United States

Country Overview

With a population of over 331 million, the United States is our third largest export market behind China and Australia. New Zealand’s main exports to the US include travel products, meat, dairy, beverages and business services.

What makes the US a friendly market for New Zealand exporters are its low regulatory barriers and the significant opportunities for companies that get it right.

With nine time zones and 50 states, each with its own discrete rules, regulations and procedures, the US is anything but a single homogenous market. It’s important to be laser focused in this nation of almost endless opportunities. Finding your niche and investing in experts are keys to success.

Trade agreements

While New Zealand does not yet have a free trade agreement with the United States, the two countries are close strategic partners. A bilateral trade and investment agreement has been in place since 1992.

Country intelligence

The Robinson Country Intelligence Index is a holistic measurement of country-level risk and serves as an alternative measure of country development. It incorporates four broad dimensions of Governance, Economics, Operations and Society. A higher ranking indicates a better Country Intelligence Index score.

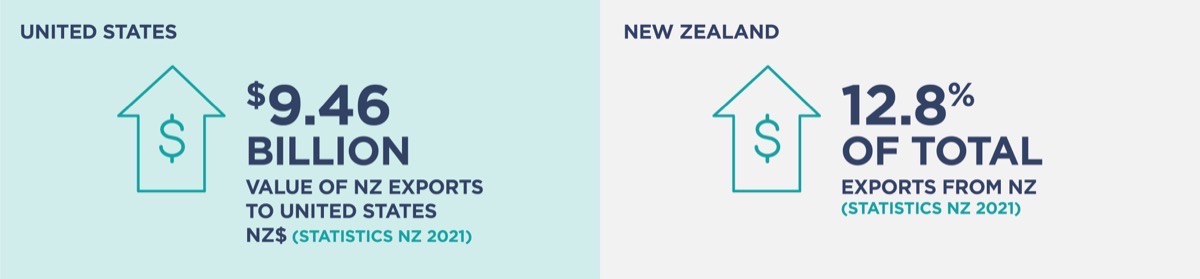

Value of New Zealand exports

International logistics performance

The International Logistics Performance Index measures how efficiently countries move goods across and within borders. Countries are ranked on their index score with a higher ranking indicating higher performance of trade logistics based on six components: customs, infrastructure, ease of international shipments, logistics services quality and competence, tracking and tracing, and timeliness.

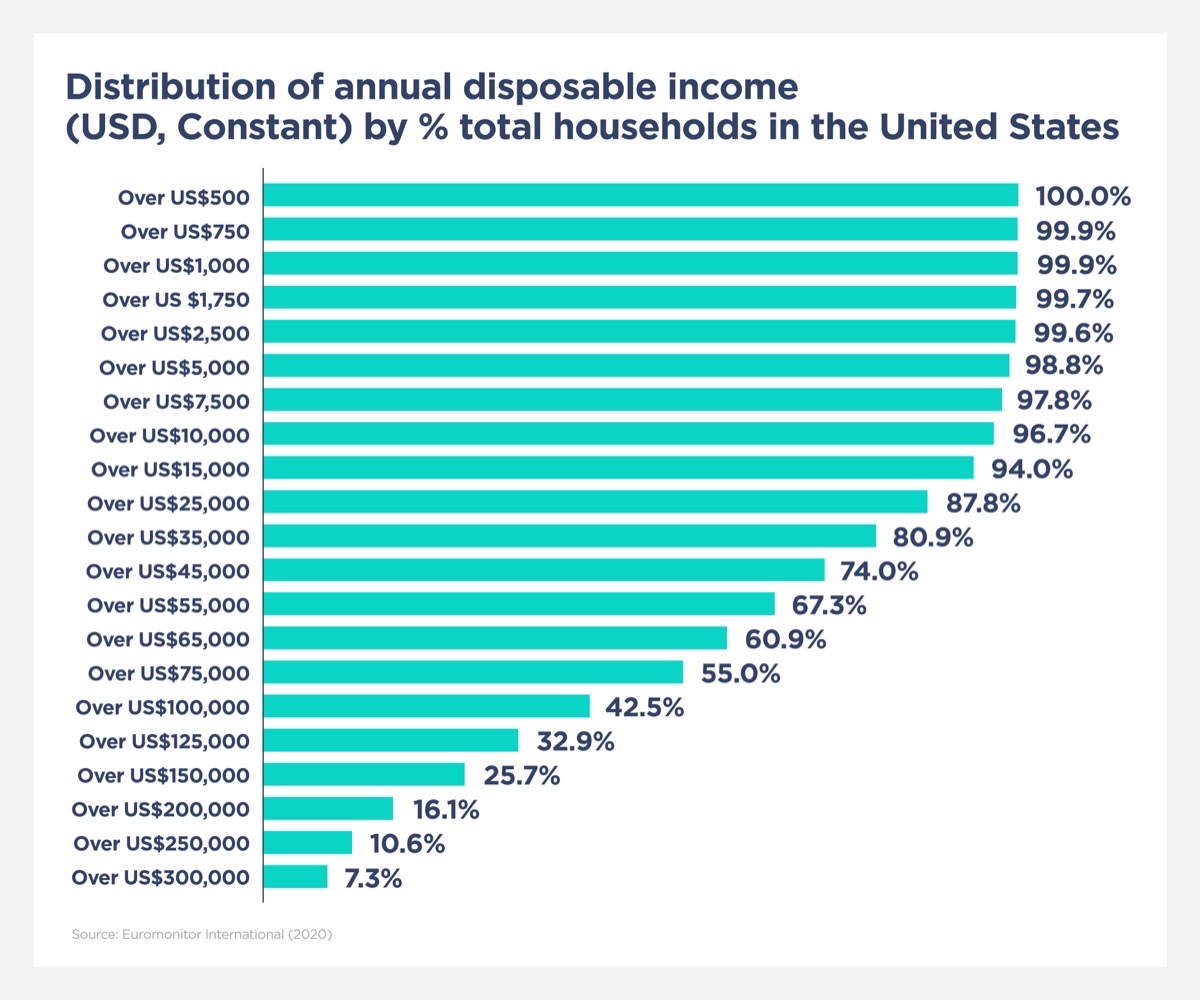

Income and distribution of wealth

Global National Income (GNI) per capita is the dollar value of a country's final income in a year, divided by its population.

Annual Disposable Income refers to gross income minus social security contributions and income taxes. Each income band presents data referring to the percentage of households with a disposable income over that amount.

Further information

For more information to validate the United States as an export market, see our United States Market Guide.

- Vitamins & Dietary Supplements

- Skin Care

- Dog & Cat Food

- Alcoholic Drinks

- Health & Wellness Packaged Food & Beverages

Vitamins & Dietary Supplements

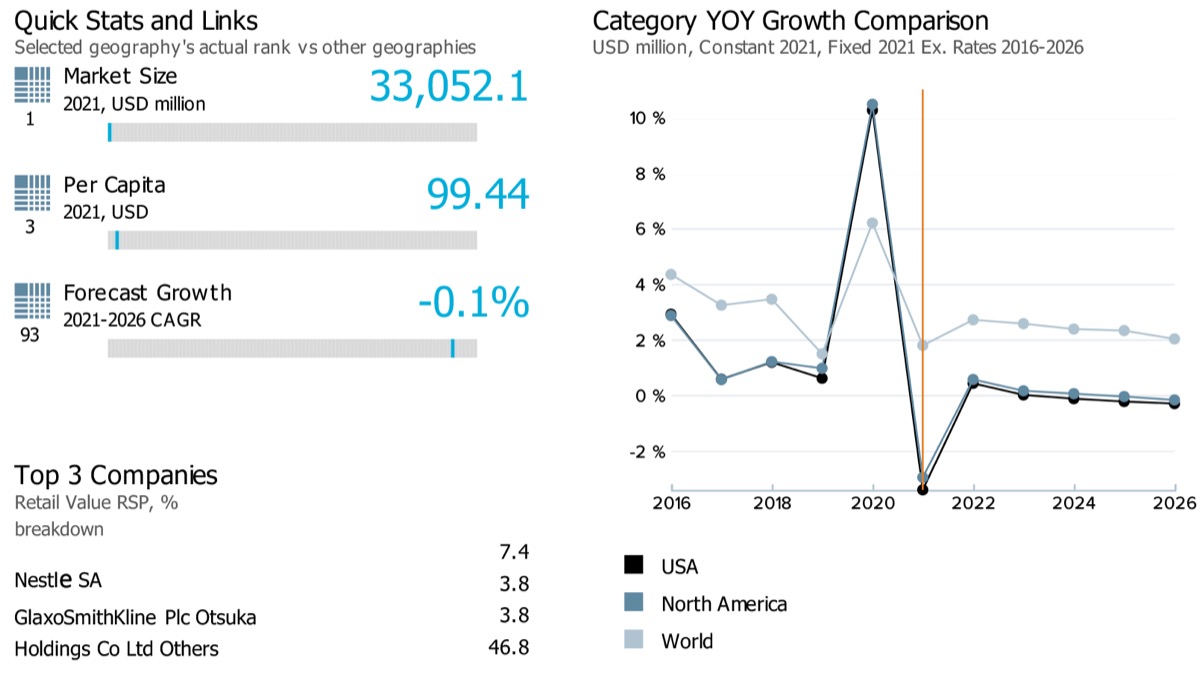

- Market size and growth

-

Note: Data on the top left corner of the image (1,3 and 93) showcases respective ranks for the USA for its market sizes, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Note: Latest market size data for the year 2021 has been shared for Vitamins & Dietary Supplements

Retail value sales of vitamins and dietary supplements in the USA witnessed a historic compound annual growth of 3.7% during 2016-2021. It is further expected to decline at a retail value CAGR of -0.06% over 2021-2026. The expected slowdown is mainly in line with the global performance of the category, where it witnessed a historic CAGR of 5.1% and an estimated slowdown for the forecast CAGR (2.4%) over the same period for its retail value sales.

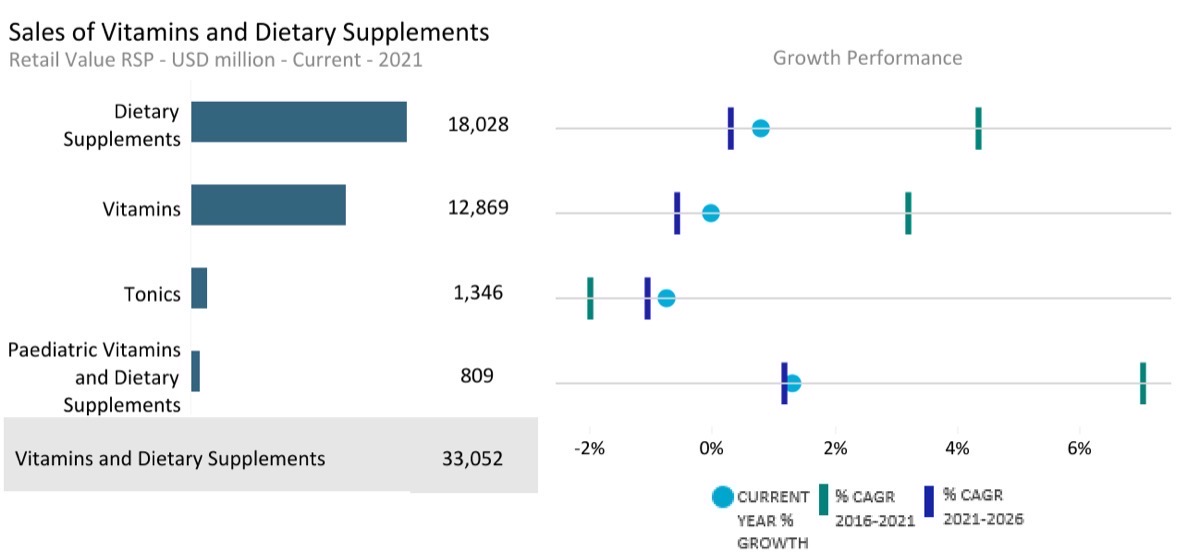

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to the period 2021-22

Category

Unit

Market size (2021)

Retail value RSP

Forecast compound annual growth rate (2021/2026) %

Vitamins and Dietary Supplements

USD million

33,052.11

-0.06

Vitamins

USD million

12,868.51

-0.57

Paediatric Vitamins and Dietary Supplements

USD million

809.47

1.18

Dietary Supplements

USD million

18,027.74

0.31

Tonics

USD million

1,346.40

-1.07

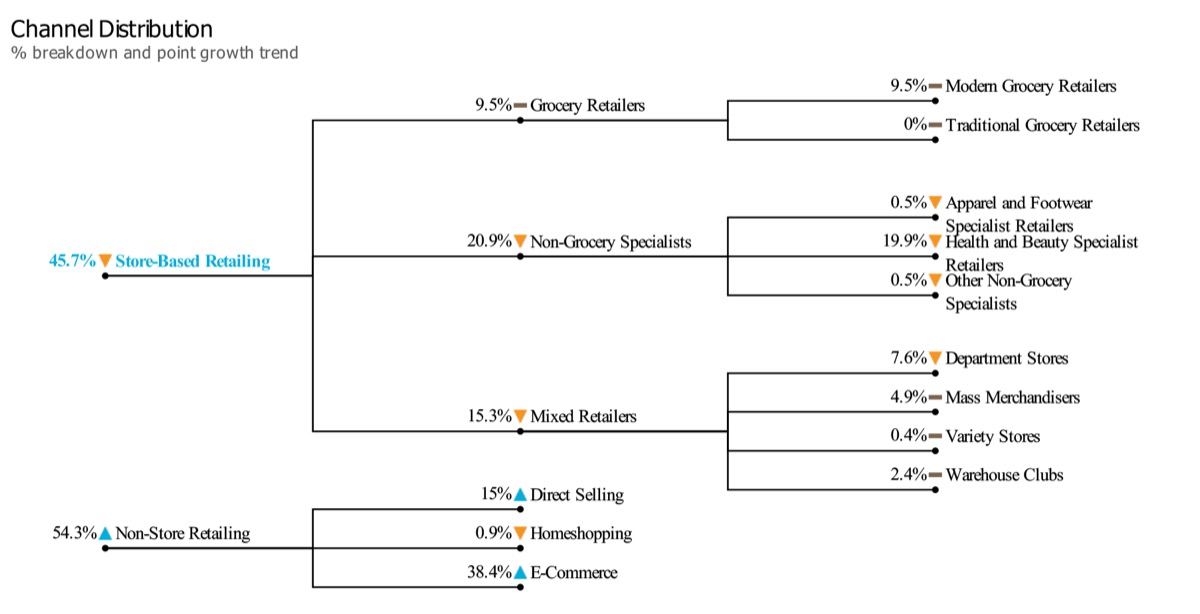

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for Vitamins and dietary supplement products in the USA in 2021. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- COVID-19 has brought significant changes to consumer health in the USA, as consumer priorities and routines have shifted more towards preventive health and wellness. In line with the trend, demand for dietary supplements, particularly those orientated towards immunity, has been enjoying significant demand. The age-old preventive health measure of dietary supplements usage has emerged as a priority for consumers to put themselves in a position to fight the COVID-19 virus better.

- Consumers have, therefore, increasingly been demanding vitamins and dietary supplements orientated towards immunity to improve their body’s defence against infection at previously unseen levels. The biggest winner of this surge in preventive healthcare purchasing in vitamins and dietary supplements has been Vitamin C. Like Vitamin C, multivitamins have also experienced strong growth in 2020 due to the pandemic and positive developments in the self-care phenomenon.

Prospects and growth opportunity

- With COVID-19 introducing many new consumers to the vitamins space and increasing recurring purchases, optimism exists for a sustained level of strong demand for vitamins following in 2021 and beyond. The heightened awareness of immunity and protecting oneself against infection will bode well for vitamin C and vitamin D in the coming years.

- Also, the greater demand for dietary supplements in the country has spurred innovation in the formats of these products. Moving beyond pills, brands are looking to alternative formats for consumers to engage with, such as gummies, shots, powders and functional foods.

General health & wellness trends

- Vitamins and dietary supplements across its different categories, particularly immunity and general health-orientated varieties, saw newfound demand in 2020 as consumers looked to bolster their health during the public health crisis.

- In 2021 and over the coming years, due to historically strong demand in 2020, habit persistence of vitamins and dietary supplements consumption should benefit category’s demand. This is largely in line with the fact that many new consumers have recently experimented with these products, and immune defence will remain a key concern over the coming years.

Skin Care

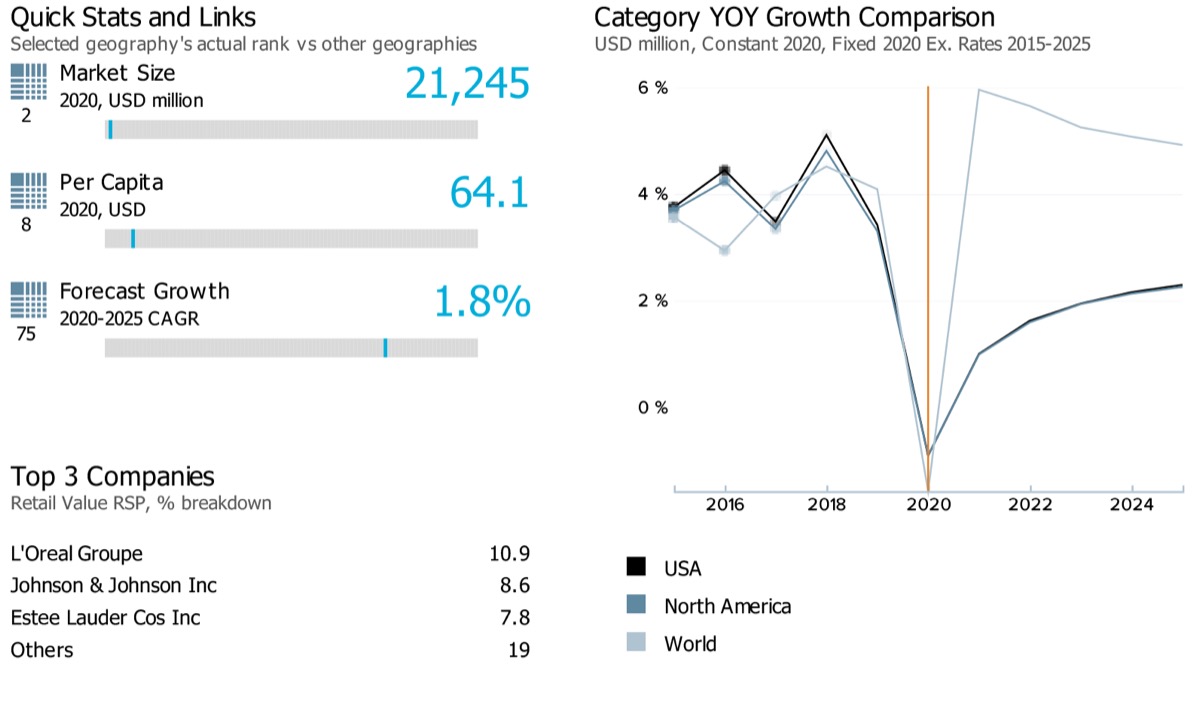

- Market size and growth

-

Note: Data on the top left corner of the image (2,8 and 75) showcases respective ranks for the USA for its market sizes, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Retail value sales of skin care products in the USA witnessed almost similar Compound Annual Growth Rate (CAGR) during 2015-2020 (4.8%) against the category’s performance at a global level (4.7%) during the same period. However, over the forecast period (2020-2025), the skin care category is estimated to witness an increased CAGR of 5.3% at the global level, while in the USA, the category’s CAGR for the same period is estimated to come down to 1.8%.

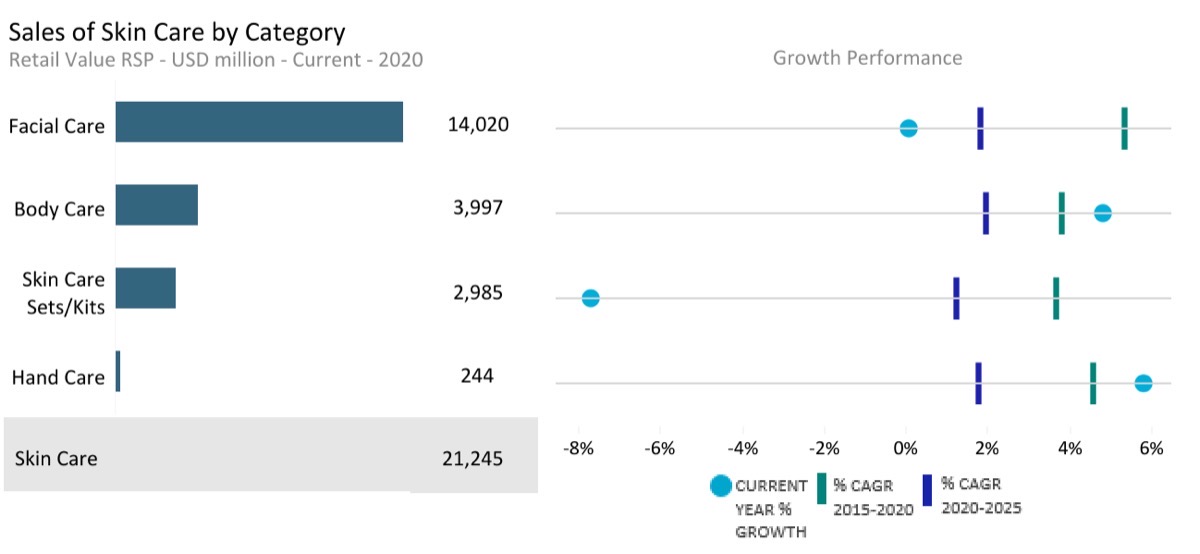

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to period 2019-20

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Skin Care

USD million

2,1245.01

1.78

Body Care

USD million

3,996.84

1.98

Facial Care

USD million

14,019.69

1.83

Hand Care

USD million

243.62

1.76

Skin Care Sets/Kits

USD million

2,984.85

1.24

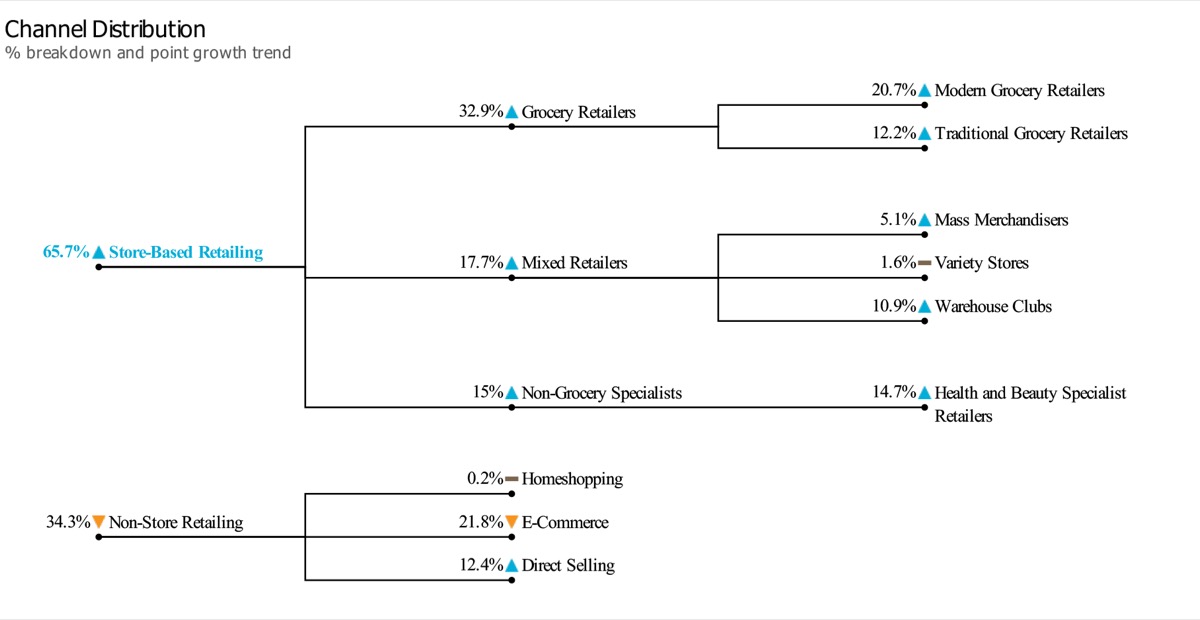

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for skin care products in the USA in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year

- Market Insights

-

Market trends

- Skin care proved its resilient during the COVID-19 pandemic, largely due to its association with self-care and wellness and its delivery of solutions for “maskne” and dry skin from frequent hand washing.

- Botanicals continued to trend upward in the USA skin care and were made even more popular due to their close association to “naturals” and having antibacterial, anti-inflammation, anti-dulling, anti-ageing or immunity-boosting properties. Propolis, aloe vera, elderberry, black seed, spirulina, mango, saffron, ginseng, pumpkin and adaptogens such as ashwagandha and mushrooms, to name a few, remained in demand.

- Skin care’s other advantage was its association with feeling pampered, renewed, relaxed and relieved of stress - affecting how consumers “feel” and, more broadly, positively impacting mental and emotional health. So, while colour cosmetics routines decreased, skin care routines were more likely ramped up.

Prospects and growth opportunity

- American consumers will likely continue to look for skin care products that lower stress and anxiety and heighten sensory experiences, such as face masks, body scrubs, format-changing cleansers, sleeping masks (made popular from South Korea) and other bath and shower products (e.g. bath additives, etc.).

- While the pandemic brought on more dedication to self-care and a renewed focus on skin care due to less makeup-wearing, skin care players should capitalise on several trends that will likely become a part of habit persistence. Formulas that emphasise improvements in complexion (hyperpigmentation, dark eye circles, dullness from photo-ageing, rosacea, etc.). and contain hero ingredients (ingredients that are supposed to provide benefit to the skin i.e. antioxidants, bioactive agents etc.) are expected to remain the key growth areas since the consumers are predicted to wear less facial make-up, favouring a bare-faced look, over the coming years.

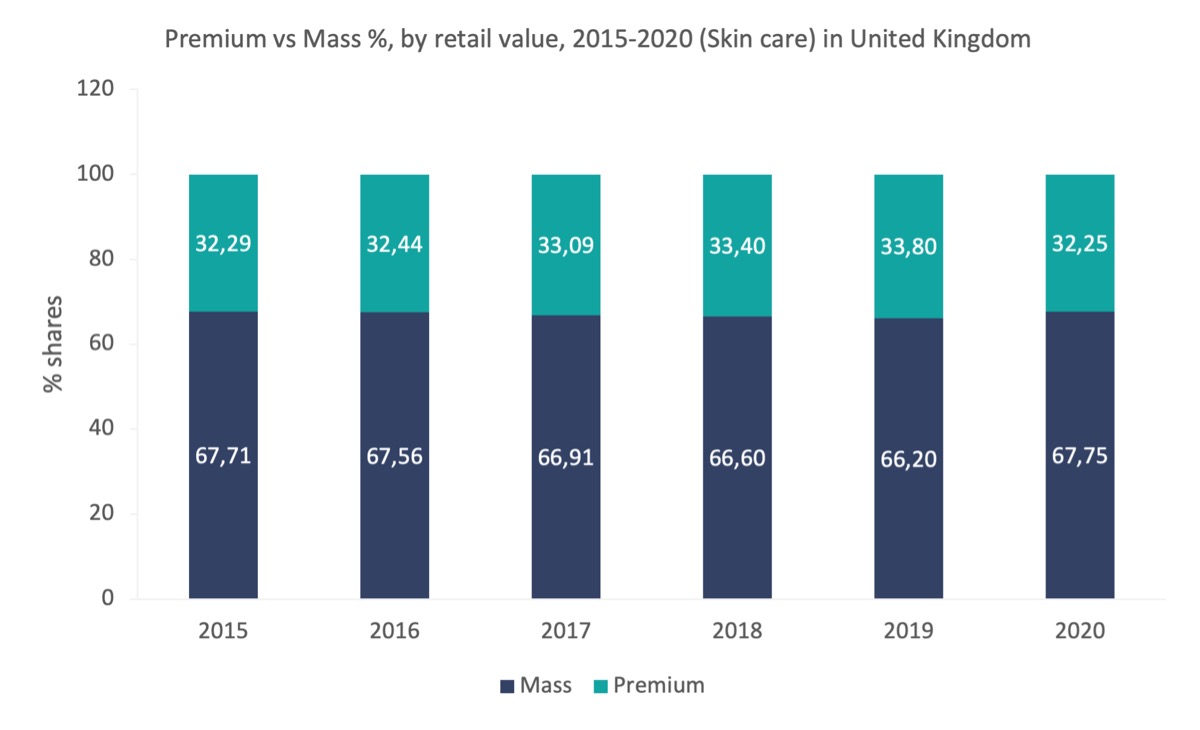

- The USA mass skin care segment is currently witnessing a significant demand, in contrast to the 2015-2020 period, where innovation and growth came from the premium skin care segment. 2021 will likely witness renewed attention in mass and masstige skin care since USA consumers were already trading down from premium skin care and settling in masstige tiers. Ingredients typically seen in premium skin care, such as niacinamide and hyaluronic acid, have a greater presence in mass brands.

General health & wellness trends

- Self-pampering routines will still be on-trend in 2021, as consumers are beleaguered from lockdowns and economic fallout during a year-long pandemic. More focus is expected in kits, such as Pacifica’s Calming Coconut Kit for stress therapy.

- Clean beauty is likely to become a mainstay post-pandemic and certainly over the forecast period to 2025, given regulatory changes from California’s Toxic-Free Cosmetics Act (introduced on September 30, The Toxic-Free Cosmetics Act, also known as Assembly Bill 2762, makes California the first to establish a state-level ban of 24 ingredients from beauty and personal-care products) that marks the USA’s first state-level ban on beauty and personal care ingredients.

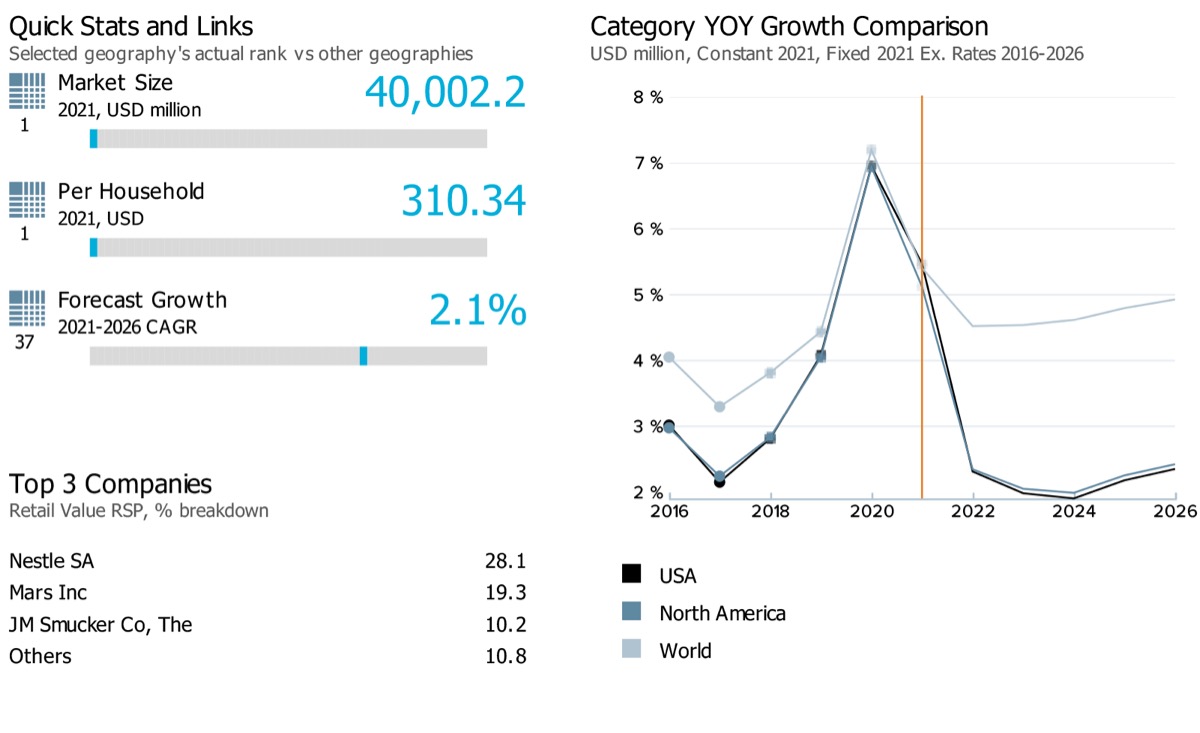

Dog & Cat Food

- Market size and growth

-

Note: Data on the top left corner of the image (1,1 and 37) showcases respective ranks for the USA for its market sizes, per capita, and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

Note: Latest market size data for the year 2021 has been shared for Dog and Cat food

Performance of retail value sales of dog and cat food in the USA is estimated to slow down from a historic Compound Annual Growth Rate (CAGR) of 6.3% during 2016-2021 to an estimated forecast CAGR of 2.1% over 2021-2026. The category’s performance in the country has been slightly slower than its global performance. Globally, the category witnessed a historic CAGR of 6.9% and an estimated forecast CAGR of 4.7% during the same period.

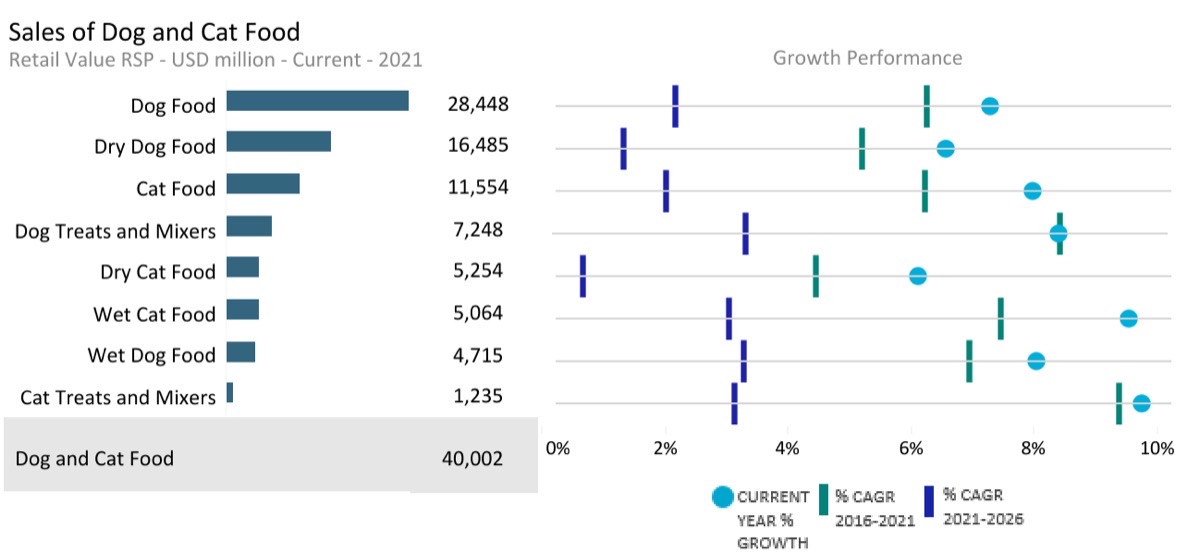

- Sub-category breakdown

-

Note: Current year growth in the above chart refers to period 2020-21

Category

Unit

Market size (2021)

Retail value RSP

Forecast compound annual growth rate (2021/2026) %

Dog and Cat Food

USD million

40,002.24

2.14

Dog Food

USD million

28,448.48

2.19

Dog Treats and Mixers

USD million

7,247.99

3.33

Dry Dog Food

USD million

16,485.00

1.34

Wet Dog Food

USD million

4,715.49

3.28

Cat Food

USD million

11,553.76

2.02

Wet Cat Food

USD million

5,064.37

3.06

Dry Cat Food

USD million

5,254.41

0.69

Cat treats and mixers

USD million

1,234.98

3.13

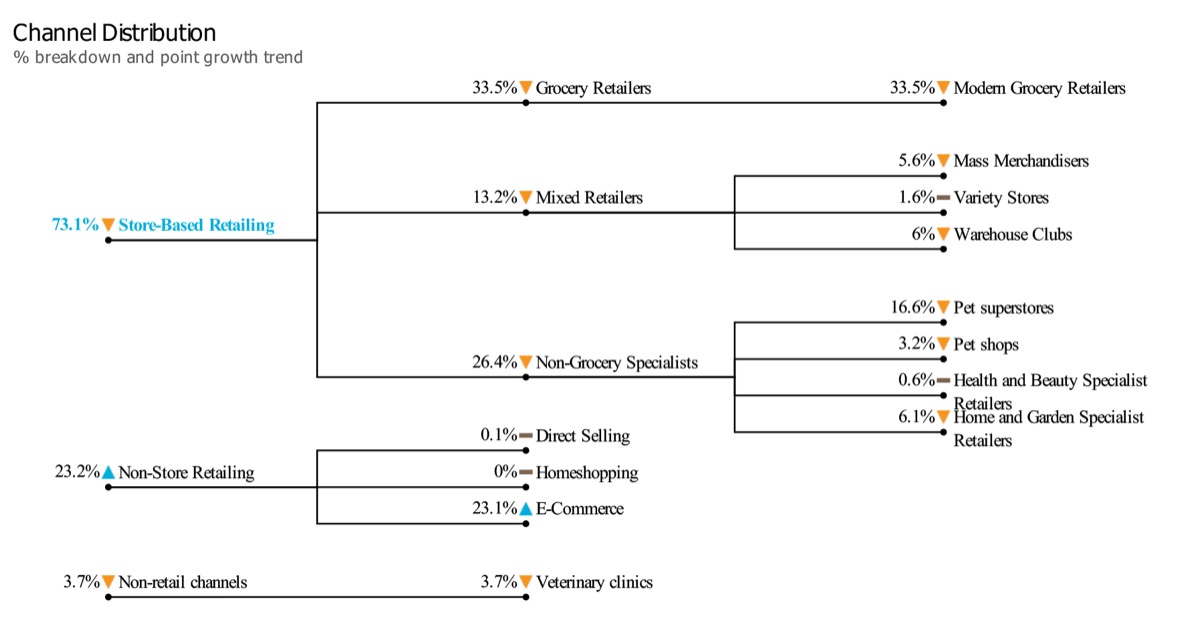

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for dog and cat food products in the USA in 2021. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year.

- Market Insights

-

Market trends

- The dog and cat food category is expected to continue performing well in both retail volume and current value terms in 2021, continuing the trend from an already good year in 2020, mainly due to the rising pet population. As people spent more time at home due to COVID-19, pet adoption is expected to be on the rise in 2020 and 2021 as well. Many people adopted a cat in search of companionship, as home seclusion amongst many contributed to loneliness. Spending more time at home also meant new cat owners could take the time to help their pet settle into their new home, and adoption was, therefore, an easier process.

- Premiumisation has also continued, largely because dog and cat owners have not been willing to trade down to cheaper food options for their pets. They often view their pets as valued family members and would try reducing other costs before switching to lower-quality food for their pets. For many, the cost of pet food is not a flexible “luxury” cost, but instead, it is an essential concrete component of their monthly budget.

Prospects and growth opportunity

- Growth for e-commerce (and decline for pet specialty retail stores) is expected to continue even through 2021, although at a slightly slower rate as increased number of consumers get vaccinated and thereby feel more comfortable visiting retail outlets once again. However, the share of e-commerce is not predicted to fall despite two years of exceptional growth, as the convenience of this distribution channel is likely to make it a permanent choice for many consumers, especially if they have had previous good experiences shopping via this channel. Consumers are expected to value the wide choice of products available online, which is better than that available in any single store-based retailer and also price efficient. Click-and-collect and subscription models are also growing in popularity. Leading e-commerce retailers Amazon and Chewy have established a strong foothold, offering a wide range of cat food, often at more affordable prices than in store-based retailers.

- One of the other major trends over the forecast period is expected to be sustainability. Despite the focus on COVID-19 in 2020 and 2021, sustainable products and packaging are expected to remain a key concern for consumers for both cat and dog food. Owners are likely to pay greater attention to where ingredients come from and whether they are sustainably sourced. This is also a great way for brands to differentiate from the masses and appeal to consumers looking to reduce their carbon footprint. One of the emerging sustainable ingredients is insect protein, for example, Jiminys dog food.

General health & wellness trends

- Pet healthcare has showcased continued growth potential as pet owners care greatly about the health and wellbeing of their pets. This is manifested in the foods and pet dietary supplements they purchased, following the trends in the human sphere. Pet dietary supplements are therefore expected to continue growing as consumers sustain strong demand to maintain their pets’ health.

- Pet dietary supplements containing different ingredients, such as probiotics and turmeric, and also those geared towards various functions, from joint health to itch relief, or may just be simple multivitamins are being increasingly sought after by consumers in the country.

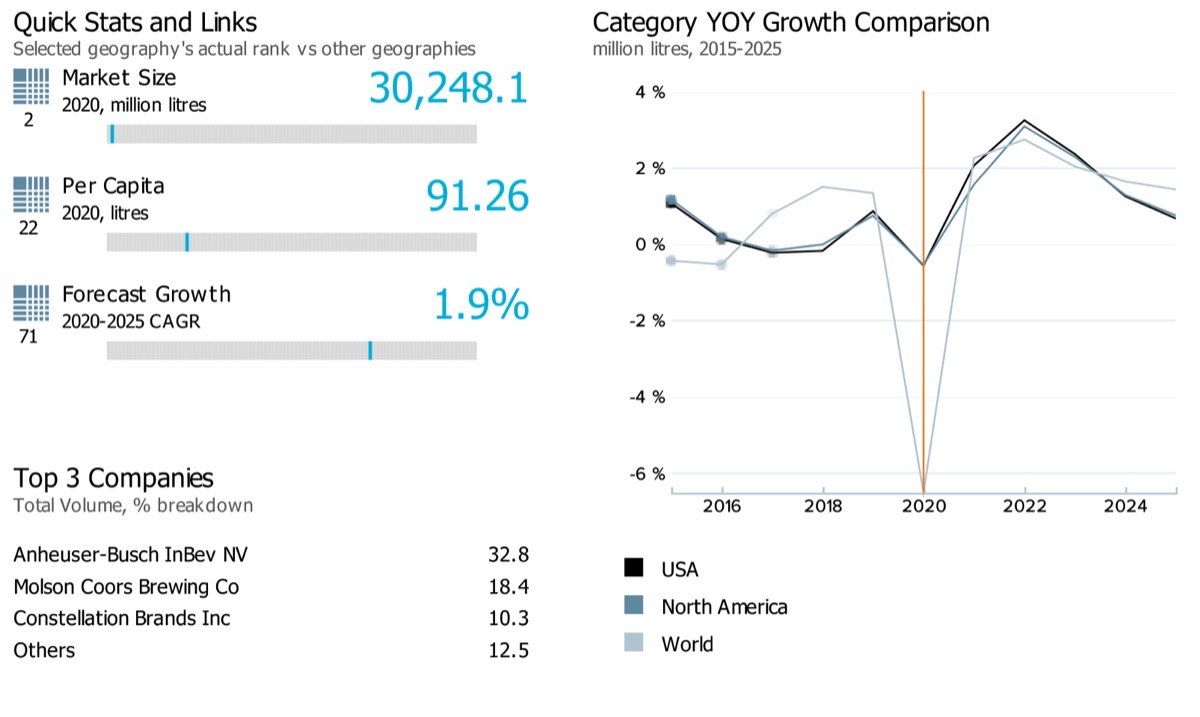

Alcoholic Drinks

- Market size and growth

-

Note: Market size data for the alcoholic drinks category in the country reflects the total volume in a million litres. Data on the top left corner of the image (2,22 and 71) showcases respective ranks for the USA for its market sizes, per capita, and forecast growth rate compared against 99 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

The compound annual growth rate for alcoholic drinks in the USA, both in terms of total value and volume, is expected to gain momentum over the forecast period (2020-2025: FCAGR for total value: 5.6% and for total volume: 1.9% ) against its performance in the historic period (2015-2020: HCAGR for total value: -0.4% and for total volume: -0.01% ). This is largely in line with the category’s performance at the global level, where both in terms of total value and volume, alcoholic drinks are expected to gain momentum over the forecast period (2020-2025: FCAGR for total value: 4.6% and for total volume: 2.0% ) against its performance in the historic period (2015-2020: HCAGR for total value: 0.9% and for total volume: -0.7%)

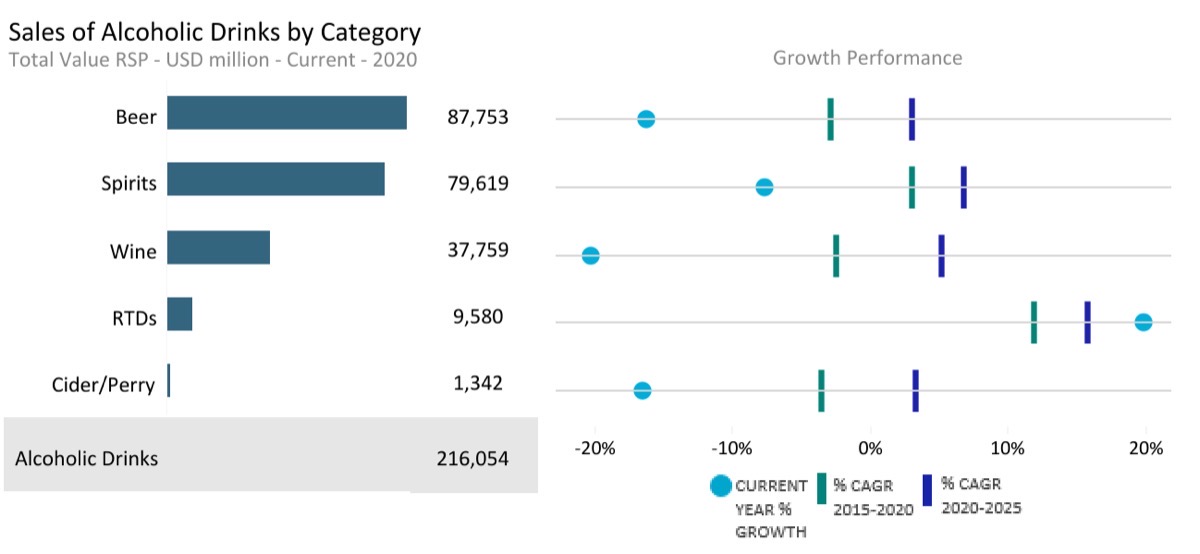

- Sub-category breakdown

-

Current year growth in the above chart refers to the period 2019-20

Category

Data type

Market size (2020)

USD million

Forecast compound annual growth rate (2020/2025) %

Alcoholic Drinks

Total Value RSP

2,16,053.83

5.58

Alcoholic Drinks

Off-trade Value RSP

1,35,713.96

1.13

Alcoholic Drinks

On-trade Value RSP

80,339.87

11.73

Beer

Total Value RSP

87,752.86

3.13

Beer

Off-trade Value RSP

54,407.06

-2.25

Beer

On-trade Value RSP

33,345.80

10.05

Cider/Perry

Total Value RSP

1,342.12

3.29

Cider/Perry

Off-trade Value RSP

814.85

-1.81

Cider/Perry

On-trade Value RSP

527.27

9.60

RTDs

Total Value RSP

9,580.33

15.89

RTDs

Off-trade Value RSP

7,608.47

16.72

RTDs

On-trade Value RSP

1,971.86

12.44

Spirits

Total Value RSP

79,619.36

6.84

Spirits

Off-trade Value RSP

45,772.28

1.74

Spirits

On-trade Value RSP

33,847.08

12.47

Wine

Total Value RSP

37,759.16

5.18

Wine

Off-trade Value RSP

27,111.30

0.54

Wine

On-trade Value RSP

10,647.86

14.27

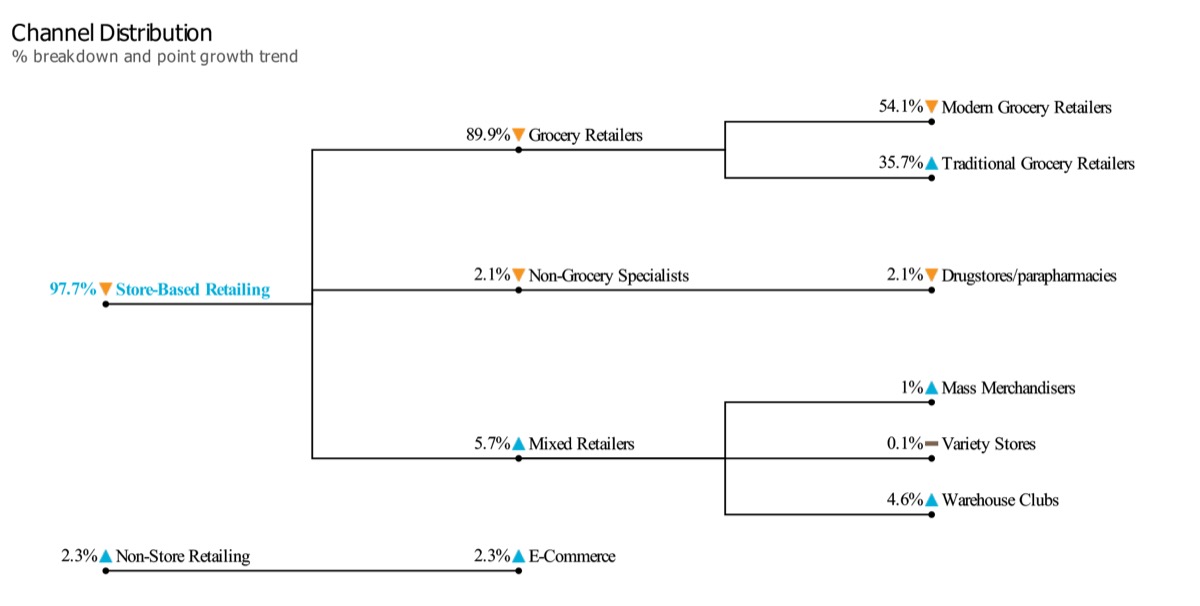

- Channel distribution

-

Note: The chart here showcases the off-trade volume share of different channel sales for alcoholic drink products in the USA in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year

- Market Insights

-

Market trends

- COVID-19 has had a profound impact on the USA alcoholic drinks industry, shaping how much Americans spend on alcohol and where they consume it and which products they choose. During the early stages of the pandemic, many Americans stockpiled alcohol for at-home consumption, fearing supply shortages. This led to growth in off-trade sales across categories, with familiar leading brands seeing the most improvement. Despite increased at-home consumption, however, overall sales for alcohol drinks were down in 2020, with the on-trade decline too steep to be offset by the off-trade growth.

- Beer and spirits continued to remain the most sought-after categories under alcoholic drinks by Americans. Domestic light beers such as Bud Light, Miller Lite and Coors Light accounted for the biggest shares of beer sales in the USA. The large size of the domestic light beers category also meant that it had witnessed stagnant growth due to maturity, especially with the competition from RTDs and imported beers.

- Within spirits, at-home consumption became the focal point for the category’s growth as on-trade sales plummeted. Risk-averse consumers flocked towards bigger and familiar brands when stocking up for lockdowns. This dealt an additional blow to craft spirits which remained already devastated by the restrictions on the on-trade channel and tourism industry. Despite the struggles of craft products, premiumisation did not end by any means.

Prospects and growth opportunity

- Americans are increasingly demanding non-alcoholic beer, which is largely in line with the growing health awareness amongst consumers. Small craft brewers, such as Athletic Brewing and WellBeing Brewing, are advertising their drinks as a responsible and health-conscious alternative to alcoholic drinks, aimed at younger consumers – as part of the “mindful drinking” trend. Both are using regular craft beer trends such as IPAs (India Pale Ales) to make non-alcoholic beer more palatable and interesting and updated brewing methods to provide higher quality. Non-alcoholic beer is expected to continue witnessing increased demand over the forecast period as well.

- In spirits, agave-based products remained the most sought-after by Americans. Tequila, which made up most of the sales of agave spirits, more than doubled its already-impressive pre-pandemic growth rates.

General industry trends

- The USA alcoholic drinks industry has seen widespread innovation driven by consumer desire for new flavours, the rising importance of health and wellness, and a premium craft positioning. One of the most dynamic categories was RTDs, with hard seltzers absorbing an increasing share within the market.

- A similar trend was also seen within non-alcoholic beer. This category also witnessed high growth rates, attracting consumer interest as a health-focused alternative without compromising the flavour.

- Mindful drinking trends remained less important in 2020, but as consumer interest in health and wellness reawakens over the forecast period to 2025, it should come back stronger as many consumers who drank higher-than-usual levels during the pandemic would reassess their relationship with alcohol.

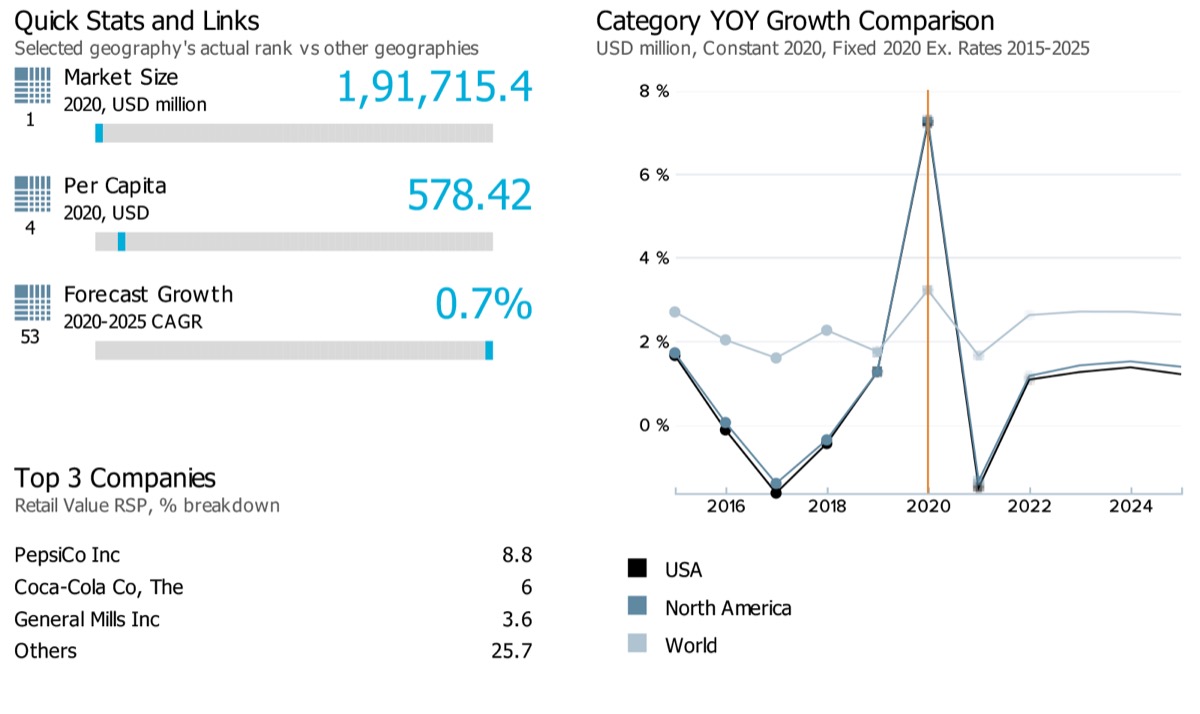

Health & Wellness Packaged Food & Beverages

- Market size and growth

-

Note: Data on the top left corner of the image (1,4 and 53) showcases respective ranks for the USA for its market sizes, per capita, and forecast growth rate compared against 53 countries globally. The blue line on the grey bar represents the relative position of the country as per their rank.

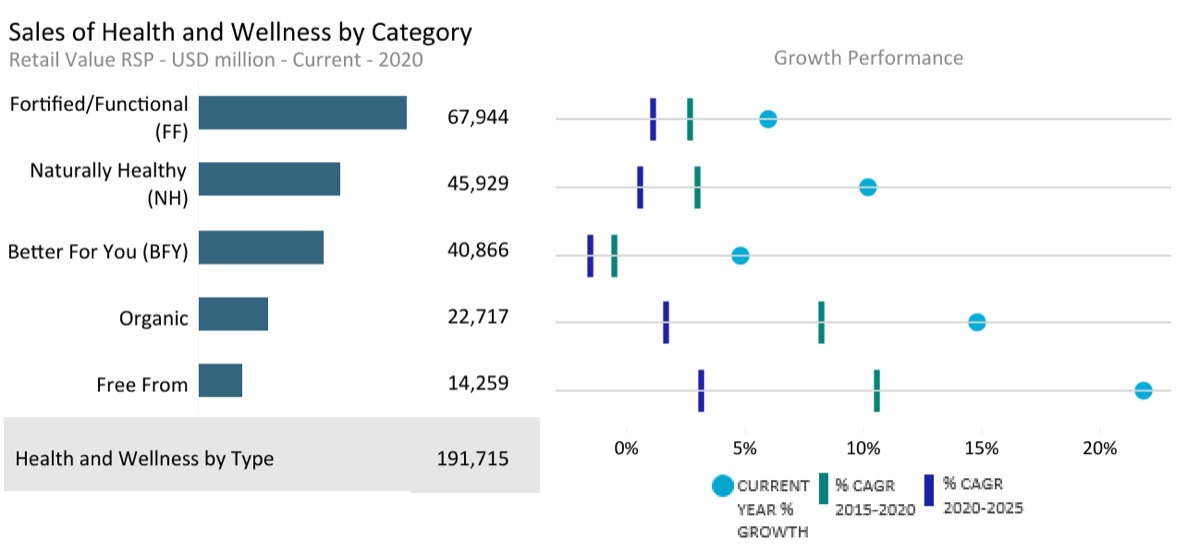

The retail value sales of health and wellness food and beverage products in the USA is expected to slow down when comparing the compound annual growth rates from historic to forecast periods, i.e. (3.0% during 2015-2020 to 0.7% during 2020-2025). This was also the case with the category’s performance at the global level, where its compound annual growth rate for retail value sales is estimated to slow down from 4.6% during 2015-2020 to 2.4% during 2020-2025.

- Sub-category breakdown

-

Current year growth in the above chart refers to the period 2019-20

Category

Unit

Market size (2020)

Retail value RSP

Forecast compound annual growth rate (2020/2025) %

Health and Wellness by Type

USD million

1,91,715.35

0.66

Better For You (BFY)

USD million

40,865.99

-1.55

Fortified/Functional (FF)

USD million

67,944.46

1.14

Free From

USD million

14,258.93

3.13

Naturally Healthy (NH)

USD million

45,928.99

0.53

Organic

USD million

22,716.97

1.65

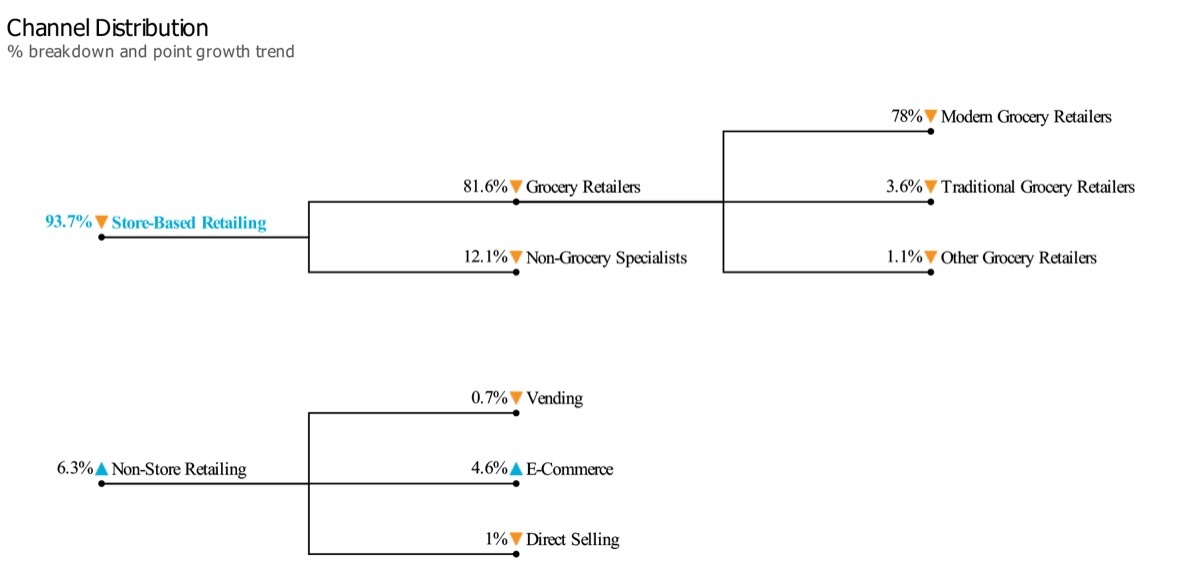

- Channel distribution

-

Note: The chart here showcases the retail value share of different channel sales for health and wellness by type products in the USA in 2020. The triangle/dash represents whether the specific channel share has increased/decreased or remained the same against its share in the previous year

- Market Insights

-

Market trends

- The COVID-19 pandemic, as a health crisis, has reinforced consumer consciousness around healthier choices. Most segments within health and wellness continued to do well. Fortified/functional beverages remained an important growth driver across the non-alcoholic drinks space. Naturally healthy beverages witnessed the biggest boost amidst the pandemic, mainly due to renewed interest in juices due to their immunity-boosting benefits. Free-from packaged food also witnessed strong growth in 2020, most notably from meat and dairy alternatives.

- Product categories, i.e. functional teas, probiotics and other naturally healthy food and beverages, witnessed increased demand from consumers in line with their increased interest in immunity-boosting foods. Consumers were found to think more about the nutrient content of the foods they consumed, which further boosted sales for fortified/functional packaged food categories.

- Naturally Healthy 100% juice witnessed a drastic turnaround in its performance in 2020. Until 2020, consumers’ enthusiasm for these products was tempered by the high sugar content of many naturally healthy juices. However, the COVID-19 pandemic put these concerns on the back burner, favouring the naturally occurring vitamins and nutrients within these beverages, which were perceived to boost the immune system.

Prospects and growth opportunity

- Of the larger categories, fortified/functional beverages are set to experience the highest growth over the forecast period due to enduring consumer interest in added benefits and different energy solutions. Fortified/functional beverages are also expected to witness the largest boost from hot drinks as the tea market continues to shift away from black tea and towards health-focused teas with specific benefits.

- Free from packaged food is also expected to witness strong growth over the forecast period as consumers continue to gain interest in plant-based meat and dairy alternatives. Innovations in this space are expected to keep this category on a high-performing trajectory.

General health & wellness trends

- Health and wellness trends are expected to expand further in the post-pandemic world, as consumers will increasingly take their health into their own hands and look for food and drinks that complement their adjusted lifestyles. Immunity is likely to be a continuing concern for consumers, and in line with it, there is expected to be increased demand for immunity-boosting foods. As manufacturers think about innovation over the coming years, they must consider the products that will resonate most with consumers’ demand.

- Apart from the strengthening health trends that continue to work their way into consumers routines, indulgence is also expected to play an important role in their diet. Fortified/Functional sweet biscuits combine indulgence with health. Many consumers want to increase their protein intake for a more balanced diet. Fortified/Functional sweet biscuits often contain additional protein, making them a more favourable alternative compared with their conventional competitors. Consumers still want to indulge, but they want to limit the guilt they feel while doing so.

Retail Landscape

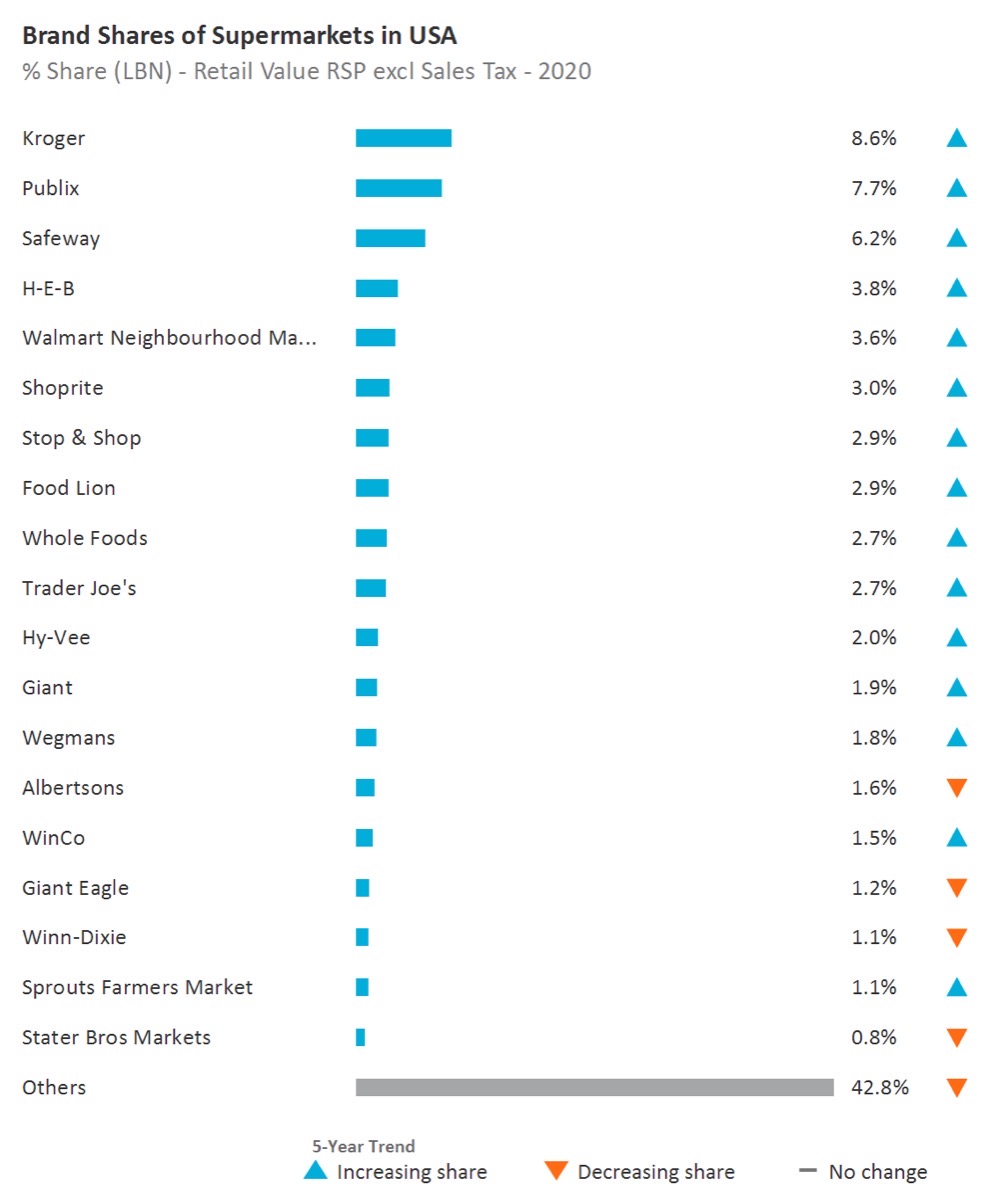

- Brand shares of supermarkets

-

Note: The 5th supermarket in the above chart is – Walmart Neighbourhood market

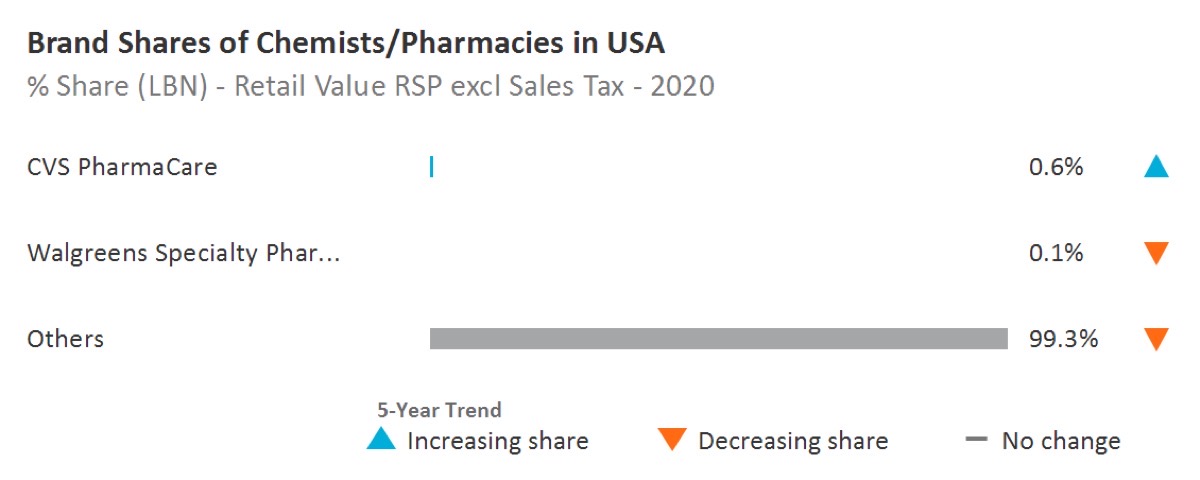

- Brand shares of chemists/pharmacies

-

Note: The 2nd chemist/pharmacies in the above chart is – Walgreens Speciality Pharmacy

- Retail insights

-

- The USA retailing industry has seen significant shifts in recent years as the rapid advance of e-commerce has changed the way consumers shop for products of all kinds. Millions of people that had previously sought to minimise the time they spent in public spaces due to their concerns about coronavirus infection and transmission will take up in-store shopping again with relish, finding pleasure in the simple act of picking out items for themselves from a store’s shelves. As a result, store-based retailing sales in the USA are expected to post healthy growth in 2021 and 2022.

- Several external factors surrounding lockdown measures during the pandemic also contributed to the growth of supermarkets in 2020. Social distancing regulations implemented in customer-facing businesses caused most restaurants to close for all except takeout and delivery services. Although this brought the consumer foodservice industry to its knees, supermarkets were the natural beneficiary of a populace that could no longer dine out. Similarly, with offices in urban centres closed and employees largely working from home, spending dramatically shifted towards grocery - and, by extension, supermarkets. As such, for the vast majority of 2020, workers across the country saw their grocery bills rise as they prepared and ate most meals at home.

- Perhaps the most significant long-term change in the USA consumer behaviour will be the permanently heightened importance of e-commerce. Many of them were motivated to shift most of their retail spending to digital channels during the pandemic, with some individuals shopping online for the very first time. As a result, millions of people in the country are now much more comfortable utilising the internet for their shopping needs than before 2020.

- Chemists/pharmacies held a value (Retail value RSP excluding sales tax) market size of USD 42,258.0 million for the year 2020 in the country. For the year 2020-2021, the channel witnessed a year on year growth rate of 2.7% which was almost close to its value compound annual growth rate over the historic period (2015-2020) of 2.6%. Also, over the forecast period (2020-2025), the retail value compound annual growth rate of the channel is expected to remain mostly steady at 2.7%.

- Definitions

- Acronyms Used & Key Notes

Definitions

|

Industry |

Category |

Definition |

|---|---|---|

|

Alcoholic Drinks |

Alcoholic Drinks |

Alcoholic drinks are the aggregation of beer, wine, spirits, cider/perry and RTDs. |

|

Alcoholic Drinks |

Beer |

An alcoholic drink usually brewed from malt, sugar, hops and water and fermented with yeast. Some beers are made by fermenting a cereal, especially barley, and therefore not flavoured by hops. Alcohol content for beer is varied – anything up to and over 14% ABV (alcohol by volume), although 3.5% to 5% is most common. Beer is the aggregation of lager, dark beer, stout and non/low alcohol beer. |

|

Alcoholic Drinks |

Cider/Perry |

Cider is made from fermented apple juice while perry is made from fermented pear juice. Both artisanal and industrial cider/perry are included. |

|

Alcoholic Drinks |

RTDs |

RTD stands for ‘ready-to-drink’. Other terms which may be used for these products are FABs, alcopops and premixes. The RTDs sector is the aggregation of malt-, wine-, spirit- and other types of premixed drinks. These drinks usually have an alcohol content of around 5% but this can reach as high as 10% ABV. Premixes containing a high percentage of alcohol of around 15%+ combined with juice or any other soft drink are included here. RTDs are usually marketed as products to be drunk neat, with ice, or as a cocktail ingredient. Fruit-flavoured, vodka-based spirits with an alcohol content of between 16-21% are classified here. Examples: Alizé, Ursus Roter, Berentzen Fruchtige, Kleiner Feigling. |

|

Alcoholic Drinks |

Spirits |

This is the aggregation of whisk(e)y, brandy and Cognac, white spirits, rum, tequila, liqueurs and other spirits. |

|

Alcoholic Drinks |

Wine |

This is the aggregation of still and sparkling light grape wines, fortified wine and vermouth and non-grape wine. In terms of alcohol content, light wine usually falls into the 8-14% ABV bracket while fortified wine ranges from 14-23% ABV. Low and non-alcoholic wine is also included in the data (attributed to each sector as appropriate). |

|

Beauty and Personal Care |

Skin Care |

This is the aggregation of facial care, body care, hand care and skin care sets/kits. |

|

Beauty and Personal Care |

Body Care |

This is the aggregation of firming/anti-cellulite products and general-purpose body care. |

|

Beauty and Personal Care |

Facial Care |

This is the aggregation of acne treatments, moisturisers and treatments, facial cleansers, toners, face masks, and lip care. Please note that Moisturisers and Treatments is the aggregation of basic moisturisers and anti-agers. |

|

Beauty and Personal Care |

Hand Care |

Includes all hand moisturisers, both premium and mass market, as well as combination hand and nail products. Includes protective emollients and deep moisturisers formulated to sooth and hydrate very dry or irritated skin, as well as those that prevent, or that are suitable for, eczema-prone or redness-prone skin. Excludes medicated emollients and/or those positioned as treatment for eczema or psoriasis. |

|

Beauty and Personal Care |

Skin Care Sets/Kits |

Multiple skin care items of the same brand line packaged together in a set and priced at an advantageous price compared to purchasing the items separately. Includes traditional gift sets, multi-step skin care regimens, skin care starter kits (including acne treatment regimen sets/kits) and skin care travel kits (sold through retail outlets). Also includes sets, which comprise of products from multiple categories (e.g. makeup and skin care), as long as the primary product is skin care. Men’s, women’s and unisex versions are included. Excludes: GWP (Gift with Purchase) – consumer does not pay for this (e.g. free product when you purchase a set or a free sample kit). |

|

Consumer Health |

Dietary Supplements |

It is the aggregation of all dietary supplements: Minerals, fish oils/omega fatty acids, garlic, ginseng, ginkgo biloba, evening primrose oil, Echinacea, St John's Wort, protein supplements, probiotic supplements, eye health supplements, co-enzyme Q10, glucosamine, combination herbal/traditional supplements, non-herbal/traditional supplements, and all other dietary supplements specific to country coverage. |

|

Consumer Health |

Paediatric Vitamins and Dietary Supplements |

All vitamin and dietary supplement products formulated, designed, marketed and labelled specifically for children. |

|

Consumer Health |

Tonics |

Include versions of combination dietary supplements that are sold in the format of liquid concentrates, mini-drinks, shots or oral gels. Include concentrated energy shot boosters and tonics such as 5-Hour Energy and Lipovitan. Exclude remedies made with active pharmaceutical ingredients as well as super fruit juice concentrates and weight-loss beverages, tracked under the Health and Wellness (HW) system. |

|

Consumer Health |

Vitamins |

This is the aggregation of multivitamins and single vitamins. |

|

Health and Wellness |

Health and Wellness by Type |

Health and Wellness by Type is the aggregation of all health and wellness food and beverages broken down by organic, fortified/functional, naturally healthy, better for you and free from products. |

|

Health and Wellness |

Better For You (BFY) |

Products where the amount of a substance considered to be less healthy (eg fat, sugar, salt, carbohydrates) has been actively reduced during production. To qualify for inclusion in this category, the “less healthy” element of the foodstuff needs to have been actively removed or substituted during the processing. This should also form a key part of the positioning/marketing of the product. Products which are naturally fat/sugar/carbohydrate -free are not included as nothing out of the ordinary has been done during their production to make them “better for you”. “No added sugar” claims are excluded too. Products most likely to be included here will be those which are low-fat/low-sugar versions of standard products (i.e. reduced fat mayonnaise, reduced fat cheese, reduced fat milk, reduced sugar confectionery, etc). |

|

Health and Wellness |

Fortified/Functional (FF) |

This category includes fortified/functional food and beverages. When identifying fortified/functional products, we focus on products to which health ingredients or/and nutrients have been added as well as brands that are positioned to deliver a certain functionality. To be included here the enhancement must be highlighted in the label or hold a health claim/nutritional claim. Fortified/functional food and beverages provide health benefits beyond their nutritional value and/or the level of added ingredients wouldn’t normally be found in that product. To merit inclusion in this category, the defining criterion here is that the product must have been actively fortified/enhanced during production. As such, inherently healthy products such as 100% fruit/vegetable juices are only included under "fortified/functional" if additional health ingredients (e.g. calcium, omega 3) have been added. To be included, the health benefit needs to form part of positioning/marketing of the product. For product category definitions please refer to the definitions section (can be found under the "Help" section on Passport) for the respective system: Packaged Food, Hot Drinks, Soft Drinks. |

|

Health and Wellness |

Free From |

This category includes free from gluten, free from lactose, free from allergens, free from dairy and free from meat products. This excludes foods which are certified ‘free’ of a specific product when this is based on use of sterilised equipment. |

|

Health and Wellness |

Naturally Healthy (NH) |

This category includes food and beverages based on naturally containing a substance that improves health and wellbeing beyond the product’s pure calorific value. These products are usually a healthier alternative within a certain sector/subsector. High fibre food (wholegrain/wholemeal/brown), soy products, sour milk drinks, nuts, seeds and trail mixes, honey, fruit and nut bars and olive oil are considered NH foods and 100% fruit/vegetable juice, superfruit juice, natural mineral water, spring water, RTD green tea etc. are considered NH beverages. While many of these products are marketed on a health basis, this might not always be the case. Naturally healthy food and beverages that are additionally fortified fall into the 'fortified/functional' category. |

|

Health and Wellness |

Organic |

Certified organic products are those which have been produced, stored, processed, handled and marketed in accordance with precise technical specifications (standards) and certified as "organic" by a certification body such as the Soil Association in the UK, the European Union or the US Department of Agriculture. It is important to note that an organic label applies to the production process, ensuring that the product has been produced and processed in an ecologically sound manner. The organic label is therefore a production process claim as opposed to a product quality claim. Note: For organic products to be included, the organic aspect needs to form a significant part of the overall positioning/marketing of the product, including the organic certification label in the packaging. |

|

Pet Care |

Dog and Cat Food |

This is the aggregation of dog and cat food. |

|

Pet Care |

Cat Food |

This is the aggregation of wet and dry cat food. |

|

Pet Care |

Cat Treats and Mixers |

This is the aggregation of mixers and treats for cats. |

|

Pet Care |

Dry Cat Food |

These products have a moisture content of 10-14% and are generally packed into paper, plastic or cardboard. Dry cat food is typically made from a combination of grain-based ingredients (corn and rice) and a meat component. It is typically produced by extrusion cooking under high heat and pressure and then sprayed with fat to increase palatability. Other ingredients may also be added to complete its composition. This is the aggregation of premium, mid-priced and economy dry cat food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal), have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Cat Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet cat food. |

|

Pet Care |

Dog Food |

This is the aggregation of wet and dry dog food. |

|

Pet Care |

Dog Treats and Mixers |

This is the aggregation of mixers and treats for dogs. |

|

Pet Care |

Dry Dog Food |

These products generally have a moisture content of 6-14% and are generally packed into paper, plastic or cardboard. Complete dry dog foods fall into two broad categories: Flaked (or 'Muesli' type blended products) and Extruded products (meat and cereals cooked by direct steaming). This is the aggregation of premium, mid-priced and economy dry dog food. Note: semi-moist food is included here. These products are extruded (combining meat and cereal) have a higher moisture content (20-40%) and are usually packaged in plastic or foil sachets. |

|

Pet Care |

Wet Dog Food |

These products have a moisture content of 60-85% and are generally (though not always) preserved by heat treatment. They are packaged in steel or aluminium cans, rigid or flexible plastic or semi-rigid aluminium trays. This is the aggregation of premium, mid-priced and economy wet dog food. |

|

Retail in Alcoholic Drinks |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Alcoholic Drinks |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Alcoholic Drinks |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Alcoholic Drinks |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Alcoholic Drinks |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (readymade sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Alcoholic Drinks |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Alcoholic Drinks |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Alcoholic Drinks |

Food/drink/tobacco specialists |

Retail outlets specialising in the sale of mainly one category of food, drinks store and tobacconists. Includes bakers (bread and flour confectionery), butchers (meat and meat products), fishmongers (fish and seafood), greengrocers (fruit and vegetables), drinks stores (alcoholic and non-alcoholic drinks), tobacconists (tobacco products and smokers’ accessories), cheesemongers, chocolatiers and other single food categories. Alcoholic drinks stores are retail outlets with a primary focus on selling beer/wine/spirits/other alcoholic beverages. Example brands include: Threshers, Gall & Gall, Liquorland, Watson’s Wine Cellar |

|

Retail in Alcoholic Drinks |

Independent Small Grocers |

Retail outlets selling a wide range of predominantly grocery products. These outlets are usually not chained and if chained will have fewer than 10 retail outlets. Mainly family owned, often referred to as Mom and Pop stores. |

|

Retail in Alcoholic Drinks |

Other Grocery Retailers |

Other retailers selling predominantly food, beverages and tobacco or a combination of these. Includes kiosks, markets selling predominantly groceries. Includes CTNs and health food stores, Food & drink souvenir stores and regional speciality stores. Direct home delivery, eg of milk, meat from farm/dairy is excluded. Sari-Sari stores in Philippines and Warung (Waroon) in Indonesia, that can either be markets or kiosks, are included in Other grocery retailers unless they occupy a separate permanent outlet building, in which case they are included in Independent small grocers. Outlets located within wet markets, particularly in South East Asia (often located in government-owned multi-story buildings) should be counted as separate outlets. Wine sales from Vineyards are included here. |

|

Retail in Alcoholic Drinks |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Alcoholic Drinks |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Alcoholic Drinks |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Alcoholic Drinks |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Alcoholic Drinks |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Alcoholic Drinks |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Alcoholic Drinks |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Alcoholic Drinks |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Alcoholic Drinks |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Alcoholic Drinks |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Alcoholic Drinks |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Alcoholic Drinks |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Beauty and Personal Care |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Beauty and Personal Care |

Modern Grocery Retailers |

Modern grocery retailing is the aggregation of those grocery channels that have emerged alongside the growth of chained retail: Hypermarkets, Supermarkets, Discounters, Forecourt Retailers and Convenience Stores. |

|

Retail in Beauty and Personal Care |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Beauty and Personal Care |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Beauty and Personal Care |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (ready-made sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Beauty and Personal Care |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Beauty and Personal Care |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Beauty and Personal Care |

Traditional Grocery Retailers |

Traditional grocery retailing is the aggregation of those channels that are invariably non-chained and are, therefore, owned by families and/or run on an individual basis. Traditional grocery retailing is the aggregation of three channels: Independent Small Grocers, Food/Drink/Tobacco Specialists and Other Grocery Retailers. |

|

Retail in Beauty and Personal Care |

Non-Grocery Specialists |

Retail outlets selling predominantly non-grocery consumer goods. Non-grocery retailers is the aggregation of: • Apparel and footwear specialist retailers • Electronics and appliance specialist retailers • Health & beauty specialist retailers • Home and garden specialist retailers • Leisure and personal goods specialist retailers • Other non-grocery retailers |

|

Retail in Beauty and Personal Care |

Apparel and Footwear Specialist Retailers |

Outlets specialising in the sale of all types of apparel, footwear and fashion accessories including costume jewellery, belts, handbags, hats, scarves or a combination of these (for example stores selling handbags only are included). This includes those stores that carry a combination of all products for either men or women or children and those that may specialise by either gender, age or product. Example brands include Gap, H&M, Zara, C&A, Miss Selfridge, Foot Locker, Uniglo, Next, Matalan. Brands that offer sports apparel and sports goods are excluded from Apparel and footwear specialist retailers and are included in Sports goods stores. |

|

Retail in Beauty and Personal Care |

Electronics and Appliance Specialist Retailers |

Retail outlets specialising in the sale of large or small domestic electrical appliances, consumer electronic equipment (including mobile phones), computers or a combination of these. For mobile phone retailers, this excludes revenues derived from telecoms service plans and top-up cards, etc. Example brands include Apple, Best Buy, Euronics, PC World, Darty, But, Media Markt, Yamada Denki, Gome (China). |

|

Retail in Beauty and Personal Care |

Health and Beauty Specialist Retailers |

This is the aggregation of chemists/pharmacies, drugstores/parapharmacies, beauty specialist retailers, optical goods stores and other healthcare specialist retailers. |

|

Retail in Beauty and Personal Care |

Beauty Specialist Retailers |

Beauty specialist retailers are chained or independent retail outlets with a primary focus on selling fragrances, other cosmetics and toiletries, beauty accessories or a combination of these. Examples of Beauty specialist retailer brands include: Body Shop, Marionnaud, Sephora and Bath and Body Works. |

|

Retail in Beauty and Personal Care |

Chemists/Pharmacies |

Retail outlets selling prescription-bound medicines under the supervision of a pharmacist and as its core activity (other activities include sales of OTC healthcare and cosmetics and toiletries products). |

|

Retail in Beauty and Personal Care |

Drugstores/parapharmacies |

Retail outlets selling mainly OTC healthcare, cosmetics and toiletries, disposable paper products, household care products and other general merchandise. Such outlets may also offer prescription-bound medicines under the supervision of a pharmacist. Drugstores in Spain (Droguerias) also sell household cleaning agents, paint, DIY products and sometimes pet products and services such as photo processing. Example brands include Rossmann (Germany), Kruidvat (Netherlands), Walgreen’s (US), CVS (US), Medicine Shoppe (US), Matsumoto Kiyoshi (Japan), HAC Kimisawa (Japan). |

|

Retail in Beauty and Personal Care |

Home and Garden Specialist Retailers |

This is the aggregation of homewares and home furnishing stores and home improvement and gardening stores. Business-to-business sales are excluded. Home improvement and gardening stores are chained or independent retail outlets with a primary focus on selling one or more of the following categories: Home improvement materials and hardware, Paints, coatings and wall coverings, Kitchen and bathroom, fixtures and fittings, Gardening equipment, House/Garden plants. Home improvement and gardening stores includes Home improvement centres / DIY stores, Hardware stores (Ironmongers), Garden centres, Kitchen and bathroom showrooms, Tile specialists, Flooring specialists. Homewares and Home Furnishing stores are retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Homewares and Home Furnishing Stores |

Retail outlets specialising in the sale of home furniture and furnishings, homewares, floor coverings, soft furnishings, lighting etc. |

|

Retail in Beauty and Personal Care |

Other Non-Grocery Specialists |

Other non-grocery retailers are chained or independent retail outlets, kiosks, market stalls or street vendors and with a primary focus on selling non-food merchandise. Other non-grocery retailers include Charity shops, Second-hand shops and Market stalls. |

|

Retail in Beauty and Personal Care |

Outdoor Markets |

Includes bazaars, kiosks, street vendors and beach vendors. |

|

Retail in Beauty and Personal Care |

Mixed Retailers |

This is the aggregation of department stores, variety stores, mass merchandisers and warehouse clubs. |

|

Retail in Beauty and Personal Care |

Department Stores |

Outlets selling mainly non-grocery merchandise and at least five lines in different departments, usually with a sales area of over 2,500 sq metres. They are usually arranged over several floors. Example brands include Macy’s, Bloomingdale’s, Marks & Spencer, Harrods, Sears, JC Penney, Takashimaya, Mitsukoshi, Daimaru, Karstadt, Rinascente. |

|

Retail in Beauty and Personal Care |

Mass Merchandisers |

Mixed retail outlets that usually: (1) convey the image of a high-volume, fast-turnover outlet selling a variety of merchandise for less than conventional prices; (2) provide centralised check-out service; and (3) provide minimal customer assistance within each department. Example brands include Wal-Mart, Target and Kmart. Excludes hypermarkets and warehouse clubs/cash and carry stores. |

|

Retail in Beauty and Personal Care |

Variety Stores |

Non-grocery general merchandise outlets usually located on one floor, offering a wide assortment of extensively discounted fast-moving consumer goods on a self-service basis. Normally over 1,500 sq. metres in size, except in the case of dollar stores, these outlets give priority to fast-moving non-grocery items that have long shelf-lives. Includes catalogue showrooms and dollar stores. Example brands include Woolworth (Germany), Upim (Italy). |

|

Retail in Beauty and Personal Care |

Warehouse Clubs |

Warehouse Clubs are chained outlets that sell a wide variety of merchandise but do have a strong mix of both grocery and non-grocery products. Customers have to pay an annual membership fee in order to shop. The clubs are able to keep prices low due to the no-frills format of the stores and attempt to drive volume sales through aggressive pricing techniques. Warehouse Clubs typically: - exceed 2,500 sq. metres of selling space and are invariably -over 4,000 sq. metres in size; - convey the image of a high-volume, fast-turnover retailing at less than conventional prices; - provide minimal customer assistance within each department; and - are situated in out-of-town locations. Example brands include: - Costco - Sam’s Club (Wal-Mart) - PriceSmart - Cost-U-Less |

|

Retail in Beauty and Personal Care |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Beauty and Personal Care |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Beauty and Personal Care |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Beauty and Personal Care |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Beauty and Personal Care |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Beauty and Personal Care |

Hair Salons |

Hair salons |

|

Retail in Health and Wellness |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Health and Wellness |

Convenience Stores |

Chained grocery retail outlets selling a wide range of groceries and fitting several of the following characteristics: Extended opening hours •Selling area of less than 400 sq. metres •Located in residential neighbourhoods •Handling two or more of the following product categories: audio-visual goods (for sale or rent), foodservice (prepared take-away, made-to-order, and hot foods), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include 7-Eleven, Spar. |

|

Retail in Health and Wellness |

Discounters |

Discounters are retail outlets typically with a selling space of between 400 and 2,500 square metres. Retailers' primary focus is on selling private label products within a limited range of food/beverages/tobacco and other groceries at budget prices. Discounters may also sell a selection of non-groceries, frequently as short-term special offers. Discounters can be classified as hard discounters and soft discounters. Hard discounter: first introduced by Aldi in Germany, and also known as limited-line discounters. Retail outlets, typically of 300-900 square metres, stocking fewer than 1,000 product lines, largely in packaged groceries. Goods are mainly private-label or budget brands. Soft discounter: usually slightly larger than hard discounters, and also known as extended-range discounters. Retail outlets typically stocking 1,000-4,000 product lines. As well as private-label and budget brands, stores commonly carry leading brands at discounted prices. Discounters excludes mass merchandisers and warehouse clubs. Example brands include Aldi, Lidl, Plus, Penny, Netto. |

|

Retail in Health and Wellness |

Forecourt Retailers |

Grocery retail outlets selling a wide range of groceries from a gas station forecourt and fitting several of the following characteristics: • Extended opening hours • Selling area of less than 400 sq. metres • Handling two or more of the following product categories: audio-visual goods (for sale or rent), take-away food (ready made sandwiches, rolls or hot food), newspapers or magazines, cut flowers or pot plants, greetings cards, automotive accessories. Example brands include BP Connect, Shell Select. Forecourt retailers includes both chained forecourt retailers and independent forecourt retailers. |

|

Retail in Health and Wellness |

Hypermarkets |

Hypermarkets are retail outlets with a selling space of over 2,500 square metres and with a primary focus on selling food/beverages/tobacco and other groceries. Hypermarkets also sell a range of non-grocery merchandise. Hypermarkets are frequently located on out-of-town sites or as the anchor store in a shopping centre. Example brands include Carrefour, Tesco Extra, Géant, E Leclerc, Intermarché, Auchan. Excludes cash and carry, warehouse clubs and mass merchandisers. |

|

Retail in Health and Wellness |

Supermarkets |

Retail outlets selling groceries with a selling space of between 400 and 2,500 square metres. Excludes discounters, convenience stores and independent grocery stores. Example brands include Champion, Tesco, Casino. |

|

Retail in Health and Wellness |

Independent Small Grocers |

Retail outlets selling a wide range of predominantly grocery products. These outlets are usually not chained and if chained will have fewer than 10 retail outlets. Mainly family owned, often referred to as Mom and Pop stores. |

|

Retail in Health and Wellness |

Other Grocery Retailers |

Other retailers selling predominantly food, beverages and tobacco or a combination of these. Includes kiosks, markets selling predominantly groceries. Includes CTNs and health food stores, Food & drink souvenir stores and regional speciality stores. Direct home delivery, e.g. of milk, meat from farm/dairy is excluded. Sari-Sari stores in Philippines and Warung (Waroon) in Indonesia, that can either be markets or kiosks, are included in Other grocery retailers unless they occupy a separate permanent outlet building, in which case they are included in Independent small grocers. Outlets located within wet markets, particularly in South East Asia (often located in government-owned multi-story buildings) should be counted as separate outlets. Wine sales from Vineyards are included here. |

|

Retail in Health and Wellness |

Non-Store Retailing |

The retail sale of new and used goods to the general public for personal or household consumption from locations other than retail outlets or market stalls. Non-store retailing is the aggregation of Vending, Direct Selling, Homeshopping and Internet Retailing. |

|

Retail in Health and Wellness |

Vending |

Vending means automatic retailing. It covers the sale of products and services at an unattended point of sale through a machine operated by introducing coins, bank notes, payment cards, tokens or other means of cashless payment. Coverage includes vending systems installed in public and semi-captive environments only. Hotels, transport networks, recreational centres, shopping centres/malls are included. Factories, offices, hospitals, prisons, schools and other captive environments are excluded. |

|

Retail in Health and Wellness |

Homeshopping |

Homeshopping is the sale of consumer goods to the general public via mail order catalogues, TV shopping and direct mail. Consumers purchase goods in direct response to an advertisement or promotion through a mail item, printed catalogue, TV shopping programme, or Internet catalogue whereby the order is placed, and payment is made by phone, by post or through other media such as digital TV. Excludes sales on returned products/unpaid invoices. Excludes sales ordered and paid online which are instead included within Internet retailing. |

|

Retail in Health and Wellness |

E-Commerce |

Sales of consumer goods to the general public via the Internet. Please note that this includes sales through mobile phones and tablets. Internet retailing includes sales generated through pure e-commerce web sites and through sites operated by store-based retailers. Sales data is attributed to the country where the consumer is based, rather than where the retailer is based. Also includes orders placed through the web for which payment is then made through a storecard, an online credit account subsequent to delivery or on delivery of the product. This payment may be by any mode of payment including postal cheque, direct debit, standing order or other banking tools. Includes orders paid for cash on delivery. Includes m-commerce: where consumers use smart phones or tablets to connect to Internet and purchase the goods online. |

|

Retail in Health and Wellness |

Direct Selling |

Direct selling is the marketing of consumer goods directly to consumers, generally in their homes or the homes of others, at their workplace and other places away from permanent retail locations. Direct selling occurs in two primary ways: one-to-one basis (usually by prior arrangement a demonstration is given by a direct seller to a customer) or party-plan basis (selling through explanation and demonstration of products to a group of prospective customers by a direct seller usually in the home of a host(ess) who invites other persons for this purpose). |

|

Retail in Pet Care |

Store-Based Retailing |

Store-based retailing is the aggregation of grocery retailers and non-grocery specialists and mixed retailers. |

|

Retail in Pet Care |

Grocery Retailers |

Retailers selling predominantly food/beverages/tobacco and other everyday groceries. This is the aggregation of hypermarkets, supermarkets, discounters, convenience stores, independent small grocers, forecourt retailers, food/drink/tobacco specialists and other grocery retailers. |

|

Retail in Pet Care |

Modern Grocery Retailers |

Modern grocery retailing is the aggregation of those grocery channels that have emerged alongside the growth of chained retail: Hypermarkets, Supermarkets, Discounters, Forecourt Retailers and Convenience Stores. |

|

Retail in Pet Care |

Convenience Stores |