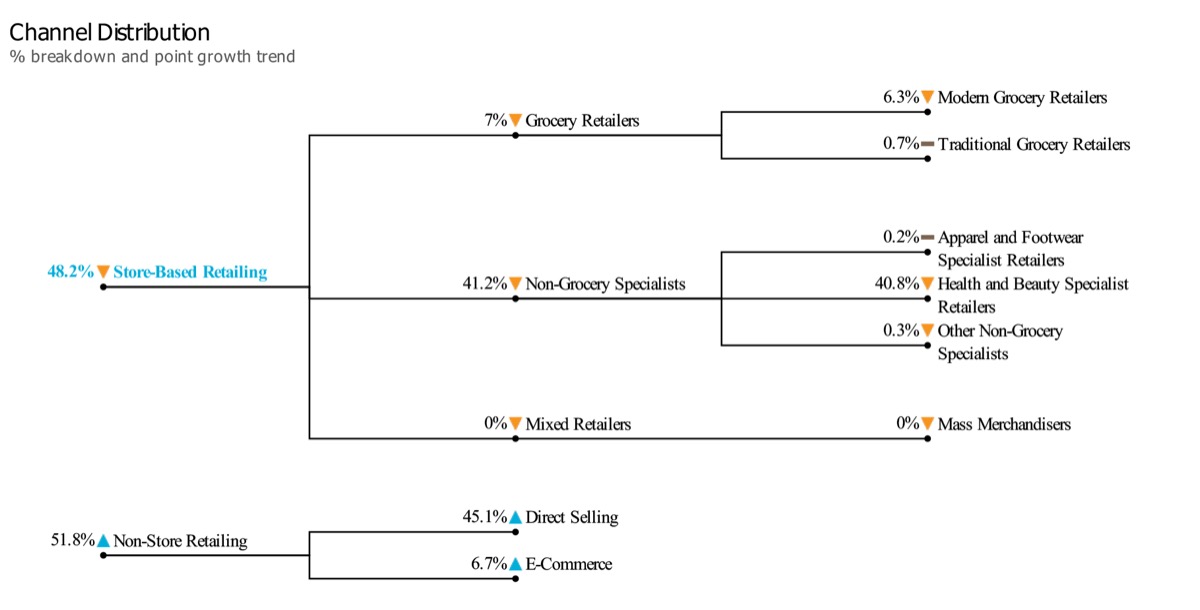

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for Vitamins and dietary supplement products in Brazil in 2021. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- Consumer health remained the most resilient industry in Brazil in terms ofCOVID-19’s impact. Categories such as analgesics and vitamins witnessed stronger demand, with the former being perceived to treat the effects of COVID-19 and the latter to boost consumers immunisation.

- Like vitamins, in 2020, dietary supplements sales were also driven by the increased consumers’ interest in purchasing products that they felt could offer better immunization. Among the areas most positively affected by this trend were combination dietary supplements and garlic, which benefited from the common belief that the supplement could help protect against COVID-19 due to its antibacterial properties. Similarly, demand for Vitamin C and D also benefited in the country, in line with consumers increased demand for immunisation as many consumers believed that the intake of vitamins could offer them protection against the virus.

Prospects and growth opportunity

- Brazilians showcased an increased interest in demand for propolis as well. This is usually known for its antimicrobial properties, helping to increase immunisation upon consumption. Demand for propolis has normalised post the peak of the COVID-19 pandemic in the country, but consumers’ recent increased interest in it is expected to have a positive effect on its future sales as well.

- Over the coming years, while growth will not be as dynamic as in 2020, vitamins will continue to record strong performances. Across the review period (2016-2021), vitamins consistently posted strong growth rates – and the COVID-19 pandemic then took sales to a new level in 2020. However, per capita consumption in Brazil remains low compared to more developed countries; for example, it is just a 10th that of the US. This means that there is significant potential for further growth, with performances expected to remain positive in the years to come, helped by greater awareness of these products among consumers and increasing investments by industry players.

General health & wellness trends

- Sales over the forecast period (2021-2026) are expected to remain positive. The categories that were most negatively affected by COVID-19, such as sports nutrition, are expected to quickly get back on track. The consumption of these products may even receive a boost from the number of consumers looking to get back to their pre-COVID-19 body shape or weight as quickly as possible.

- Differentiation is quite limited in vitamins. To counter this issue, leading players focus on offering vitamins associated with other substances or targeting specific niches. More recently, several companies have introduced formulations focused on women’s health, with products targeting general health or specific items for pregnant and lactating women. Another trend that may become more relevant for vitamins in Brazil is the format used. Wyeth Indústria Farmacêutica (Pfizer) recently launched Centrum Vitagomas, for example, a multivitamin product in gummy candy format, offering convenience to consumers who cannot properly ingest a vitamin in pill format.

Skin Care

- Market size and growth

-

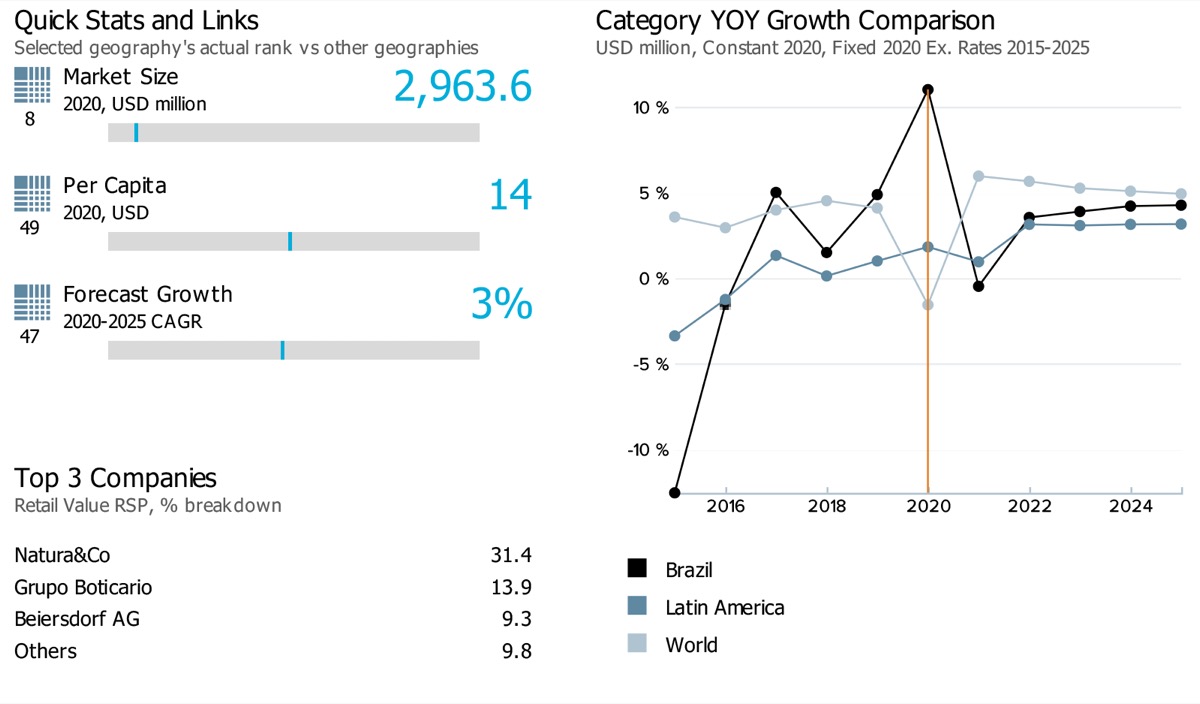

Note: Data on the top left corner of the image (8, 49, and 47) showcases respective ranks for Brazil for its market size, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Retail value sales of skin care products in Brazil is expected to witness a slow down from its compound annual growth rate (CAGR) over the historic (2015-2020: 8.6%) to forecast period (2020-2025: 3.0%). However, at the global level, the retail value sales of the category are estimated to witness a slightly increased CAGR over the forecast period (2020-2025: 5.3%) against its performance over the historic period (2015-2020: 4.7%).

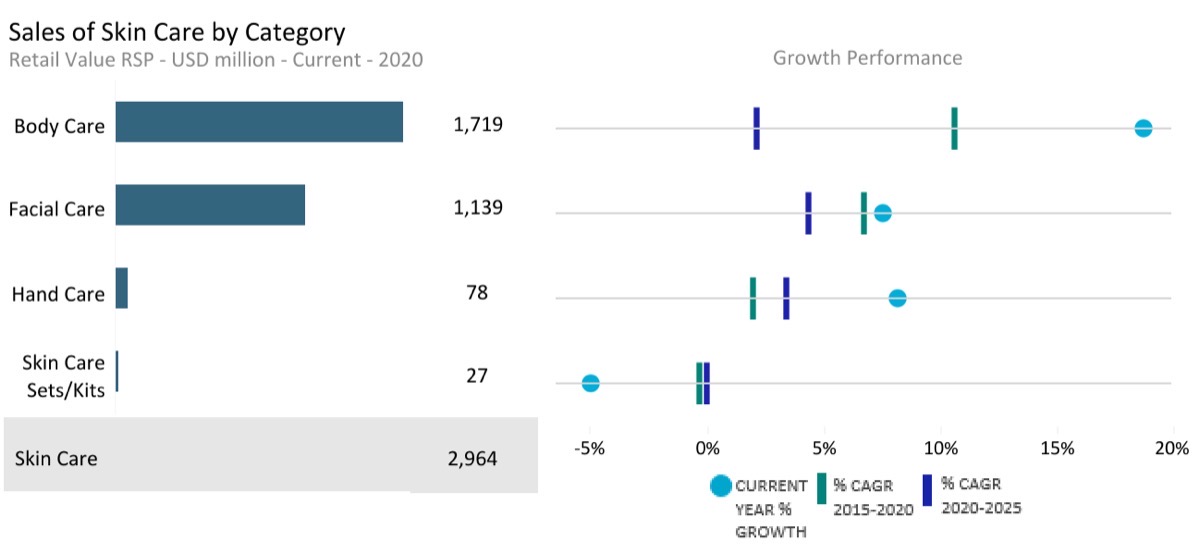

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to period 2019-20

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Skin Care

USD million

2,963.61

3.04

Body Care

USD million

1,719.29

2.17

Facial Care

USD million

1,138.94

4.35

Hand Care

USD million

78.42

3.39

Skin Care Sets/Kits

USD million

26.96

-0.04

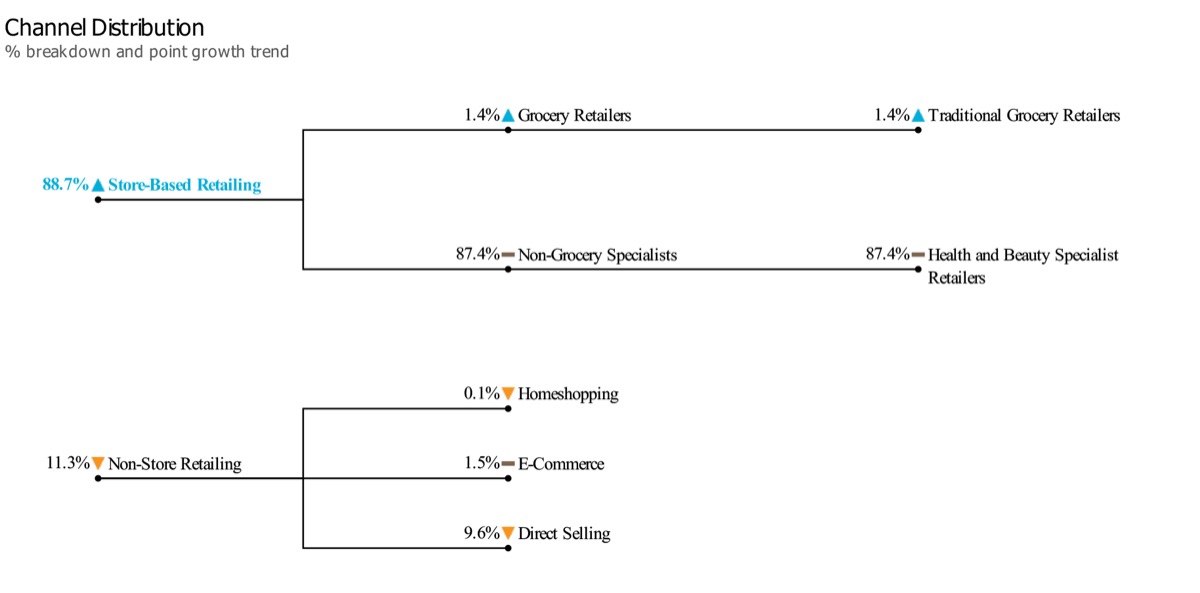

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for skin care products in Brazil in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

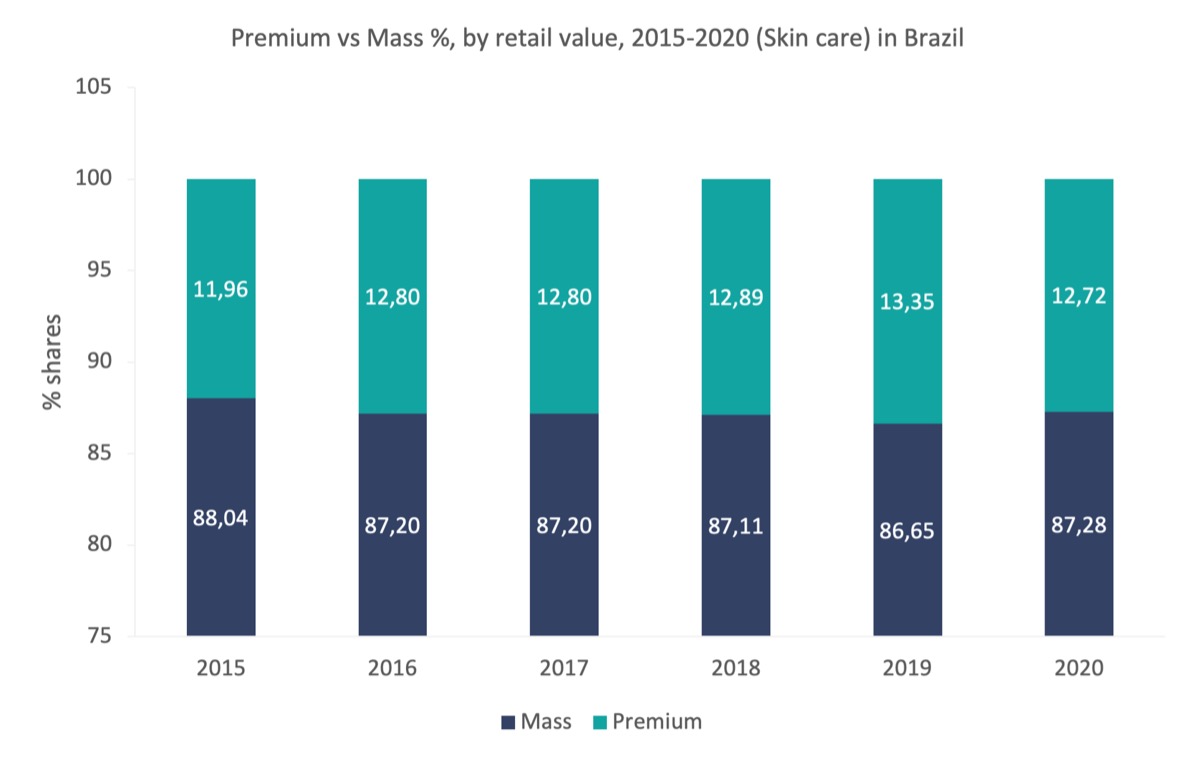

Market trends

- Skin care products in Brazil managed to perform positively, along with consumers’ increasing desire for self-care and wellness rituals, and preventative health. Incorporation of active ingredients and functional benefits remained at the forefront of innovation in the category by brands. Products with different combinations of acids, vitamins, probiotics, natural ingredients, and even similar components to CBD (not yet approved for cosmetics in Brazil) were made available. Growth in the category was still sustained by the most developed companies, but emerging digital brands also drove consumers’ interest – examples include Creamy and Sallve, which bring a cool positioning to their skin care lines through colourful packaging.

- The biggest highlight was body care, which witnessed double-digit value growth (year on year growth: 2019-2020: 18.7%), driven by general-purpose body care. With more time at home and in need of self-pampering occasions to mitigate anxiety, many Brazilians surrendered to the benefits of body care. The consolidation of product usage as a ritual was among the strongest drivers of growth in skin care in 2020. With limited budgets and rising production costs being passed along to final consumers, mass products were at the forefront of this new movement. While specific products with benefits such as firming/anti-cellulite had their own consolidated target, mass general purpose body care is usually the first step in the skin care universe for most consumers.

Prospects and growth opportunity

- A famous illustration of periods of economic crisis, the “lipstick effect” seemed to be replaced by the “hand cream effect” in Brazil in 2020. While lipstick will maintain its relevance in the Brazilian market in the long-term – just like all colour cosmetics – hand cream seems to have conquered a special share of Brazilians’ budgets and shelf space in stores. Leveraged by new needs during the quarantine, such as to address dryness due to excessive use of hand sanitiser and home care disinfectants, these products are among the cheapest SKUs in companies’ skin care portfolios. Most of them are offered in smaller pack sizes (from 25ml to 100ml), leading to more affordable unit prices per pack and the possibility of trying different fragrances.

- In drugstores/parapharmacies, investment in product and brand mixes was fundamental, as many consumers started to see these outlets as an excuse to leave their homes. What was before a channel for quick purchases of necessities became an exploratory tour for new brands and products – increasing the fight for shelf space. While growth in e-commerce was already happening before the pandemic, a boom was seen for this channel in 2020 as a consequence of the consolidation of marketplaces (either general, such as Amazon and Mercado Livre, or specialised, including Beleza na Web), and third-party apps such as Rappi. WhatsApp’s usage as a communication platform with clients was also a highlight, especially with the advance of in-app payment methods.

General health & wellness trends

- While colour cosmetics and facial make-up remains a very important category for Brazilian consumers, the impact of the COVID-19 pandemic in terms of reducing social occasions led to a decline in value sales. This scenario, however, contributed to accelerating a trend that had been slowly evolving in the Brazilian market: a change of mindset from frequent usage of make-up to an approach of preventative skin care. Two main reasons were behind this trend, more available time at home and more conscious perception of wellbeing and health.

- Apart from the already very fierce competitive scenario in the category, a new trend has been gaining space in skin care in Brazil: digitally native brands. This concept refers to beauty and personal care brands that are developed and launched through digital channels only and are not available in physical channels such as grocery retailers, drugstores/parapharmacies or even direct sellers. Basically, the only way to purchase them is through their own website or social networks. Some of these brands have also been developed by digital beauty influencers, which fuels consumers’ interest and brand awareness at a rapid pace. Sallve, created in 2019 by Julia Petit, one of Brazil’s most important digital influencers, is a great example of a successful digitally native brand.

Dog & Cat Food

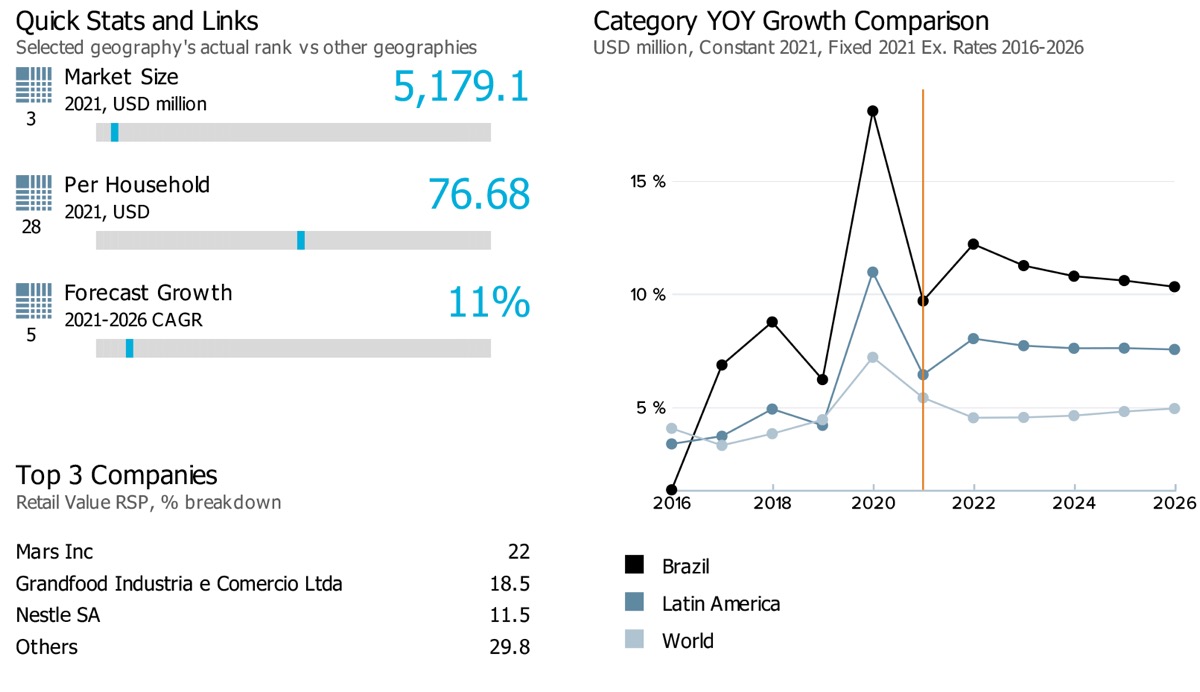

- Market size and growth

-

Note: Data on the top left corner of the image (3, 28, and 5) showcases respective ranks for Brazil for its market size, per capita, and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Note: Latest market size data for the year 2021 has been shared for Dog and Cat food

The performance of Brazil’s retail value sales of dog and cat food is estimated to slightly slowdown from historic compound annual growth rate (CAGR) of 13.5% during 2016-2021 to an estimated forecast CAGR of 11.0% over 2021-2026. The category’s performance in the country has been stronger than its global performance. Globally, the category witnessed a historic CAGR of 6.9% and an estimated forecast CAGR of 4.7% during the same period.

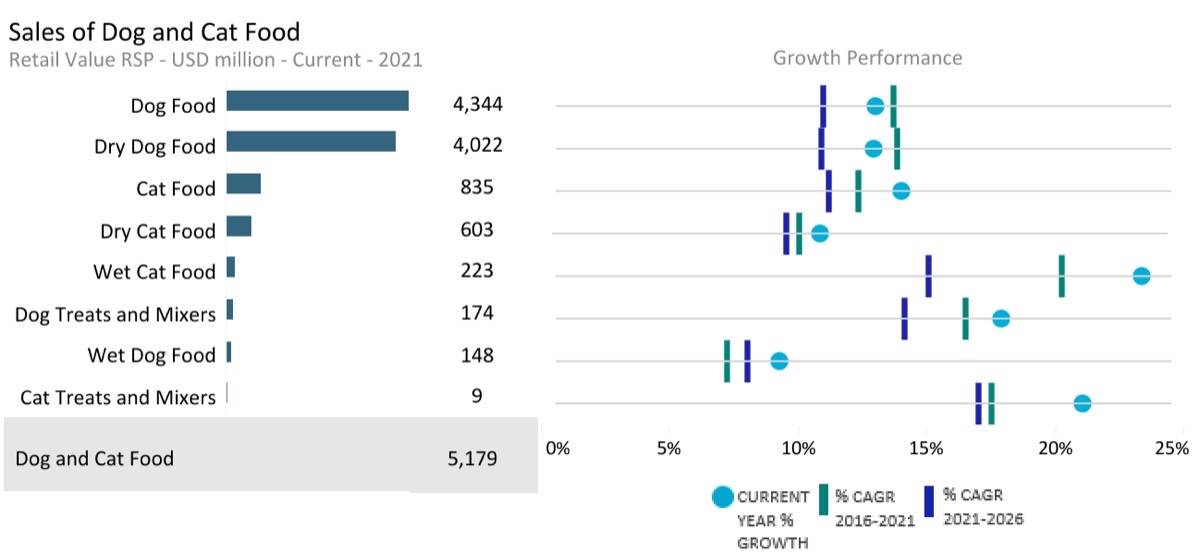

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to period 2020-21

Category

Unit

Market size (2021)

Retail value RSP

Forecast compound annual growth rate (2021/2026) %

Dog and Cat Food

USD million

5,179.06

11.00

Dog Food

USD million

4,343.92

10.96

Dog Treats and Mixers

USD million

173.83

14.17

Dry Dog Food

USD million

4,022.12

10.91

Wet Dog Food

USD million

147.98

8.00

Cat Food

USD million

835.14

11.23

Wet Cat Food

USD million

222.88

15.10

Dry Cat Food

USD million

603.14

9.55

Cat treats and mixers

USD million

9.12

17.03

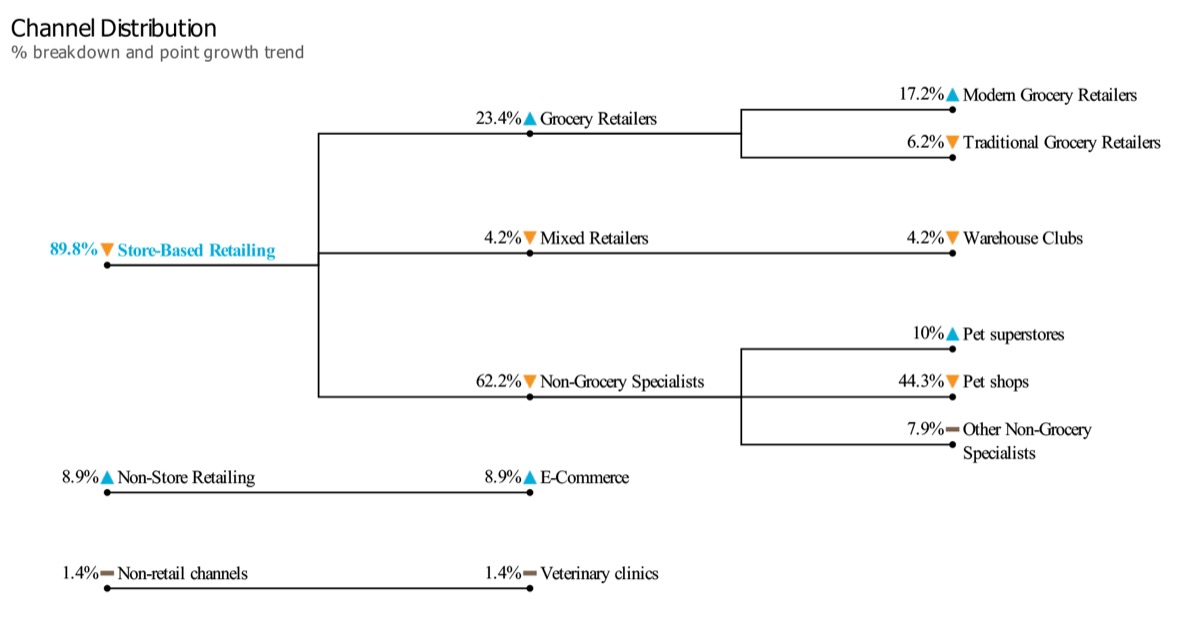

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for dog and cat food products in Brazil in 2021. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- In contrast to many FMCG categories, dog food sales kept growing throughout 2020, even facing supply disruptions, as experienced by well-known premium companies, and rising prices, particularly for more economic-positioned products. This outstanding performance for the category was supported by the government’s emergency financial aid, which allowed lower-income families to keep buying processed dog food instead of resorting to leftovers as a substitute, benefiting mainly economy brands. Many pet owners had to trade down for less expensive options as income sources became unstable during the pandemic period, benefiting mid-priced brands such as Mars’s Pedigree and Special Dog. Also, with a strong cost-benefit appeal, private label developments in dog treats gained more presence in 2020, as was the case for the Petz brand.

- The impact of movement restrictions and establishment closures as measures to control the pandemic spread was mainly felt by local pet shops and clinics. However, while they remained open as they were considered essential services, these smaller businesses suffered as consumers were not going to physical stores and started migrating to e-commerce platforms. Online pet shops subsequently gained more attention from owners and some of them were able to replicate the trust relationship consumers previously had with their local pet shops, an important cultural factor in Brazil’s pet care market.

- Subscription programmes with highly competitive discounts, as offered by Petlove and Petz, found great acceptance among owners during the pandemic period, increasing e-commerce penetration over other channels. Also, digital shops provide more product variety and access to innovation in other regions outside central urban areas, which was essential for the premiumisation process to expand geographically. In addition to improving their online shops, some companies such as Cobasi, also aimed at strategic partnerships with delivery apps, such as iFood, to leverage their distribution coverage.

Prospects and growth opportunity

- Cat adoptions are expected to maintain high growth rates in the next five years to 2026, resulting from new owners choosing cats as the “ideal first pet”, but also from those adopting more cats, given the relatively low costs and the necessity to provide additional company for their pet cats. The cat population is growing rapidly among groups with higher purchasing power in urban areas, which indicates cat owners will be more demanding for premium products rather than low-cost options. In terms of growth projections, after the high demand period seen from 2020 into 2021, this peak will tend to stabilise as cat adoptions increase at a slower pace through the end of the forecast period.

- The pandemic impact on pet owners’ consumption habits and consequently higher monthly spending on their pets are here to stay. Unlike other shopping routines acquired during home seclusion, buying pet products, and particularly pet food, became equivalent to caring for a family member and this close relationship is not expected to fade over the forecast period (2021-2026).

- Seeking to diversify their dogs’ diets, owners will look for alternatives to improve meals as pleasant experiences, relying more on treats and premium brands. This trend will allow wet food categories to gain more penetration as many brands are pushing through to grow in this space. Special Dog recently inaugurated a production unit specialised in wet food lines, aiming to bring good cost-benefit options for consumers.

General health & wellness trends

- Pet care is expected to maintain high growth rates across 2021 as pet adoptions due to home seclusion will continue to be a relevant trend through the next few years. Also, pet humanisation habits developed during periods at home, such as prioritising premium food brands, will tend to continue as pet owners remain working from home and in close contact with their pets. The proportion of pets consuming industrial food rather than homemade and leftovers is also expected to increase considerably over the next five years, as disposable income is expected to increase after the economic effects of COVID-19 recede.

- Cat food is projected to achieve even greater relevance in the next few years for pet food manufacturers as the dog/cat population ratio starts to change rapidly from 2020 onwards. All the main companies started expanding the variety of their cat products and also reinforced brand exposure in retail establishments and online marketplaces. Cat food will tend to become less concentrated as new brands appear at the economic end of the market, as seen for the Special Cat brand, and also at the premium end, with product claims that large players cannot make, such as natural meals and non-GMO lines.

Alcoholic Drinks

- Market size and growth

-

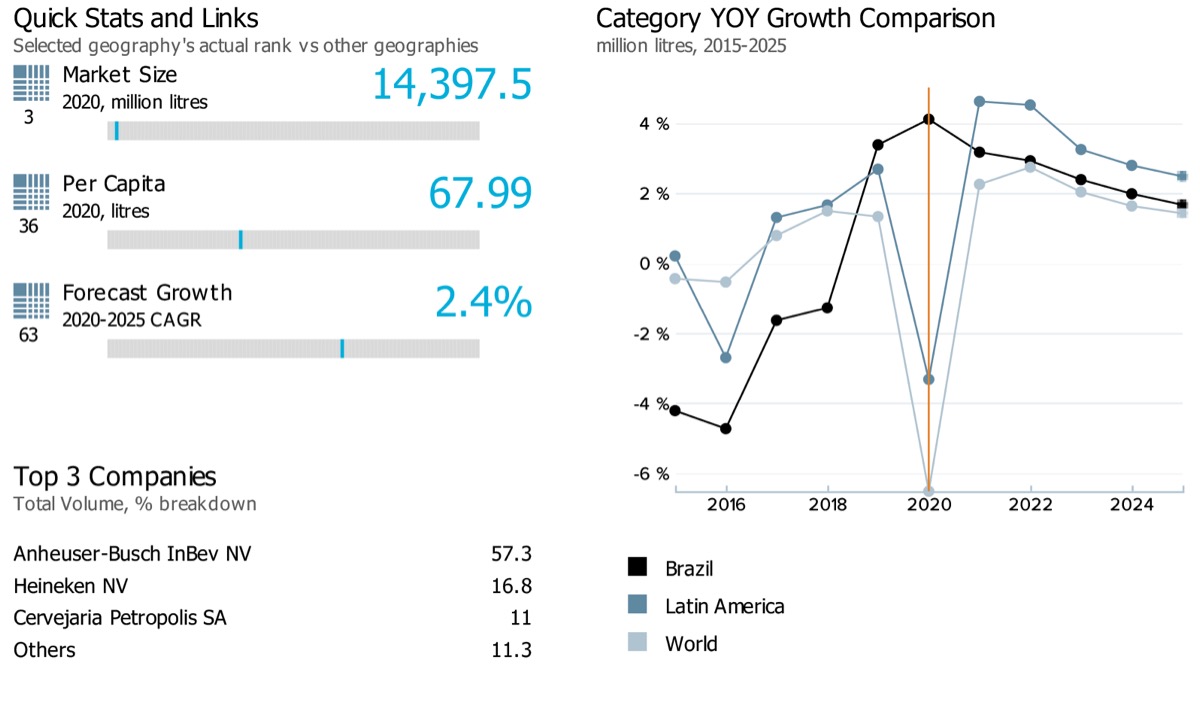

Note: Market size data for the alcoholic drinks category in the country reflects the total volume in a million litres. Data on the top left corner of the image (3, 36, and 63) showcases respective ranks for Brazil for its market size, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Brazil’s total value compound annual growth rate (CAGR) for alcoholic drinks is expected to witness a slight slowdown from historic to forecast (2015-2020: HCAGR: 7.5%, 2020-2025: FCAGR: 6.1%). However, in terms of total volume, the category is expected to gain momentum over the forecast period (2020-2025: FCAGR: 2.4%, 2015-2020: HCAGR: -0.1%). The category’s performance at the global level, both in terms of total value and volume, is expected to gain momentum over the forecast period (2020-2025: FCAGR for total value: 4.6% and for total volume: 2.0%) against its performance in the historic period (2015-2020: HCAGR for total value: 0.9% and for total volume: -0.7%).

- Sub-category breakdown

-

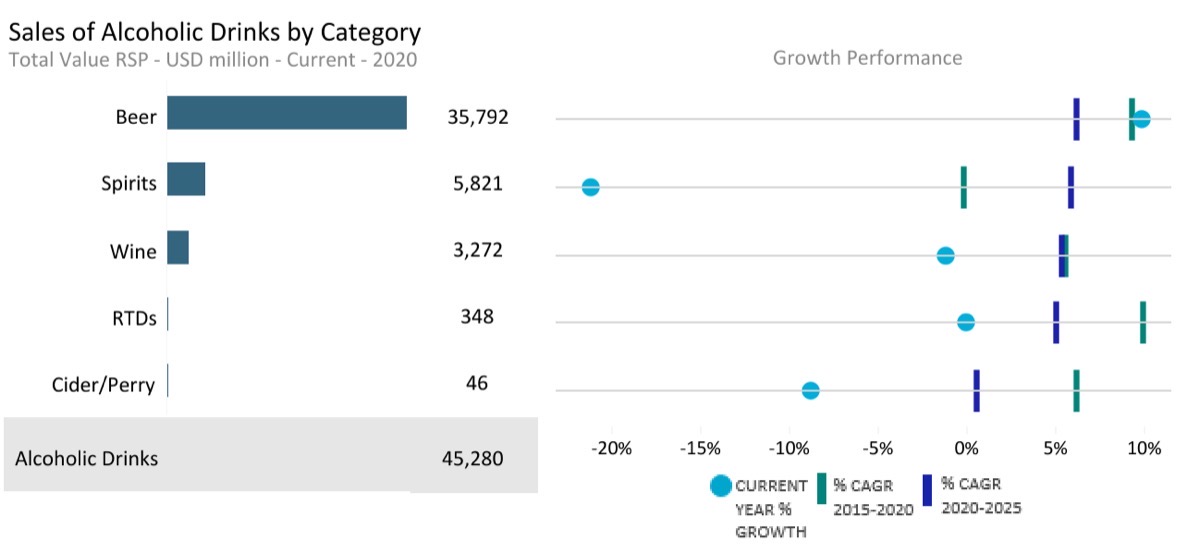

Current year growth in the above chart refers to period 2019-20

Category

Data type

Market size (2020)

USD million

Forecast compound annual growth rate (2020/2025) %

Alcoholic Drinks

Total Value RSP

45,279.89

6.11

Alcoholic Drinks

Off-trade Value RSP

13,602.90

5.76

Alcoholic Drinks

On-trade Value RSP

31,676.99

6.26

Beer

Total Value RSP

35,791.96

6.24

Beer

Off-trade Value RSP

9,673.39

6.24

Beer

On-trade Value RSP

26,118.57

6.24

Cider/Perry

Total Value RSP

46.27

0.56

Cider/Perry

Off-trade Value RSP

45.13

0.52

Cider/Perry

On-trade Value RSP

1.14

2.03

RTDs

Total Value RSP

348.38

5.05

RTDs

Off-trade Value RSP

255.98

5.97

RTDs

On-trade Value RSP

92.40

2.33

Spirits

Total Value RSP

5,821.09

5.88

Spirits

Off-trade Value RSP

1,388.26

4.97

Spirits

On-trade Value RSP

4,432.83

6.16

Wine

Total Value RSP

3,272.19

5.31

Wine

Off-trade Value RSP

2,240.14

4.19

Wine

On-trade Value RSP

1,032.05

7.59

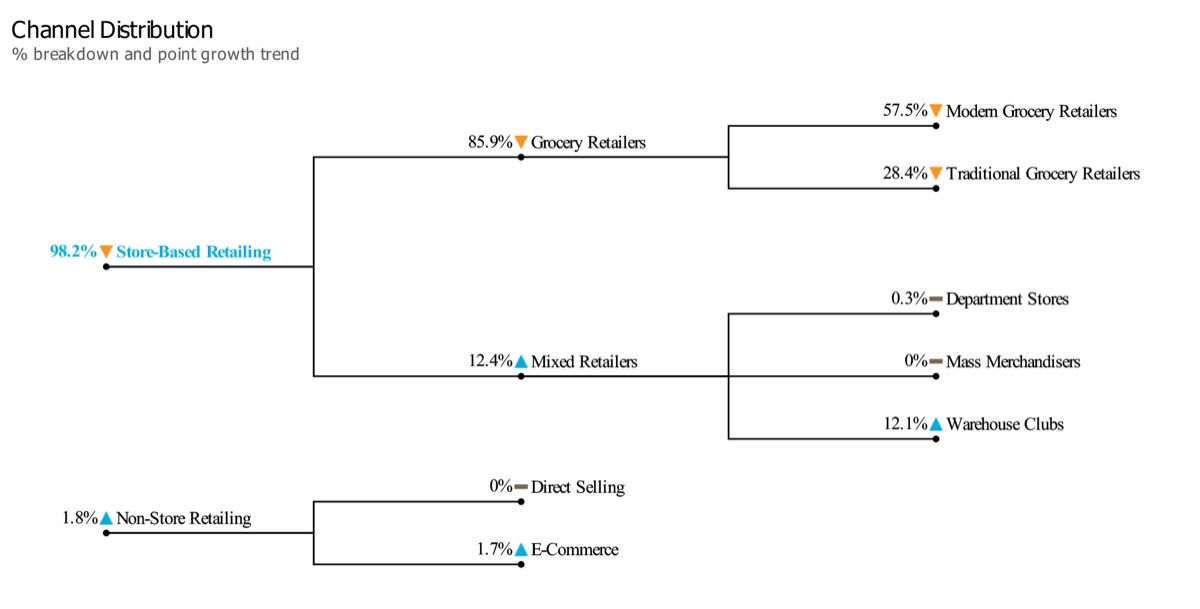

- Channel distribution

-

Note: The chart here showcases the off-trade volume share of different channel sales for alcoholic drink products in Brazil in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- COVID-19 was a change maker for the alcoholic drinks market in 2020, and its effects will ripple well into the end of the forecast period (2020-2025). Although the scenario was dire for the on-trade, it did not mean that consumers gave up alcoholic drinks, quite the contrary, with record-breaking volumes in some categories, especially wine which was labelled ‘the pandemic beverage of choice’. Wine already had a foothold among Brazilian consumers, being mostly consumed at home or at social events. It is a ready to drink beverage, requiring no preparation in order to consume it, and its varied price range makes it accessible to a wide range of consumers. Many wine retailers already had a strong online presence prior to the pandemic, so the logistics were already in place to ensure no supply chain interruptions as more consumers started to shop on the internet. Wine’s comparatively low alcohol content make it a drink that people feel comfortable with, and it even has mental wellness appeal.

- In the catastrophic scenario of 2020, the consolidated and bigger players were able to sail smoother seas, as supply, logistics, and availability were the main points of retaining consumers. This meant that Ambev, Heineken, and Diageo, to cite a few, were able to maintain a sense of normality. Another important push for companies was in packaging formats; as the glass bottleneck that plagued the Brazilian market became more prevalent, shifting to metal beverage cans became a must, as was seen by Diageo’s shift of Smirnoff Ice from glass to metal packaging. New channel strategies also played a role, for example, in the case of Zé Delivery by Ambev, an online D2C platform connecting the final consumer to the company via a highly proficient logistics system.

Prospects and growth opportunity

- The search for low or no alcoholic options did not wane during 2020; in fact, the launch of Heineken 0.0, zero-alcohol beer option, increased and showed the market and consumers how a zero abv beer can be positioned, sold, marketed, and produced. The main characteristic of this product was how it could be marketed to the same public but should explore new consumption occasions. Drinking during work, as you work out, or when driving are occasions that do not work with classic alcoholic beverages, but this new product can be fully explored. Trying to fit the consumption of zero-alcohol beer to the classic and often social occasions never worked in the Brazilian market, with many brands trying to make this product work but always with dubious or poor results. Hence, competition is only expected to grow as more consumers choose a healthier lifestyle and zero-alcohol versions of classic alcoholic beverages.

- After the success and growth seen by the wine industry in 2020, it is expected, that the newfound loyalty of consumers will be the main driver behind growth over the forecast period. The good experience, increasing investment in logistics and availability as well as the price competitivity of wine products developed the consumer market and kickstarted a more cultural consumption of the product, thereby strengthening the habit persistence driver for this product. However, sustained growth over the coming years will demand adaptability and innovation from the industry as wine historically relied heavily on the winter seasonality and in-house occasions. Early signs of what it will look like are investment in e-commerce; expansion of canned wines; bigger investment in marketing and branding, and stimulation for the off-season market, with white and rosé wines.

General industry trends

- With COVID-19 slowing down, the pent-up demand was bound to return, as consumers are desperately searching for opportunities to socialise again. If 2020 showed us anything, it is that Brazilian consumers are always looking for opportunities to indulge, so the shift towards hedonism from health and wellness comes as no surprise.

- The future for the biggest part of spirits in Brazil relies on cachaça (a distilled spirit made from fermented sugarcane juice) companies’ strategies in the following years. It has been years since cachaça was outperformed by other products, especially gin and whisky. What these two categories have done right in recent years and in 2020 was branding, especially at a premium level. Gin also played its cards right with claims such as ‘organic’, but it is also perceived as low-calorie. Furthermore, both products have an education and experimentation aspect, as they have different ingredients and organoleptic profiles that attract the curious consumers.

Health & Wellness Packaged Food & Beverages

- Market size and growth

-

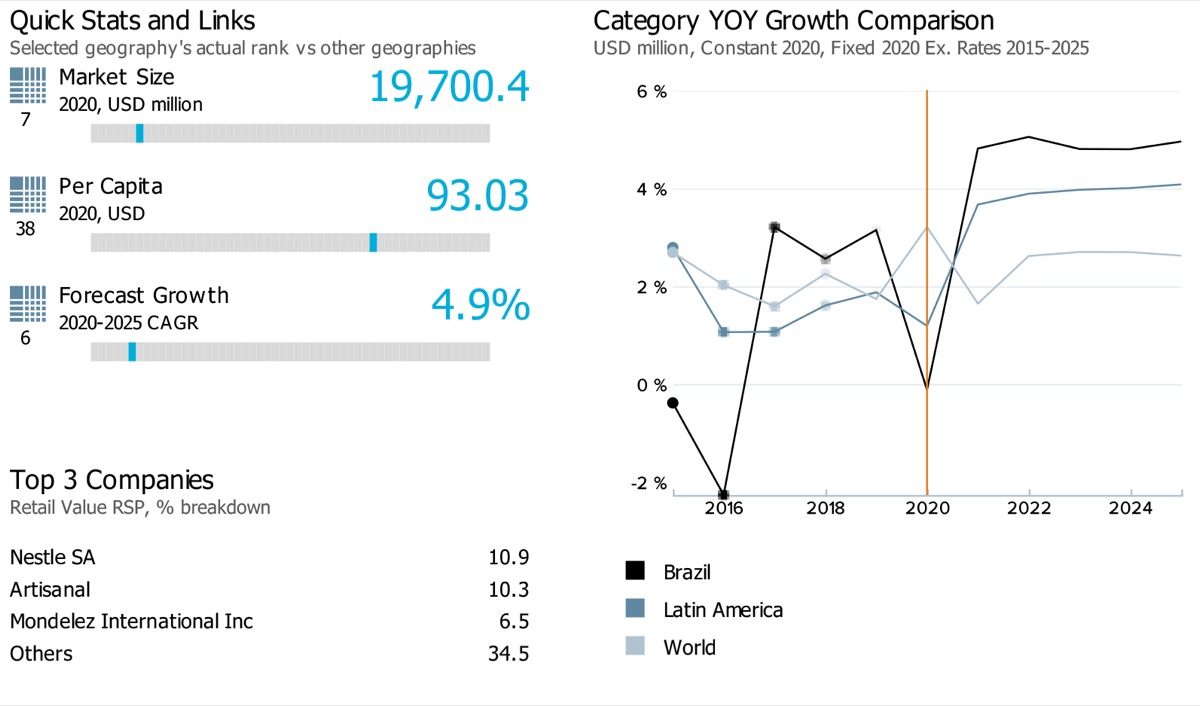

Note: Data on the top left corner of the image (7, 38, and 6) showcases respective ranks for Brazil for its market size, per capita, and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

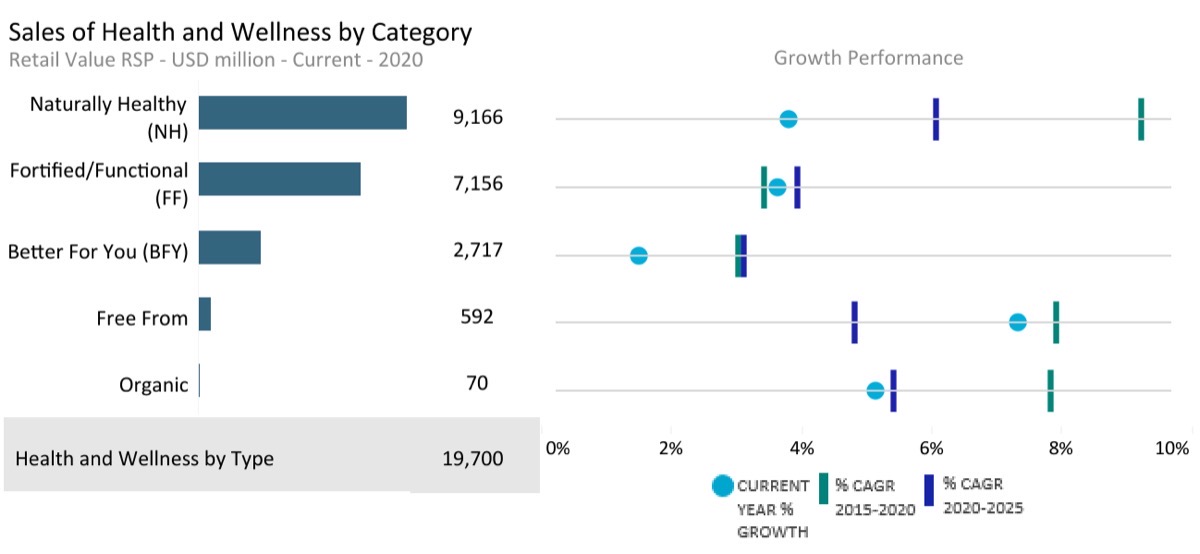

The retail value sales of health and wellness food and beverage products in Brazil is expected to slow down when comparing the compound annual growth rates from historic to forecast periods, i.e. (5.9% during 2015-2020 to 4.9% during 2020-2025). This was also the case with the category’s performance at the global level, where its compound annual growth rate for retail value sales is estimated to slow down from 4.6% during 2015-2020 to 2.4% during 2020-2025.

- Sub-category breakdown

-

Current year growth in the above chart refers to period 2019-20

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Health and Wellness by Type

USD million

19,700.37

4.88

Better For You (BFY)

USD million

2,716.53

3.12

Fortified/Functional (FF)

USD million

7,155.69

3.94

Free From

USD million

592.37

4.82

Naturally Healthy (NH)

USD million

9,165.82

6.07

Organic

USD million

69.95

5.41

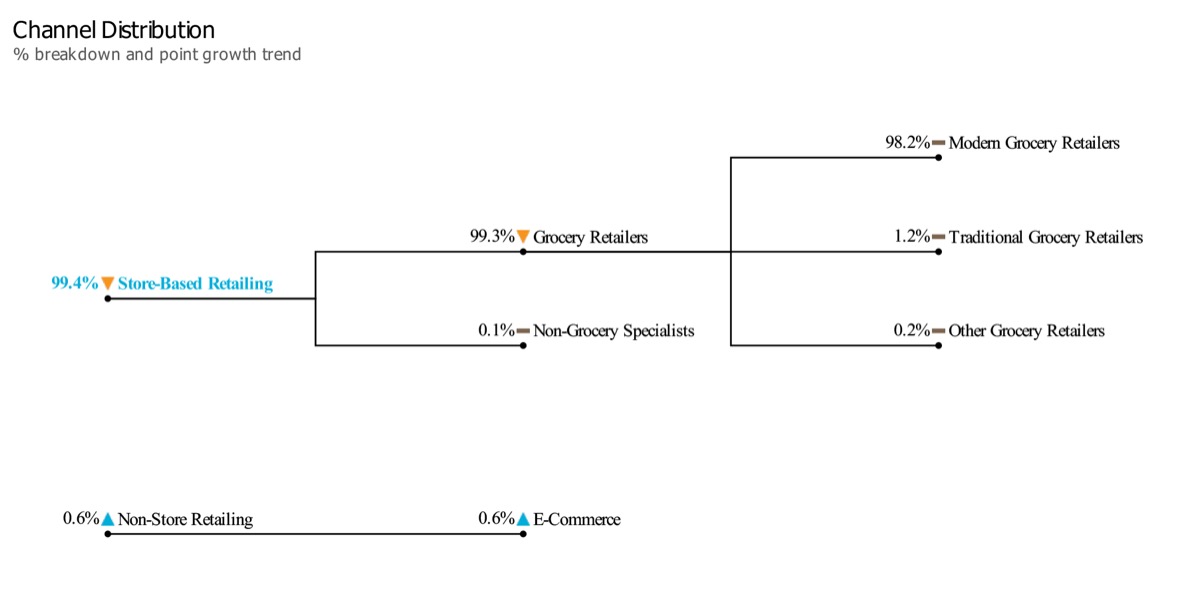

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for health and wellness by type products in Brazil in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- The year 2020 in the world was unique in many aspects, and Brazil’s health and wellness industry was no different. At first glance, the market was expected to increase due to rising health concerns among consumers, but what transpired was the opposite. There was a major shift among Brazilian consumers towards basic and essential products in food and beverages, driven mainly by economic constraints on many consumers. Another important trend that COVID-19 helped boost was the consumption of indulgence products. This was a direct migration from health and wellness products to less healthy options, such as regular products. Driven mainly by consumers looking for comfort during stress-heavy times and no leisure via food service, indulgence consumption led to the growth of categories that were losing volumes, such as regular cola carbonates and frozen food.

- Naturally healthy (NH) products suffered for the same reasons as other health and wellness categories, high prices and migration to indulgence products. One highlight, however, was the performance of NH teas, which increased in volume in a traditional coffee-drinking market such as Brazil. This consumption was directly linked to the health benefits of NH teas, but especially to the stress-relief properties of chamomile tea or passion fruit tea.

Prospects and growth opportunity

- Retailing shifts were significant during 2020. Retail volume sales across all channels increased mainly due to migration from institutional and foodservice channels. One channel that gained shares during this period is “atacarejo”, a type of wholesale club in Brazil that sells mainly to the on-trade but also individuals. This channel is often associated with offering bargains and lower prices than others which, as a result, gained space during the 2016 economic crisis in Brazil and again in 2020 as consumers were under more financial stress due to unemployment and/or lower incomes. Although these locations required bigger commutes than independent small grocers, price positioning was a major factor in attracting consumers, which highlights an important factor in understanding the Brazilian consumer: price takes priority overall, even over health concerns.

- Portfolio expansion through new flavours and pack sizes are expected to remain the main long-term strategy being sought after by brands in Brazil. The focus has been on new flavours and new pack sizes, demonstrating a more conservative approach from manufacturers when looking at long-term strategies. Market volatility, fierce competition and new habits acquired during quarantine require a less risky attitude towards investments. In case of naturally healthy packaged food products, examples of such a trend include Pastifício Selmi through Renata Integrale biscuits, available in strawberry and oat and cocoa and oat flavours; Lua Nova Indústria Comércio de Produtos Alimentícios through Panco 100% Integral packaged bread, available in two new flavours of Brazilian Nuts and Brazilian Nuts & Linseeds; Panduratta through Bauducco Cereale sweet biscuits and packaged cakes brand; among many others.

General health & wellness trends

- Brazilians increasingly understand the importance of consuming products with nutritious ingredients. In line with this, the use of superfruits is expected to remain an important trend within NH (naturally healthy) beverages and important for adding value to the NH juice category. Amongst the most common superfruits in NH fruit/vegetable juice over the review period were cranberries, pomegranate and coconut. Cranberries and pomegranate are popular antioxidants, and coconut water is valued for its enhanced hydration effects and nutrients, which include potassium and vitamin C. Other ingredients offered by category manufacturers include soursop, cactus leaf and pineapple.

- Artisanal products are expected to continue to dominate the category over the forecast period driven by two major polarised trends: on the one hand, middle- and lower-income consumers tend to prefer these products (especially NH high fibre bread) due to their usually lower unit prices, especially if purchased in bulk, and perceived high quality and freshness; on the other hand, more affluent consumers continue to boost the “back to basics for status” trend, by switching back to artisanal products with a premium positioning.

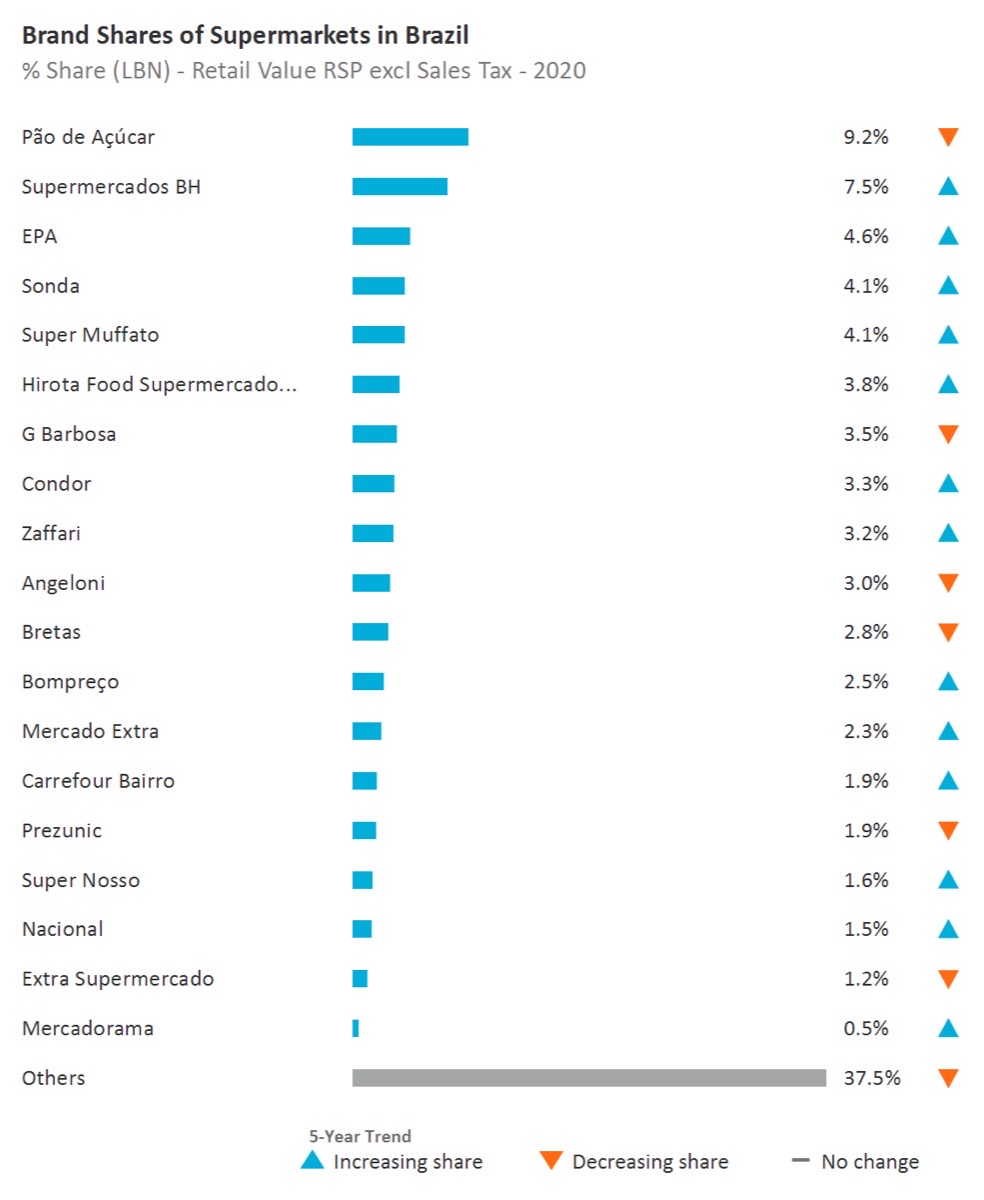

Retail Landscape

- Brand shares of supermarkets

-

Note: The 6th supermarket in the above chart is – Hirota Food Supermercado

- Brand shares of chemists/pharmacies

-

Data not available

- Retail insights

-

- The COVID-19 pandemic had a major impact on Brazil’s retailing industry over the course of 2020, with most store-based channels experiencing sales declines and significant shifts seen in spending and demand patterns. With store-based retailing under such pressure, a shift towards e-commerce was inevitable, and many retailers looked to social media and the WhatsApp messaging app to establish closer, more personal direct links with their customers in the absence of the in-store experience. Via Varejo SA, for instance, trained employees in the use of WhatsApp to provide assistance to customers shopping online, with the retailer’s use of the app enabling staff to answer questions and address concerns about products, payment and delivery. The company thus leveraged the high popularity of WhatsApp in Brazil to maintain personal contact with its customer base whilst avoiding massive layoffs among its retail staff.

- The year 2020 also witnessed Brazil’s Central Bank launch the new national instant payment system PIX, which began operating as of 16 November. The new system is expected to be a huge step towards the digitalisation of Brazil’s economy and a major step towards addressing many of the challenges that remain before Brazil can develop towards a cashless society. The PIX system enables consumers to register up to three keys which can then be used to process instant payments to any other party also registered on the system. PIX is expected to play a key role in developing e-commerce, m-commerce and other forms of digital commerce.

- In line with the above-mentioned initiatives, even after the pandemic situation has been resolved to the extent that people feel safe shopping in supermarkets once more, the convenience that online grocery shopping represents will likely continue to support growth in food and drink e-commerce. Within this context, it will be increasingly necessary for the leading players in supermarkets to focus more on developing their online presence and facilitating e-commerce sales to remain relevant and competitive. This could be done either through collaborations with app-based last-mile delivery players or via the development of retailers’ own m-commerce apps.

- The country's chemist/pharmacies market was valued at USD 376.5 million in 2020 (Retail value RSP without sales tax). In 2020-2021, the channel's year-over-year growth rate was 4.9%. The value compound annual growth rate has been 3.6% over the last five years (2015-2020). However, the channel's retail value compound annual growth rate is expected to grow at 6.6% over the forecast period (2020-2025).

- Definitions

- Acronyms Used & Key Notes

Definitions

|

Industry |

Category |

Definition |

|---|---|---|

|

Alcoholic Drinks |

Alcoholic Drinks |

Alcoholic drinks are the aggregation of beer, wine, spirits, cider/perry and RTDs. |

|

Alcoholic Drinks |

Beer |

An alcoholic drink usually brewed from malt, sugar, hops and water and fermented with yeast. Some beers are made by fermenting a cereal, especially barley, and therefore not flavoured by hops. Alcohol content for beer is varied – anything up to and over 14% ABV (alcohol by volume), although 3.5% to 5% is most common. Beer is the aggregation of lager, dark beer, stout and non/low alcohol beer. |

|

Alcoholic Drinks |

Cider/Perry |

Cider is made from fermented apple juice while perry is made from fermented pear juice. Both artisanal and industrial cider/perry are included. |

|

Alcoholic Drinks |

RTDs |

RTD stands for ‘ready-to-drink’. Other terms which may be used for these products are FABs, alcopops and premixes. The RTDs sector is the aggregation of malt-, wine-, spirit- and other types of premixed drinks. These drinks usually have an alcohol content of around 5% but this can reach as high as 10% ABV. Premixes containing a high percentage of alcohol of around 15%+ combined with juice or any other soft drink are included here. RTDs are usually marketed as products to be drunk neat, with ice, or as a cocktail ingredient. Fruit-flavoured, vodka-based spirits with an alcohol content of between 16-21% are classified here. Examples: Alizé, Ursus Roter, Berentzen Fruchtige, Kleiner Feigling. |

|

Alcoholic Drinks |

Spirits |

This is the aggregation of whisk(e)y, brandy and Cognac, white spirits, rum, tequila, liqueurs and other spirits. |

|

Alcoholic Drinks |

Wine |

This is the aggregation of still and sparkling light grape wines, fortified wine and vermouth and non-grape wine. In terms of alcohol content, light wine usually falls into the 8-14% ABV bracket while fortified wine ranges from 14-23% ABV. Low and non-alcoholic wine is also included in the data (attributed to each sector as appropriate). |

|

Beauty and Personal Care |

Skin Care |

This is the aggregation of facial care, body care, hand care and skin care sets/kits. |

|

Beauty and Personal Care |

Body Care |

This is the aggregation of firming/anti-cellulite products and general-purpose body care. |

|

Beauty and Personal Care |

Facial Care |

This is the aggregation of acne treatments, moisturisers and treatments, facial cleansers, toners, face masks, and lip care. Please note that Moisturisers and Treatments is the aggregation of basic moisturisers and anti-agers. |

|

Beauty and Personal Care |

Hand Care |

Includes all hand moisturisers, both premium and mass market, as well as combination hand and nail products. Includes protective emollients and deep moisturisers formulated to sooth and hydrate very dry or irritated skin, as well as those that prevent, or that are suitable for, eczema-prone or redness-prone skin. Excludes medicated emollients and/or those positioned as treatment for eczema or psoriasis. |

|

Beauty and Personal Care |

Skin Care Sets/Kits |

Multiple skin care items of the same brand line packaged together in a set and priced at an advantageous price compared to purchasing the items separately. Includes traditional gift sets, multi-step skin care regimens, skin care starter kits (including acne treatment regimen sets/kits) and skin care travel kits (sold through retail outlets). Also includes sets, which comprise of products from multiple categories (e.g. makeup and skin care), as long as the primary product is skin care. Men’s, women’s and unisex versions are included. Excludes: GWP (Gift with Purchase) – consumer does not pay for this (e.g. free product when you purchase a set or a free sample kit). |

|

Consumer Health |

Dietary Supplements |

It is the aggregation of all dietary supplements: Minerals, fish oils/omega fatty acids, garlic, ginseng, ginkgo biloba, evening primrose oil, Echinacea, St John's Wort, protein supplements, probiotic supplements, eye health supplements, co-enzyme Q10, glucosamine, combination herbal/traditional supplements, non-herbal/traditional supplements, and all other dietary supplements specific to country coverage. |

|

Consumer Health |

Paediatric Vitamins and Dietary Supplements |

All vitamin and dietary supplement products formulated, designed, marketed and labelled specifically for children. |

|

Consumer Health |

Tonics |

Include versions of combination dietary supplements that are sold in the format of liquid concentrates, mini-drinks, shots or oral gels. Include concentrated energy shot boosters and tonics such as 5-Hour Energy and Lipovitan. Exclude remedies made with active pharmaceutical ingredients as well as super fruit juice concentrates and weight-loss beverages, tracked under the Health and Wellness (HW) system. |

|

Consumer Health |

Vitamins |

This is the aggregation of multivitamins and single vitamins. |

|

Health and Wellness |

Health and Wellness by Type |

Health and Wellness by Type is the aggregation of all health and wellness food and beverages broken down by organic, fortified/functional, naturally healthy, better for you and free from products. |

|

Health and Wellness |

Better For You (BFY) |

Products where the amount of a substance considered to be less healthy (eg fat, sugar, salt, carbohydrates) has been actively reduced during production. To qualify for inclusion in this category, the “less healthy” element of the foodstuff needs to have been actively removed or substituted during the processing. This should also form a key part of the positioning/marketing of the product. Products which are naturally fat/sugar/carbohydrate -free are not included as nothing out of the ordinary has been done during their production to make them “better for you”. “No added sugar” claims are excluded too. Products most likely to be included here will be those which are low-fat/low-sugar versions of standard products (i.e. reduced fat mayonnaise, reduced fat cheese, reduced fat milk, reduced sugar confectionery, etc). |

|

Health and Wellness |

Fortified/Functional (FF) |

This category includes fortified/functional food and beverages. When identifying fortified/functional products, we focus on products to which health ingredients or/and nutrients have been added as well as brands that are positioned to deliver a certain functionality. To be included here the enhancement must be highlighted in the label or hold a health claim/nutritional claim. Fortified/functional food and beverages provide health benefits beyond their nutritional value and/or the level of added ingredients wouldn’t normally be found in that product. To merit inclusion in this category, the defining criterion here is that the product must have been actively fortified/enhanced during production. As such, inherently healthy products such as 100% fruit/vegetable juices are only included under "fortified/functional" if additional health ingredients (e.g. calcium, omega 3) have been added. To be included, the health benefit needs to form part of positioning/marketing of the product. For product category definitions please refer to the definitions section (can be found under the "Help" section on Passport) for the respective system: Packaged Food, Hot Drinks, Soft Drinks. |

|

Health and Wellness |

Free From |

This category includes free from gluten, free from lactose, free from allergens, free from dairy and free from meat products. This excludes foods which are certified ‘free’ of a specific product when this is based on use of sterilised equipment. |

|

Health and Wellness |

Naturally Healthy (NH) |

This category includes food and beverages based on naturally containing a substance that improves health and wellbeing beyond the product’s pure calorific value. These products are usually a healthier alternative within a certain sector/subsector. High fibre food (wholegrain/wholemeal/brown), soy products, sour milk drinks, nuts, seeds and trail mixes, honey, fruit and nut bars and olive oil are considered NH foods and 100% fruit/vegetable juice, superfruit juice, natural mineral water, spring water, RTD green tea etc. are considered NH beverages. While many of these products are marketed on a health basis, this might not always be the case. Naturally healthy food and beverages that are additionally fortified fall into the 'fortified/functional' category. |

|

Health and Wellness |

Organic |

Certified organic products are those which have been produced, stored, processed, handled and marketed in accordance with precise technical specifications (standards) and certified as "organic" by a certification body such as the Soil Association in the UK, the European Union or the US Department of Agriculture. It is important to note that an organic label applies to the production process, ensuring that the product has been produced and processed in an ecologically sound manner. The organic label is therefore a production process claim as opposed to a product quality claim. Note: For organic products to be included, the organic aspect needs to form a significant part of the overall positioning/marketing of the product, including the organic certification label in the packaging. |

|

Pet Care |

Dog and Cat Food |

This is the aggregation of dog and cat food. |

|

Pet Care |

Cat Food |

This is the aggregation of wet and dry cat food. |

|

Pet Care |

Cat Treats and Mixers |

This is the aggregation of mixers and treats for cats. |

|

Pet Care |

Dry Cat Food |

These products have a moisture content of 10-14% and are generally packed into paper, plastic or cardboard. Dry cat food is typically made from a combination of grain-based ingredients (corn and rice) and a meat component. It is typically produced by extrusion cooking under high heat and pressure and then sprayed with fat to increase palatability. Other ingredients may also be added to complete its composition. This is the aggregation of premium, mid-priced and economy dry cat food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal), have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Cat Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet cat food. |

|

Pet Care |

Dog Food |

This is the aggregation of wet and dry dog food. |

|

Pet Care |

Dog Treats and Mixers |

This is the aggregation of mixers and treats for dogs. |

|

Pet Care |

Dry Dog Food |

These products generally have a moisture content of 6-14% and are generally packed into paper, plastic or cardboard. Complete dry dog foods fall into two broad categories: Flaked (or 'Muesli' type blended products) and Extruded products (meat and cereals cooked by direct steaming). This is the aggregation of premium, mid-priced and economy dry dog food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal) have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Dog Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet dog food. |

|

Retail in Alcoholic Drinks |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Alcoholic Drinks |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Alcoholic Drinks |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Alcoholic Drinks |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Alcoholic Drinks |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (readymade sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Alcoholic Drinks |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Alcoholic Drinks |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Alcoholic Drinks |

Food/drink/tobacco specialists |

Retail outlets specialising in the sale of mainly one category of food, drinks store and tobacconists. Includes bakers (bread and flour confectionery), butchers (meat and meat products), fishmongers (fish and seafood), greengrocers (fruit and vegetables), drinks stores (alcoholic and non-alcoholic drinks), tobacconists (tobacco products and smokers’ accessories), cheesemongers, chocolatiers and other single food categories. Alcoholic drinks stores are retail outlets with a primary focus on selling beer/wine/spirits/other alcoholic beverages. Example brands include: Threshers, Gall & Gall, Liquorland, Watson’s Wine Cellar |

|

Retail in Alcoholic Drinks |

Independent Small Grocers |

Retail outlets selling a wide range of predominantly grocery products. These outlets are usually not chained and if chained will have fewer than 10 retail outlets. Mainly family owned, often referred to as Mom and Pop stores. |

|

Retail in Alcoholic Drinks |

Other Grocery Retailers |

Other retailers selling predominantly food, beverages and tobacco or a combination of these. Includes kiosks, markets selling predominantly groceries. Includes CTNs and health food stores, Food & drink souvenir stores and regional speciality stores. Direct home delivery, eg of milk, meat from farm/dairy is excluded. Sari-Sari stores in Philippines and Warung (Waroon) in Indonesia, that can either be markets or kiosks, are included in Other grocery retailers unless they occupy a separate permanent outlet building, in which case they are included in Independent small grocers. Outlets located within wet markets, particularly in South East Asia (often located in government-owned multi-story buildings) should be counted as separate outlets. Wine sales from Vineyards are included here. |

|

Retail in Alcoholic Drinks |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Alcoholic Drinks |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Alcoholic Drinks |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Alcoholic Drinks |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Alcoholic Drinks |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Alcoholic Drinks |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Alcoholic Drinks |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Alcoholic Drinks |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Alcoholic Drinks |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Alcoholic Drinks |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Alcoholic Drinks |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Alcoholic Drinks |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Beauty and Personal Care |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Beauty and Personal Care |

Modern Grocery Retailers |

Modern grocery retailing is the aggregation of those grocery channels that have emerged alongside the growth of chained retail: Hypermarkets, Supermarkets, Discounters, Forecourt Retailers and Convenience Stores. |

|

Retail in Beauty and Personal Care |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Beauty and Personal Care |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Beauty and Personal Care |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (ready-made sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Beauty and Personal Care |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Beauty and Personal Care |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Beauty and Personal Care |

Traditional Grocery Retailers |

Traditional grocery retailing is the aggregation of those channels that are invariably non-chained and are, therefore, owned by families and/or run on an individual basis. Traditional grocery retailing is the aggregation of three channels: Independent Small Grocers, Food/Drink/Tobacco Specialists and Other Grocery Retailers. |

|

Retail in Beauty and Personal Care |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Beauty and Personal Care |

Apparel and Footwear Specialist Retailers |

Outlets specialising in the sale of all types of apparel, footwear and fashion accessories including costume jewellery, belts, handbags, hats, scarves or a combination of these (for example stores selling handbags only are included). This includes those stores that carry a combination of all products for either men or women or children and those that may specialise by either gender, age or product. Example brands include Gap, H&M, Zara, C&A, Miss Selfridge, Foot Locker, Uniglo, Next, Matalan. Brands that offer sports apparel and sports goods are excluded from Apparel and footwear specialist retailers and are included in Sports goods stores. |

|

Retail in Beauty and Personal Care |

Electronics and Appliance Specialist Retailers |

Retail outlets specialising in the sale of large or small domestic electrical appliances, consumer electronic equipment (including mobile phones), computers or a combination of these. For mobile phone retailers, this excludes revenues derived from telecoms service plans and top-up cards, etc. Example brands include Apple, Best Buy, Euronics, PC World, Darty, But, Media Markt, Yamada Denki, Gome (China). |

|

Retail in Beauty and Personal Care |

Health and Beauty Specialist Retailers |

This is the aggregation of chemists/pharmacies, drugstores/parapharmacies, beauty specialist retailers, optical goods stores and other healthcare specialist retailers. |

|

Retail in Beauty and Personal Care |

Beauty Specialist Retailers |

Beauty specialist retailers are chained or independent retail outlets with a primary focus on selling fragrances, other cosmetics and toiletries, beauty accessories or a combination of these. Examples of Beauty specialist retailer brands include: Body Shop, Marionnaud, Sephora and Bath and Body Works. |

|

Retail in Beauty and Personal Care |

Chemists/Pharmacies |

Retail outlets selling prescription-bound medicines under the supervision of a pharmacist and as its core activity (other activities include sales of OTC healthcare and cosmetics and toiletries products). |

|

Retail in Beauty and Personal Care |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Beauty and Personal Care |

Home and Garden Specialist Retailers |

This is the aggregation of homewares and home furnishing stores and home improvement and gardening stores. Business-to-business sales are excluded. Home improvement and gardening stores are chained or independent retail outlets with a primary focus on selling one or more of the following categories: Home improvement materials and hardware, Paints, coatings and wall coverings, Kitchen and bathroom, fixtures and fittings, Gardening equipment, House/Garden plants. Home improvement and gardening stores includes Home improvement centres / DIY stores, Hardware stores (Ironmongers), Garden centres, Kitchen and bathroom showrooms, Tile specialists, Flooring specialists. Homewares and Home Furnishing stores are retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Homewares and Home Furnishing Stores |

Retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Other Non-Grocery Specialists |

Other non-grocery retailers are chained or independent retail outlets, kiosks, market stalls or street vendors and with a primary focus on selling non-food merchandise. Other non-grocery retailers include Charity shops, Second-hand shops and Market stalls. |

|

Retail in Beauty and Personal Care |

Outdoor Markets |

Includes bazaars, kiosks, street vendors and beach vendors. |

|

Retail in Beauty and Personal Care |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Beauty and Personal Care |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Beauty and Personal Care |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Beauty and Personal Care |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Beauty and Personal Care |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Beauty and Personal Care |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Beauty and Personal Care |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Beauty and Personal Care |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Beauty and Personal Care |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Beauty and Personal Care |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Hair Salons |

Hair salons |

|

Retail in Health and Wellness |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Health and Wellness |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Health and Wellness |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Health and Wellness |

Forecourt Retailers |